OPEN-SOURCE SCRIPT

已更新 Universal Valuation[public code]

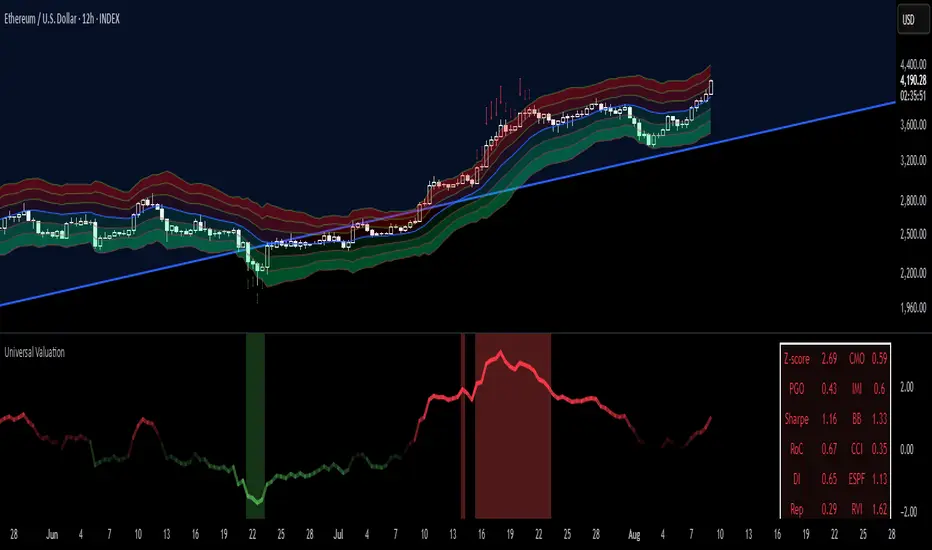

Universal valuation indicator for all assets. Consists of 12 different indicators which are z-scored and averaged out.

> Volatility bands via Keltner Channels with a NWMA

> Confluence when price > vol.bands and valuation is high/low. The confluence is marked with red arrows when above the upper third band(green when below the lower on the downside), and 50% transparency when between 2/3 band(green when below the lower 2/3 bands on the downside.)

> Can be used separately of course.

> Can be used as valuation of indicators, when possible. (eg. Global Liquidity index valuation)

Code is a mess a bit, but parts can be extracted and a new strategy/indicator can be made.

*Big probs to the creator of this indicator [tradingview.com/script/8ylRJMKr-Universal-Valuation-GTies/]. Inspired by him. I want to make it possible for people to extrapolate and create their own indicators/strategies. And of course, so I can do the same.

> Volatility bands via Keltner Channels with a NWMA

> Confluence when price > vol.bands and valuation is high/low. The confluence is marked with red arrows when above the upper third band(green when below the lower on the downside), and 50% transparency when between 2/3 band(green when below the lower 2/3 bands on the downside.)

> Can be used separately of course.

> Can be used as valuation of indicators, when possible. (eg. Global Liquidity index valuation)

Code is a mess a bit, but parts can be extracted and a new strategy/indicator can be made.

*Big probs to the creator of this indicator [tradingview.com/script/8ylRJMKr-Universal-Valuation-GTies/]. Inspired by him. I want to make it possible for people to extrapolate and create their own indicators/strategies. And of course, so I can do the same.

版本注释

Polished some code. *Disclaimer: ⚠️ This is not financial advice. It’s for educational purposes only. Use at your own risk.

版本注释

> Found out that with some tickers(eg. WRBWFRBL or the Fed Net Balance Sheet) IMI produces a NaN thus the whole valuation becomes a NaN. IMI now defaults to the CMO value when this happens, otherwise works as intended. 开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。