OPEN-SOURCE SCRIPT

Volume Flares

Volume Flares – Spotting Abnormal Volume by Time of Day

Most volume tools compare current volume to a moving average of the last X bars. That’s fine for seeing short-term changes, but it ignores how volume naturally ebbs and flows throughout the day.

Volume at 9:35 is not the same as volume at 1:15.

A standard MA will treat them the same.

What Volume Flares does differently:

Breaks the day into exact time slots (based on your chosen timeframe).

Calculates the historical average volume for each slot across past sessions.

Compares the current bar’s volume only to its own slot’s historical average.

Marks when current volume is significantly higher than normal for that exact time of day.

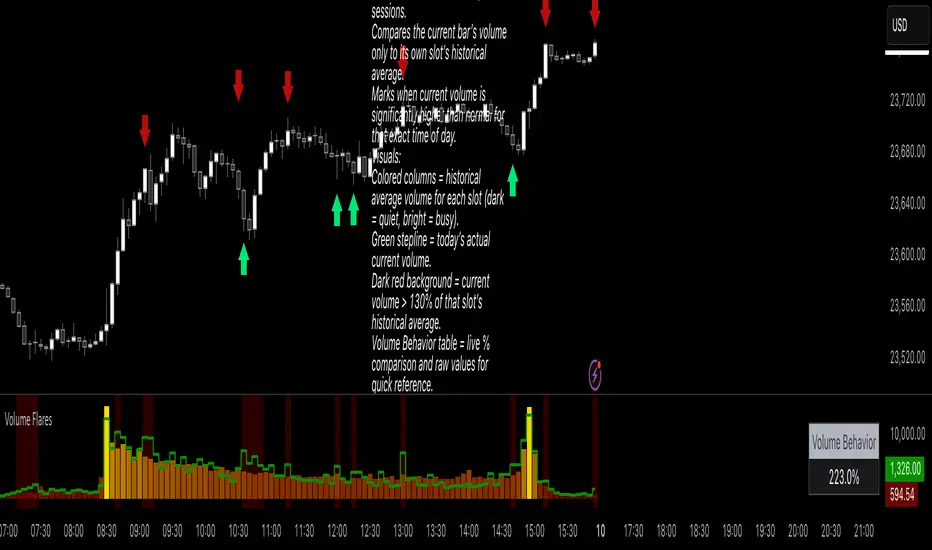

Visuals:

Colored columns = historical average volume for each slot (dark = quiet, bright = busy).

Green stepline = today’s actual current volume.

Dark red background = current volume > 130% of that slot’s historical average.

Volume Behavior table = live % comparison and raw values for quick reference.

How I use it:

Red and green arrows on the price chart are manually drawn where the background turns red in the volume panel.

These often align with liquidity grabs, institutional entries, or areas where the market is “louder” than it should be for that moment in the day.

Helps filter out false urgency — high volume at the open isn’t the same as high volume in the lunch lull.

Key takeaway:

This is not a buy/sell signal.

It’s context.

It’s about spotting when the market is behaving out of character for that specific moment, and using that to read intent behind the move.

Most volume tools compare current volume to a moving average of the last X bars. That’s fine for seeing short-term changes, but it ignores how volume naturally ebbs and flows throughout the day.

Volume at 9:35 is not the same as volume at 1:15.

A standard MA will treat them the same.

What Volume Flares does differently:

Breaks the day into exact time slots (based on your chosen timeframe).

Calculates the historical average volume for each slot across past sessions.

Compares the current bar’s volume only to its own slot’s historical average.

Marks when current volume is significantly higher than normal for that exact time of day.

Visuals:

Colored columns = historical average volume for each slot (dark = quiet, bright = busy).

Green stepline = today’s actual current volume.

Dark red background = current volume > 130% of that slot’s historical average.

Volume Behavior table = live % comparison and raw values for quick reference.

How I use it:

Red and green arrows on the price chart are manually drawn where the background turns red in the volume panel.

These often align with liquidity grabs, institutional entries, or areas where the market is “louder” than it should be for that moment in the day.

Helps filter out false urgency — high volume at the open isn’t the same as high volume in the lunch lull.

Key takeaway:

This is not a buy/sell signal.

It’s context.

It’s about spotting when the market is behaving out of character for that specific moment, and using that to read intent behind the move.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。