OPEN-SOURCE SCRIPT

Triple HMA Bands (1.2 / 1.4 / 1.6)

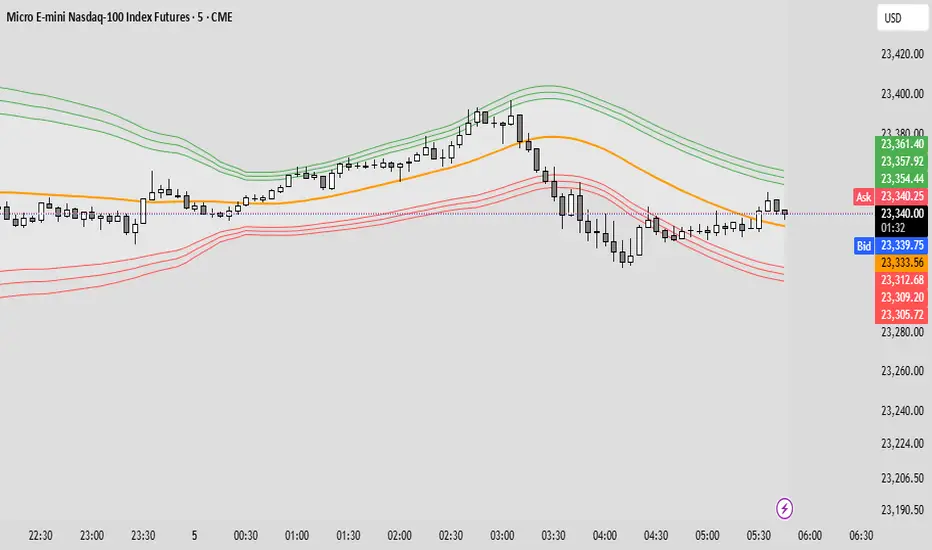

📈 Triple HMA Bands — Custom Volatility & Trend Indicator

Description:

The Triple HMA Bands indicator combines the Hull Moving Average (HMA) with volatility-based envelopes, similar to Bollinger Bands, to visualize trend direction and market extremes.

The HMA (length 90) serves as the central trend line, offering a smooth and responsive view of market direction.

Surrounding the HMA are three dynamic bands calculated using standard deviations of price:

Inner Band (1.2σ) — normal volatility range.

Middle Band (1.4σ) — elevated volatility zone.

Outer Band (1.6σ) — statistically extreme price movement.

The shaded zones between the bands help visualize volatility expansion and contraction, making it easier to identify:

Trend strength and stability

Potential reversal zones

Breakout or breakdown events

How to Use:

Price staying within the inner band may indicate a stable trend or consolidation.

Price reaching or exceeding the outer band suggests overbought/oversold conditions and potential reversal.

Widening bands = rising volatility; narrowing bands = low volatility, often before a breakout.

This indicator is ideal for trend traders, mean reversion strategies, or anyone wanting a volatility-sensitive trend filter.

Description:

The Triple HMA Bands indicator combines the Hull Moving Average (HMA) with volatility-based envelopes, similar to Bollinger Bands, to visualize trend direction and market extremes.

The HMA (length 90) serves as the central trend line, offering a smooth and responsive view of market direction.

Surrounding the HMA are three dynamic bands calculated using standard deviations of price:

Inner Band (1.2σ) — normal volatility range.

Middle Band (1.4σ) — elevated volatility zone.

Outer Band (1.6σ) — statistically extreme price movement.

The shaded zones between the bands help visualize volatility expansion and contraction, making it easier to identify:

Trend strength and stability

Potential reversal zones

Breakout or breakdown events

How to Use:

Price staying within the inner band may indicate a stable trend or consolidation.

Price reaching or exceeding the outer band suggests overbought/oversold conditions and potential reversal.

Widening bands = rising volatility; narrowing bands = low volatility, often before a breakout.

This indicator is ideal for trend traders, mean reversion strategies, or anyone wanting a volatility-sensitive trend filter.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。