PROTECTED SOURCE SCRIPT

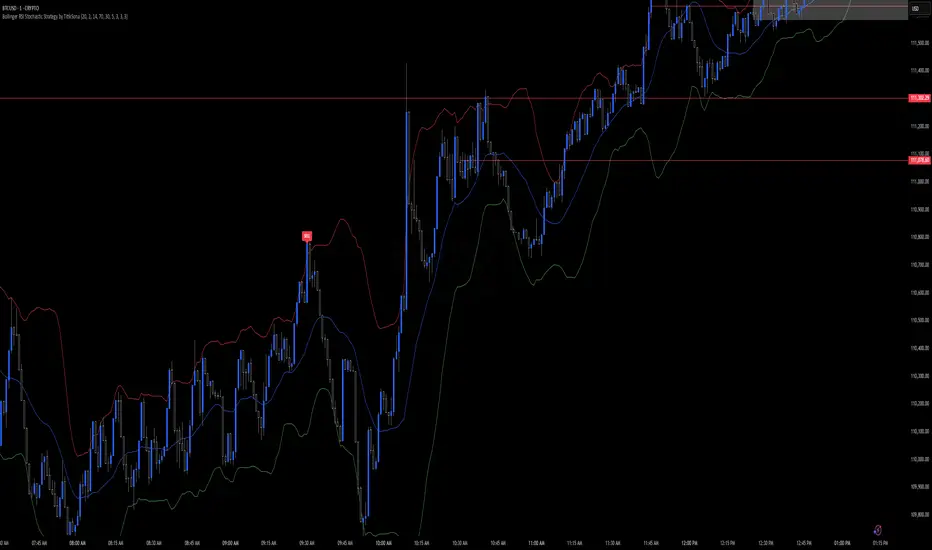

Bollinger RSI Stochastic Strategy by TitikSona

🧠 Description

Bollinger RSI Stochastic Strategy by TitikSona

This indicator combines Bollinger Bands, RSI, and Stochastic to provide an educational view of potential market conditions. It highlights areas where price, momentum, and volatility align, helping traders observe overbought and oversold conditions with optional re-entry tracking.

⚙️ Core Components

1. Bollinger Bands

- 20-period SMA as basis, with adjustable standard deviation

- Upper and lower bands highlight price extremes and potential volatility zones

2. RSI (Relative Strength Index)

- 14-period RSI with overbought and oversold thresholds

- Helps identify potential momentum exhaustion areas

3. Stochastic Oscillator

- %K and %D with smoothing

- Provides confirmation of momentum shifts within Bollinger Bands context

🎯 Observing Signals

- Buy condition: price near lower Bollinger Band, RSI below oversold, and %K crosses above %D

- Sell condition: price near upper Bollinger Band, RSI above overbought, and %K crosses below %D

- Signals are **informational markers** displayed as labels on the chart

- Maximum re-entries per trade can be tracked for observation purposes

- Does not guarantee profitable trades; used as a reference for market analysis

💡 How to Use

- Observe signals as **potential reference points**, not guaranteed entry points

- Combine with other technical analysis tools, such as support/resistance, trendlines, or volume for confirmation

- Adjust parameters to suit your preferred timeframe and market conditions

⚠️ Risk Management

- This indicator is **educational** and does not guarantee profits

- Always use proper position sizing and risk controls

- Test thoroughly in demo or paper trading environment before live application

🆓 Open & Free

- Fully open-source and free to use or modify for learning purposes

Bollinger RSI Stochastic Strategy by TitikSona

This indicator combines Bollinger Bands, RSI, and Stochastic to provide an educational view of potential market conditions. It highlights areas where price, momentum, and volatility align, helping traders observe overbought and oversold conditions with optional re-entry tracking.

⚙️ Core Components

1. Bollinger Bands

- 20-period SMA as basis, with adjustable standard deviation

- Upper and lower bands highlight price extremes and potential volatility zones

2. RSI (Relative Strength Index)

- 14-period RSI with overbought and oversold thresholds

- Helps identify potential momentum exhaustion areas

3. Stochastic Oscillator

- %K and %D with smoothing

- Provides confirmation of momentum shifts within Bollinger Bands context

🎯 Observing Signals

- Buy condition: price near lower Bollinger Band, RSI below oversold, and %K crosses above %D

- Sell condition: price near upper Bollinger Band, RSI above overbought, and %K crosses below %D

- Signals are **informational markers** displayed as labels on the chart

- Maximum re-entries per trade can be tracked for observation purposes

- Does not guarantee profitable trades; used as a reference for market analysis

💡 How to Use

- Observe signals as **potential reference points**, not guaranteed entry points

- Combine with other technical analysis tools, such as support/resistance, trendlines, or volume for confirmation

- Adjust parameters to suit your preferred timeframe and market conditions

⚠️ Risk Management

- This indicator is **educational** and does not guarantee profits

- Always use proper position sizing and risk controls

- Test thoroughly in demo or paper trading environment before live application

🆓 Open & Free

- Fully open-source and free to use or modify for learning purposes

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。