已更新

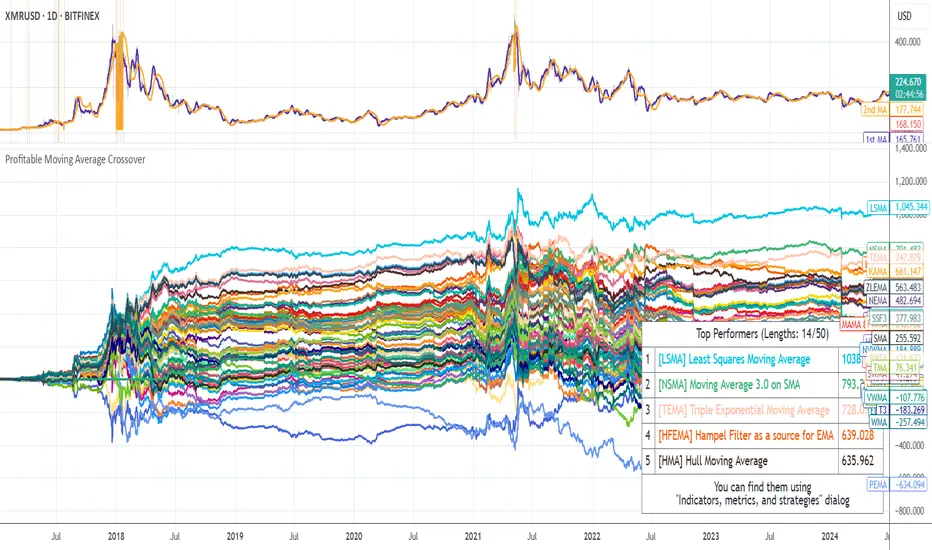

Profitable Moving Average Crossover

Hello friends,

I'm glad to introduce a powerful research and optimization tool that takes the classic moving average crossover concept to a new level. Instead of relying on guesswork or fixed MA types, it lets you objectively discover the most profitable moving average pair for any instrument and timeframe.

🛠 How It Works

Moving average crossovers are among the most popular trading systems. A buy signal occurs when a shorter (faster) moving average crosses above a longer (slower) one, and a sell signal when it crosses below. The system's responsiveness — and the number of generated signals — depend on the chosen MA lengths and types.

This script evaluates 61 moving average types (including Jurik, Kaufman, Ehlers, Apirine, and others) and backtests all possible crossover combinations either across the entire chart history or within a custom backtest window. It then plots continuous profit metric lines for each crossover type and displays the top 5 performers in a results table. Each MA type is color-coded, allowing quick visual identification of which systems have historically delivered the strongest results.

🔥 Key Features

NOTE 2: You can experiment with the tool independently or request a full study, in which case I'll share a spreadsheet of all backtest results with you.

👋 Good luck and happy trading!

I'm glad to introduce a powerful research and optimization tool that takes the classic moving average crossover concept to a new level. Instead of relying on guesswork or fixed MA types, it lets you objectively discover the most profitable moving average pair for any instrument and timeframe.

🛠 How It Works

Moving average crossovers are among the most popular trading systems. A buy signal occurs when a shorter (faster) moving average crosses above a longer (slower) one, and a sell signal when it crosses below. The system's responsiveness — and the number of generated signals — depend on the chosen MA lengths and types.

This script evaluates 61 moving average types (including Jurik, Kaufman, Ehlers, Apirine, and others) and backtests all possible crossover combinations either across the entire chart history or within a custom backtest window. It then plots continuous profit metric lines for each crossover type and displays the top 5 performers in a results table. Each MA type is color-coded, allowing quick visual identification of which systems have historically delivered the strongest results.

🔥 Key Features

- Pine Script V6 — optimized for performance and stability

- Tests 61 moving average types, from classic to adaptive designs

- Custom Backtest Window — analyze the entire history or a specific date range

- Continuous profit curves for every crossover type plotted on chart

- Top 5 crossover systems displayed in a compact summary table

- Color-coded MA identifiers for fast visual comparison

- Supports custom parameters for advanced MAs (JMA, ALMA, McGinley Dynamic, Adaptive Laguerre Filter, etc.)

- Works seamlessly across all assets and timeframes

NOTE 2: You can experiment with the tool independently or request a full study, in which case I'll share a spreadsheet of all backtest results with you.

👋 Good luck and happy trading!

版本注释

- Fixed table display when using dark theme

- Added customizable table border and text colors

- Bound metric formatting to the current chart's minimum tick size

付费空间可用

此指标仅对Trading Toolkit订阅用户开放。加入订阅即可访问此指标以及everget的其他脚本。

👨🏻💻 Coding services -> Telegram: @alex_everget

🆓 List of my FREE indicators: bit.ly/2S7EPuN

💰 List of my PREMIUM indicators: bit.ly/33MA81f

Join Bybit and get up to $6,045 in bonuses!

bybit.com/invite?ref=56ZLQ0Z

🆓 List of my FREE indicators: bit.ly/2S7EPuN

💰 List of my PREMIUM indicators: bit.ly/33MA81f

Join Bybit and get up to $6,045 in bonuses!

bybit.com/invite?ref=56ZLQ0Z

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

付费空间可用

此指标仅对Trading Toolkit订阅用户开放。加入订阅即可访问此指标以及everget的其他脚本。

👨🏻💻 Coding services -> Telegram: @alex_everget

🆓 List of my FREE indicators: bit.ly/2S7EPuN

💰 List of my PREMIUM indicators: bit.ly/33MA81f

Join Bybit and get up to $6,045 in bonuses!

bybit.com/invite?ref=56ZLQ0Z

🆓 List of my FREE indicators: bit.ly/2S7EPuN

💰 List of my PREMIUM indicators: bit.ly/33MA81f

Join Bybit and get up to $6,045 in bonuses!

bybit.com/invite?ref=56ZLQ0Z

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。