INVITE-ONLY SCRIPT

Deep in the Tape – VSA (Invite Only)

Deep in the Tape – VSA (Invite-Only)

Quick Start

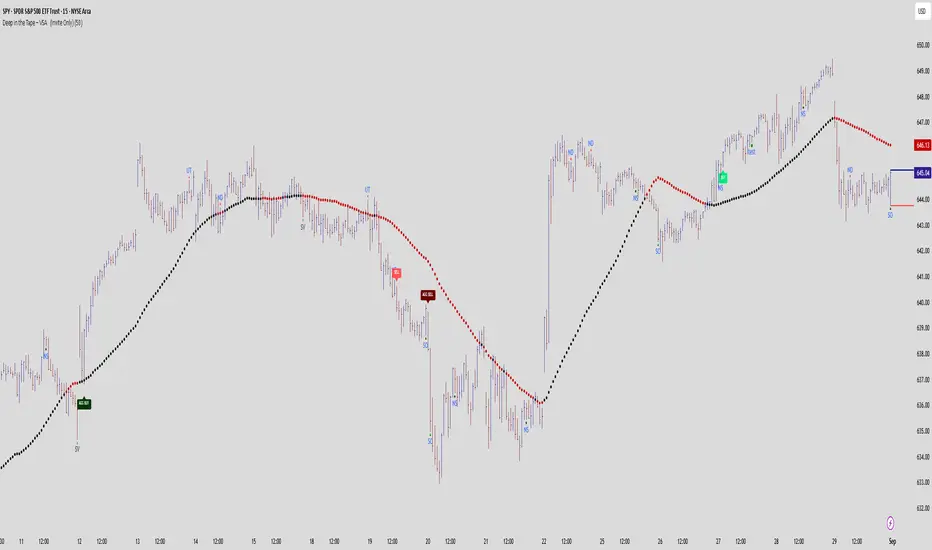

This invite-only indicator is built on Tom Williams’ Volume Spread Analysis (VSA). It highlights professional activity through classical VSA events and adds labels for confirmations, aggressive signals, and failures. The goal is to help traders study background strength/weakness, follow-through, and traps directly on the chart.

What It Shows

VSA Events: Stopping Volume, Selling Climax, Shakeout, Buying Climax, Upthrust, Supply Coming In, No Demand, No Supply, Confirmed Test Bars, End of Rising Market.

Labels:

BUY / SELL – show when classical confirmations appear (e.g., Test/NS after strength, ND after weakness).

AGG BUY / AGG SELL – highlight aggressive early entries when supply/demand is quickly absorbed or confirmed.

FAIL / TEST FAIL – show failed VSA setups where effort is not confirmed, helping traders recognize traps.

Context Tools:

High/low lines from ultra-high-volume trigger bars projected forward.

Optional high-volume cluster zones to mark potential accumulation/distribution.

Optional moving average for background context (not a signal generator).

How to Use It :

Read the Background

Look for ultra-high-volume events that mark professional activity: SC, SV, SO for strength; UT, BC, Supply Coming In for weakness.

Watch for the Response

After strength → look for Tests or No Supply to confirm demand, often labeled as BUY.

After weakness → watch for No Demand or UT follow-through, labeled as SELL.

Best Practice with Context

Bullish setups are best taken above the trigger levels and above the MA, showing demand in control.

Bearish setups are best taken below the trigger levels and below the MA, confirming supply pressure.

Study Failures and Aggressive Signals

Aggressive labels show when the market reacts quickly, confirming activity before a classical test.

Failure labels show when expected follow-through breaks down, revealing traps or absorption. These are highly educational in tape-reading.

Alerts: Ready-to-use alert conditions for all confirmations, aggressive signals, and failures, allowing real-time notifications.

Customization:

Users can toggle individual signals (e.g., Stopping Volume, No Demand, Tests, Aggressive Entries, Failure labels) on or off, tailoring the display to their preferred VSA study style.

Use Projected Levels & Clusters

Trigger levels and cluster zones provide natural S/R where professional money often reappears. Watching price response around these zones is key.

Why It’s Original

This script is not a mashup of indicators. Every condition is coded around VSA principles—spread, volume, wick proportions, close location, and context. Labels are mapped directly to Tom Williams’ methodology of background + test + confirmation. Clusters and projected levels extend the same VSA logic to make professional activity visible in real time.

