INVITE-ONLY SCRIPT

已更新 Fishing The Trend - Setup

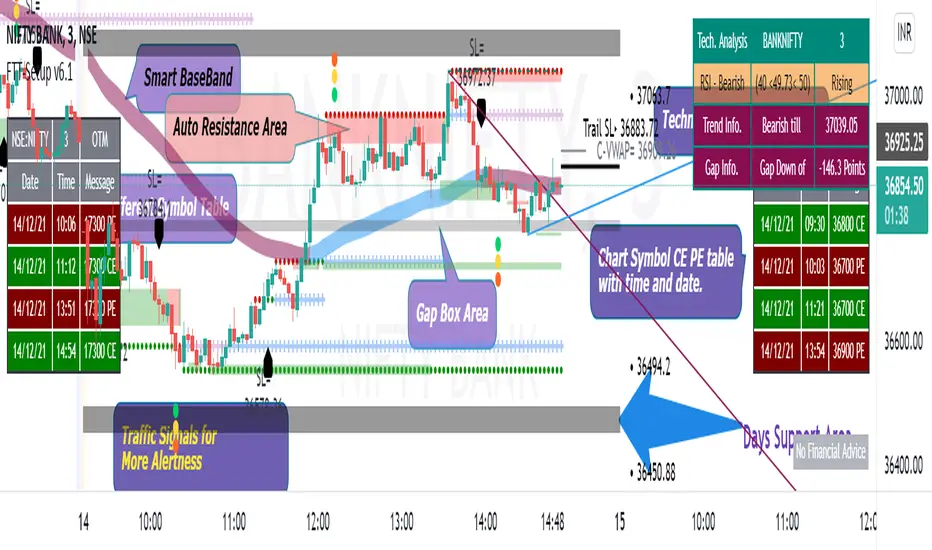

Fishing The Trend - Setup

HOW Does it work ?

The name itself says we must have a trading setup for ease of trading for getting the most from the market.

i.e. Combining the most useful indicator under one roof...

Fishing The Trend - Setup have following ::-

1) IntraDay Range.

2) Four Friends.

3) Fishing The Trend.

4) Multi Time Frame - Custom VWAP.

5) RSI based SMA.

1) Intraday Range

HOW Does it work ?

For calculating the average most probable range for any plotted security, it plots 2 bands higher band and a lower band for a particular range using the default ADR. This indicator is on - as default.

# Upper and Lower band act as support and resistance , user may see a reversal in trend from these bands

# If the price breaks these bands, don't take a trade expecting a reversal

# These bands are calculated by averaging the previous x number of days' highs and lows of the security.

2) Four Friends

HOW Does it work ?

Plotting different EMA for finding the direction of Trend / Market, There are actually 5 EMAs- F1 = 20 EMA, F2 = 50 EMA, F3 = 100EMA, F4= 150, and Trend = 200-EMA. Usually 200 EMA is used to find the trend of market whether bearish / bullish, if market is above 200 ema than we may say its bullish and below 200 ema its bearish. The 50 EMA and 100 EMA works as best pullbacks in the trending market, user can configure as per his trading style and method. This indicator can be changed to multi timeframe as required. User can plot lower time frame data onto higher time or vice-versa for finding better opportunities for early trend detection, also the user have the option to use feature of non-repainting or vice versa. The default Color MA option is un=ticked, means plotting 5 different color EMAs, If the user ticks this feature, the whole 5 EMA color will change into red or orange as per direction of closing candle, user can change color as per his / her color combination. Default plotting time is of 1 min. This second indicator is off by default - user have to tick-it to activate it

3) Fishing The Trend

HOW Does it work ?

The code uses dynamic current levels to identify trend, This indicator is using SuperTrend, ATR and relatively Smoothened ATR for

early trend reversal detection to determine the trend and direction so that a fruitful decision can be made.

To Indicate the strength of the trendline, The standard calculations of SuperTrend, along with multiple smoothen ATR results are clubbed determine the direction, a step ahead. However, the indicator is not appropriate for all the situations. It works when the market is trending. Hence it is best to use for short-term technical analysis . SuperTrend uses only the two parameters of ATR and multiplier which are not sufficient under certain conditions to predict the accurate direction of the market. Here in this indicator ATR value is not editable and after long backtests the best ATR value is kept that helps the indicator working very well.

The default setting is best for use, but user can customize the Multiplier for his own fine tunings, So once the Levels are matched, a Long / Short suggestion is plotted. Best Time Frames to use : starting from 1, 3, 5, 15, 30 Mins and so on... to determine Trend.

