PINE LIBRARY

已更新 lib_divergence

Library "lib_divergence"

offers a commonly usable function to detect divergences. This will take the default RSI or other symbols / indicators / oscillators as source data.

divergence(osc, pivot_left_bars, pivot_right_bars, div_min_range, div_max_range, ref_low, ref_high, min_divergence_offset_fraction, min_divergence_offset_dev_len, min_divergence_offset_atr_mul)

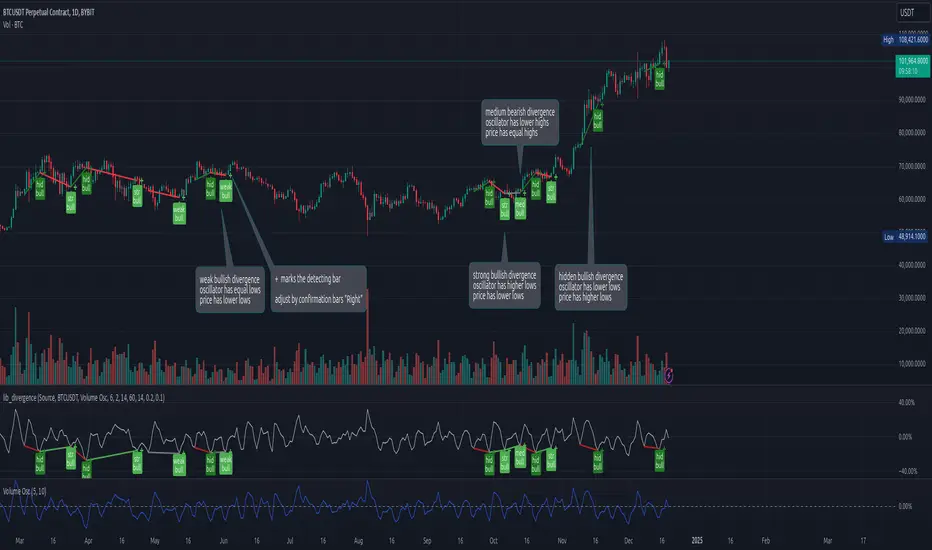

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_left_bars (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_right_bars (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 5)

div_min_range (simple int): (simple int) optional minimum distance to the pivot point creating a divergence (default: 5)

div_max_range (simple int): (simple int) optional maximum amount of bars in a divergence (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

min_divergence_offset_fraction (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L detecting following equal H/Ls (default: 0.01)

min_divergence_offset_dev_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

min_divergence_offset_atr_mul (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L detecting following equal H/Ls (default: 1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, pivot_h, pivot_l]

offers a commonly usable function to detect divergences. This will take the default RSI or other symbols / indicators / oscillators as source data.

divergence(osc, pivot_left_bars, pivot_right_bars, div_min_range, div_max_range, ref_low, ref_high, min_divergence_offset_fraction, min_divergence_offset_dev_len, min_divergence_offset_atr_mul)

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_left_bars (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_right_bars (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 5)

div_min_range (simple int): (simple int) optional minimum distance to the pivot point creating a divergence (default: 5)

div_max_range (simple int): (simple int) optional maximum amount of bars in a divergence (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

min_divergence_offset_fraction (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L detecting following equal H/Ls (default: 0.01)

min_divergence_offset_dev_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

min_divergence_offset_atr_mul (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L detecting following equal H/Ls (default: 1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, pivot_h, pivot_l]

版本注释

v2 improved performance, fixed bug in 'weak bear' detection, improved naming and comments for function parametersUpdated:

divergence(osc, pivot_confirmation_bars_left, pivot_confirmation_bars_right, pivot_min_x_distance, pivot_max_x_distance, ref_low, ref_high, pivot_min_y_distance_len, pivot_min_y_distance_dev_mult, pivot_min_y_distance_atr_mult)

Detects Divergences between Price and Oscillator action. For bullish divergences, look at trend lines between lows. For bearish divergences, look at trend lines between highs. (strong) oscillator trending, price opposing it | (medium) oscillator trending, price trend flat | (weak) price opposite trending, oscillator trend flat | (hidden) price trending, oscillator opposing it. Pivot detection is only properly done in oscillator data, reference price data is only compared at the oscillator pivot (speed optimization)

Parameters:

osc (float): (series float) oscillator data (can be anything, even another instrument price)

pivot_confirmation_bars_left (simple int): (simple int) optional number of bars left of a confirmed pivot point, confirming it is the highest/lowest in the range before and up to the pivot (default: 5)

pivot_confirmation_bars_right (simple int): (simple int) optional number of bars right of a confirmed pivot point, confirming it is the highest/lowest in the range from and after the pivot (default: 3)

pivot_min_x_distance (simple int): (simple int) optional minimum distance between pivot points considered for a divergence (should not be bigger than pivot_leftbars) (default: 5)

pivot_max_x_distance (simple int): (simple int) optional maximum distance between pivot points considered for a divergence (should not be bigger than pivot_leftbars) (default: 50)

ref_low (float): (series float) optional reference range to compare the oscillator pivot points to. (default: low)

ref_high (float): (series float) optional reference range to compare the oscillator pivot points to. (default: high)

pivot_min_y_distance_len (simple int): (simple int) optional lookback distance for the deviation detection for the offset zone around the last oscillator H/L when detecting following equal H/Ls. Used as well for the ATR that does the equal H/L detection for the reference price. (default: 14)

pivot_min_y_distance_dev_mult (simple float): (simple float) optional scaling factor for the offset zone (xDeviation) around the last oscillator H/L when detecting following equal H/Ls (default: 0.1)

pivot_min_y_distance_atr_mult (simple float): (simple float) optional scaling factor for the offset zone (xATR) around the last price H/L when detecting following equal H/Ls (default: 0.1)

return A tuple of deviation flags. [strong_bull, strong_bear, medium_bull, medium_bear, weak_bull, weak_bear, hidden_bull, hidden_bear, osc_pivot_h, osc_pivot_l]

Pine脚本库

秉承TradingView的精神,作者已将此Pine代码作为开源库发布,以便我们社区的其他Pine程序员可以重用它。向作者致敬!您可以私下或在其他开源出版物中使用此库,但在出版物中重用此代码须遵守网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

Pine脚本库

秉承TradingView的精神,作者已将此Pine代码作为开源库发布,以便我们社区的其他Pine程序员可以重用它。向作者致敬!您可以私下或在其他开源出版物中使用此库,但在出版物中重用此代码须遵守网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。