Disclaimer

This script is for educational purposes only and does not constitute financial advice. Trading and investing involve risk. Always do your own analysis and risk management.

Quick Start

This invite-only indicator is built on Tom Williams’ Volume Spread Analysis (VSA). It highlights professional activity through classical VSA events and adds labels for confirmations, aggressive signals, and failures. The goal is to help traders study background strength/weakness, follow-through, and traps directly on the chart.

What It Shows

VSA Events: Stopping Volume, Selling Climax, Shakeout, Buying Climax, Upthrust, Supply Coming In, No Demand, No Supply, Confirmed Test Bars, End of Rising Market.

Labels:

BUY / SELL – show when classical confirmations appear (e.g., Test/NS after strength, ND after weakness).

AGG BUY / AGG SELL – highlight aggressive early entries when supply/demand is quickly absorbed or confirmed.

FAIL / TEST FAIL – show failed VSA setups where effort is not confirmed, helping traders recognize traps.

Context Tools:

High/low lines from ultra-high-volume trigger bars projected forward.

Optional high-volume cluster zones to mark potential accumulation/distribution.

Optional moving average for background context (not a signal generator).

How to Use It :

Read the Background

Look for ultra-high-volume events that mark professional activity: SC, SV, SO for strength; UT, BC, Supply Coming In for weakness.

Watch for the Response

After strength → look for Tests or No Supply to confirm demand, often labeled as BUY.

After weakness → watch for No Demand or UT follow-through, labeled as SELL.

Best Practice with Context

Bullish setups are best taken above the trigger levels and above the MA, showing demand in control.

Bearish setups are best taken below the trigger levels and below the MA, confirming supply pressure.

Study Failures and Aggressive Signals

Aggressive labels show when the market reacts quickly, confirming activity before a classical test.

Failure labels show when expected follow-through breaks down, revealing traps or absorption. These are highly educational in tape-reading.

Alerts: Ready-to-use alert conditions for all confirmations, aggressive signals, and failures, allowing real-time notifications.

Customization:

Users can toggle individual signals (e.g., Stopping Volume, No Demand, Tests, Aggressive Entries, Failure labels) on or off, tailoring the display to their preferred VSA study style.

Use Projected Levels & Clusters

Trigger levels and cluster zones provide natural S/R where professional money often reappears. Watching price response around these zones is key.

Why It’s Original

This script is not a mashup of indicators. Every condition is coded around VSA principles—spread, volume, wick proportions, close location, and context. Labels are mapped directly to Tom Williams’ methodology of background + test + confirmation. Clusters and projected levels extend the same VSA logic to make professional activity visible in real time.

Disclaimer

This script is for educational purposes only and does not constitute financial advice. Trading and investing involve risk. Always do your own analysis and risk management.

仅限邀请脚本

只有经作者批准的用户才能访问此脚本。您需要申请并获得使用权限。该权限通常在付款后授予。如需了解更多详情,请按照以下作者的说明操作,或直接联系deep_in_the_tape_1。

除非您完全信任其作者并了解脚本的工作原理,否則TradingView不建议您付费或使用脚本。您还可以在我们的社区脚本中找到免费的开源替代方案。

作者的说明

This is an invite-only script. To request access, please visit https://deepinthetape.com or send me a private message on Trading View . Access is manually granted after request review. Please do not request access in the comments.

提醒:在请求访问权限之前,请阅读仅限邀请脚本指南。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

仅限邀请脚本

只有经作者批准的用户才能访问此脚本。您需要申请并获得使用权限。该权限通常在付款后授予。如需了解更多详情,请按照以下作者的说明操作,或直接联系deep_in_the_tape_1。

除非您完全信任其作者并了解脚本的工作原理,否則TradingView不建议您付费或使用脚本。您还可以在我们的社区脚本中找到免费的开源替代方案。

作者的说明

This is an invite-only script. To request access, please visit https://deepinthetape.com or send me a private message on Trading View . Access is manually granted after request review. Please do not request access in the comments.

提醒:在请求访问权限之前,请阅读仅限邀请脚本指南。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。