Long = L and Short = S.

Where and how to use?

The main use of this indicator is quick scalping and Intra-day trading. The Indicator shows the option to show Long/Short Signals which the use can be turned on or off. The indicator shows a very useful option for early detection of the ongoing trend whether there will be reversal of trend or not ?

Stop Loss - That should be done by following ones risk appetite, Ideally the High of the Previous Candle should be the stop loss for

the Long / Short but everyone has their own Risk Management Strategies based on the capital deployed.

by default this comes on..

4) Multi Time Frame - Custom VWAP.

HOW Does it work ?

VWAP = The volume weighted average price (VWAP) is a trading benchmark used by traders that gives the average price a

security has traded at throughout the day, based on both volume and price. It is important because it provides traders with insight into both the trend and value of a security.

This indicator is programmed for using vwap for spot indices / securities not having volume calculations but have futures, specially banknifty and nifty of Indian markets. User has option to change the plotting timeframe as per his requirements for checking the trend under vwap or over vwap. The user have to type the equivalent script symbol in the space provided to calculate the vwap of that particular security and plot on the non-volume script. Seems confusing !!!! have a look

at example..

eg. - if you have chart of banknifty spot and u want to place vwap on in then just write security name in the blank field banknifty future of continuous contract running month " BANKNIFTY1! " Futures Chart... that's it and u will have futures vwap plotting on spot chart... this can give user a definite idea about the vwap line. User have option to change color of bar and change color of the

vwap line which is plotted.

By default this comes off..

Note = This indicator changes bar color

5) RSI based SMA

HOW Does it work ?

# This indicator is for user using RSI, The twist is that not only it uses RSI but also simple moving average, So this makes the user more safe as it is a combination of RSI and SMA.

# Multi-colored ----> Green/Red/Yellow user can change ..moving average of choice

# user can change overbought / over sold values of RSI as required. The time frame here is fixed.

* There is an On/Off Option for each Indicator.

Disclaimer : There could be scenarios when the candle is shown as a long or short and then the candle turns into opposite direction red/green. In such scenarios , Please refer to the just preceding candle and the early detection signal and if this candle is moving into positive direction only then go for long, Similarly opposite for Short, the value of multiplier 1.0 is determined using series of back test across various assets with different time frames.

User Options : Choice of turning on / off the Long / Short Labels and early detection/StopLoss Option can also be activated or deactivated.

Visual Checks - The user could manually validate the back test results on various assets they would like to use this strategy on before putting it live.

Usage/Markets : Index Trading / Equities and also well with Commodities and Currencies

How to get access

Please click on the link / email available in the signature or send me a private message to get access.

Feedback

Please click on the link/email in the signature or send me a private message for suggestions/feedbacks.

HOW Does it work ?

The name itself says we must have a trading setup for ease of trading for getting the most from the market.

i.e. Combining the most useful indicator under one roof...

Fishing The Trend - Setup have following ::-

1) IntraDay Range.

2) Four Friends.

3) Fishing The Trend.

4) Multi Time Frame - Custom VWAP.

5) RSI based SMA.

1) Intraday Range

HOW Does it work ?

For calculating the average most probable range for any plotted security, it plots 2 bands higher band and a lower band for a particular range using the default ADR. This indicator is on - as default.

# Upper and Lower band act as support and resistance , user may see a reversal in trend from these bands

# If the price breaks these bands, don't take a trade expecting a reversal

# These bands are calculated by averaging the previous x number of days' highs and lows of the security.

2) Four Friends

HOW Does it work ?

Plotting different EMA for finding the direction of Trend / Market, There are actually 5 EMAs- F1 = 20 EMA, F2 = 50 EMA, F3 = 100EMA, F4= 150, and Trend = 200-EMA. Usually 200 EMA is used to find the trend of market whether bearish / bullish, if market is above 200 ema than we may say its bullish and below 200 ema its bearish. The 50 EMA and 100 EMA works as best pullbacks in the trending market, user can configure as per his trading style and method. This indicator can be changed to multi timeframe as required. User can plot lower time frame data onto higher time or vice-versa for finding better opportunities for early trend detection, also the user have the option to use feature of non-repainting or vice versa. The default Color MA option is un=ticked, means plotting 5 different color EMAs, If the user ticks this feature, the whole 5 EMA color will change into red or orange as per direction of closing candle, user can change color as per his / her color combination. Default plotting time is of 1 min. This second indicator is off by default - user have to tick-it to activate it

3) Fishing The Trend

HOW Does it work ?

