PROTECTED SOURCE SCRIPT

Displacement Candle Detector

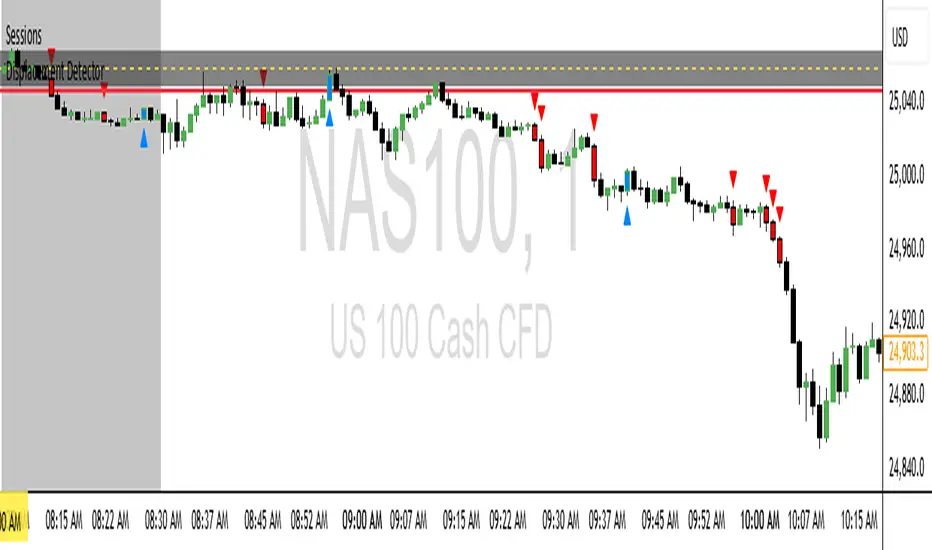

This indicator is designed to automatically identify displacement candles — large, momentum-driven candles that signal strong institutional order flow or the beginning of a market expansion.

It’s particularly useful for Step 3 of your 5-Step Model, where you wait for displacement after a liquidity sweep to confirm directional bias (Buy or Sell).

⚙️ How It Works

Calculates Candle Body Size:

Measures the absolute distance between a candle’s open and close (the real body).

Compares to Average Body (Lookback):

Uses a Simple Moving Average (SMA) of body sizes over the last n candles (default = 5).

This gives the script a baseline for what a “normal” candle looks like.

Defines a Displacement Candle:

When the current candle’s body size is ≥ 1.5× (or user-set multiplier) of the average body, it’s flagged as a displacement candle.

Distinguishes Bullish vs. Bearish Momentum:

Bullish displacement: Close > Open and candle body ≥ 1.5× average

Bearish displacement: Close < Open and candle body ≥ 1.5× average

🖥️ What It Displays on Chart

Bar Colors:

Green = Bullish displacement

Red = Bearish displacement

Labels:

Appears above or below the candle (optional toggle).

Helps you easily spot where strong moves originated.

Shapes (Triangles):

Plots a small up/down triangle for each displacement event.

Useful for backtesting, alerts, or pairing with your MSS/FVG setups later.

🧩 Inputs

Setting Description Default

len Lookback period for average body calculation 5

mult Body size multiplier threshold 1.5

showLabels Toggle for displaying candle labels true

showColors Toggle for coloring displacement candles true

🧠 Trading Application

This script acts as your “momentum confirmation filter.”

In your 5-Step Model:

Step 1–2: Wait for liquidity sweep & directional bias.

Step 3: Use this indicator to confirm that displacement (real momentum) occurred.

Step 4–5: Drop to the lower timeframe for MSS confirmation and premium/discount entry.

Once a displacement candle prints, it suggests that:

The side of liquidity swept has been taken,

Institutions are committing volume in the opposite direction,

A Fair Value Gap (FVG) is likely forming for your entry zone.

💡 Pro Tips

Timeframes: Use it on 15m for confirmation, and 1–5m for entry precision.

Multiplier Tuning:

Use 1.3–1.6 for scalping (sensitive).

Use 1.8–2.0 for swing setups (stronger confirmation).

Combine With:

Smart Money Concepts (SMC) Lite for BOS/MSS

FVG Auto-Draw for entry zones

Session Range indicator to visualize liquidity sweeps before displacement.

It’s particularly useful for Step 3 of your 5-Step Model, where you wait for displacement after a liquidity sweep to confirm directional bias (Buy or Sell).

⚙️ How It Works

Calculates Candle Body Size:

Measures the absolute distance between a candle’s open and close (the real body).

Compares to Average Body (Lookback):

Uses a Simple Moving Average (SMA) of body sizes over the last n candles (default = 5).

This gives the script a baseline for what a “normal” candle looks like.

Defines a Displacement Candle:

When the current candle’s body size is ≥ 1.5× (or user-set multiplier) of the average body, it’s flagged as a displacement candle.

Distinguishes Bullish vs. Bearish Momentum:

Bullish displacement: Close > Open and candle body ≥ 1.5× average

Bearish displacement: Close < Open and candle body ≥ 1.5× average

🖥️ What It Displays on Chart

Bar Colors:

Green = Bullish displacement

Red = Bearish displacement

Labels:

Appears above or below the candle (optional toggle).

Helps you easily spot where strong moves originated.

Shapes (Triangles):

Plots a small up/down triangle for each displacement event.

Useful for backtesting, alerts, or pairing with your MSS/FVG setups later.

🧩 Inputs

Setting Description Default

len Lookback period for average body calculation 5

mult Body size multiplier threshold 1.5

showLabels Toggle for displaying candle labels true

showColors Toggle for coloring displacement candles true

🧠 Trading Application

This script acts as your “momentum confirmation filter.”

In your 5-Step Model:

Step 1–2: Wait for liquidity sweep & directional bias.

Step 3: Use this indicator to confirm that displacement (real momentum) occurred.

Step 4–5: Drop to the lower timeframe for MSS confirmation and premium/discount entry.

Once a displacement candle prints, it suggests that:

The side of liquidity swept has been taken,

Institutions are committing volume in the opposite direction,

A Fair Value Gap (FVG) is likely forming for your entry zone.

💡 Pro Tips

Timeframes: Use it on 15m for confirmation, and 1–5m for entry precision.

Multiplier Tuning:

Use 1.3–1.6 for scalping (sensitive).

Use 1.8–2.0 for swing setups (stronger confirmation).

Combine With:

Smart Money Concepts (SMC) Lite for BOS/MSS

FVG Auto-Draw for entry zones

Session Range indicator to visualize liquidity sweeps before displacement.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。