OPEN-SOURCE SCRIPT

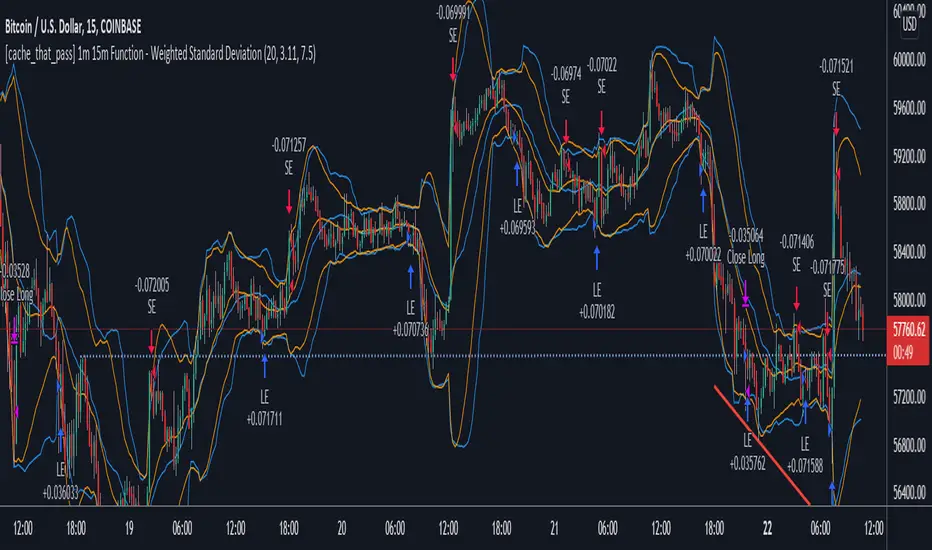

[cache_that_pass] 1m 15m Function - Weighted Standard Deviation

Tradingview Community,

As I progress through my journey, I have come to the realization that it is time to give back. This script isn't a life changer, but it has the building blocks for a motivated individual to optimize the parameters and have a production script ready to go.

Credit for the indicator is due to rumpypumpydumpy

I adapted this indicator to a strategy for crypto markets. 15 minute time frame has worked best for me.

It is a standard deviation script that has 3 important user configured parameters. These 3 things are what the end user should tweak for optimum returns. They are....

1) Lookback Length - I have had luck with it set to 20, but any value from 1-1000 it will accept.

2) stopPer - Stop Loss percentage of each trade

3) takePer - Take Profit percentage of each trade

2 and 3 above are where you will see significant changes in returns by altering them and trying different percentages. An experienced pinescript programmer can take this and build on it even more. If you do, I ask that you please share the script with the community in an open-source fashion.

It also already accounts for the commission percentage of 0.075% that Binance.US uses for people who pay fees with BNB.

How it works...

It calculates a weighted standard deviation of the price for the lookback period set (so 20 candles is default). It recalculates each time a new candle is printed. It trades when price lows crossunder the bottom of that deviation channel, and sells when price highs crossover the top of that deviation channel. It works best in mid to long term sideways channels / Wyckoff accumulation periods.

As I progress through my journey, I have come to the realization that it is time to give back. This script isn't a life changer, but it has the building blocks for a motivated individual to optimize the parameters and have a production script ready to go.

Credit for the indicator is due to rumpypumpydumpy

I adapted this indicator to a strategy for crypto markets. 15 minute time frame has worked best for me.

It is a standard deviation script that has 3 important user configured parameters. These 3 things are what the end user should tweak for optimum returns. They are....

1) Lookback Length - I have had luck with it set to 20, but any value from 1-1000 it will accept.

2) stopPer - Stop Loss percentage of each trade

3) takePer - Take Profit percentage of each trade

2 and 3 above are where you will see significant changes in returns by altering them and trying different percentages. An experienced pinescript programmer can take this and build on it even more. If you do, I ask that you please share the script with the community in an open-source fashion.

It also already accounts for the commission percentage of 0.075% that Binance.US uses for people who pay fees with BNB.

How it works...

It calculates a weighted standard deviation of the price for the lookback period set (so 20 candles is default). It recalculates each time a new candle is printed. It trades when price lows crossunder the bottom of that deviation channel, and sells when price highs crossover the top of that deviation channel. It works best in mid to long term sideways channels / Wyckoff accumulation periods.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。