The code uses dynamic current levels to identify trend, This indicator is using SuperTrend, ATR and relatively Smoothened ATR for

early trend reversal detection to determine the trend and direction so that a fruitful decision can be made.

To Indicate the strength of the trendline, The standard calculations of SuperTrend, along with multiple smoothen ATR results are clubbed determine the direction, a step ahead. However, the indicator is not appropriate for all the situations. It works when the market is trending. Hence it is best to use for short-term technical analysis . SuperTrend uses only the two parameters of ATR and multiplier which are not sufficient under certain conditions to predict the accurate direction of the market. Here in this indicator ATR value is not editable and after long backtests the best ATR value is kept that helps the indicator working very well.

The default setting is best for use, but user can customize the Multiplier for his own fine tunings, So once the Levels are matched, a Long / Short suggestion is plotted. Best Time Frames to use : starting from 1, 3, 5, 15, 30 Mins and so on... to determine Trend.

Long = L and Short = S.

Where and how to use?

The main use of this indicator is quick scalping and Intra-day trading. The Indicator shows the option to show Long/Short Signals which the use can be turned on or off. The indicator shows a very useful option for early detection of the ongoing trend whether there will be reversal of trend or not ?

Stop Loss - That should be done by following ones risk appetite, Ideally the High of the Previous Candle should be the stop loss for

the Long / Short but everyone has their own Risk Management Strategies based on the capital deployed.

by default this comes on..

4) Multi Time Frame - Custom VWAP.

HOW Does it work ?

VWAP = The volume weighted average price (VWAP) is a trading benchmark used by traders that gives the average price a

security has traded at throughout the day, based on both volume and price. It is important because it provides traders with insight into both the trend and value of a security.

This indicator is programmed for using vwap for spot indices / securities not having volume calculations but have futures, specially banknifty and nifty of Indian markets. User has option to change the plotting timeframe as per his requirements for checking the trend under vwap or over vwap. The user have to type the equivalent script symbol in the space provided to calculate the vwap of that particular security and plot on the non-volume script. Seems confusing !!!! have a look

at example..

eg. - if you have chart of banknifty spot and u want to place vwap on in then just write security name in the blank field banknifty future of continuous contract running month " BANKNIFTY1! " Futures Chart... that's it and u will have futures vwap plotting on spot chart... this can give user a definite idea about the vwap line. User have option to change color of bar and change color of the

vwap line which is plotted.

By default this comes off..

Note = This indicator changes bar color

5) RSI based SMA

HOW Does it work ?

# This indicator is for user using RSI, The twist is that not only it uses RSI but also simple moving average, So this makes the user more safe as it is a combination of RSI and SMA.

# Multi-colored ----> Green/Red/Yellow user can change ..moving average of choice

# user can change overbought / over sold values of RSI as required. The time frame here is fixed.

* There is an On/Off Option for each Indicator.

Disclaimer : There could be scenarios when the candle is shown as a long or short and then the candle turns into opposite direction red/green. In such scenarios , Please refer to the just preceding candle and the early detection signal and if this candle is moving into positive direction only then go for long, Similarly opposite for Short, the value of multiplier 1.0 is determined using series of back test across various assets with different time frames.

User Options : Choice of turning on / off the Long / Short Labels and early detection/StopLoss Option can also be activated or deactivated.

Visual Checks - The user could manually validate the back test results on various assets they would like to use this strategy on before putting it live.

Usage/Markets : Index Trading / Equities and also well with Commodities and Currencies

How to get access

Please click on the link / email available in the signature or send me a private message to get access.

Feedback

Please click on the link/email in the signature or send me a private message for suggestions/feedbacks.

版本注释

Release Notes: Fishing The Trend - Setup V2 below is what updated....- Significantly improved accuracy of zone detection.

- Many confusing options are removed which makes Setup Very Simple.

- Added alert functionality.

- The 4 friends is replaced by 200 Exponential Moving Average band (Trend Band) with non-repainting feature and also it has

option to change colour depending upon trend direction.

- Fishing the trend indicator is now having option to hide the trailing stop-loss line.

-RSI based SMA is removed with Support - Resistance with RSI line.

- The script will show warning while settings alerts because it uses functions which may repaints the results, but

the indicator is made with utmost care to not to give any false signals / inaccurate end results.

What is added ?

Auto trend lines : It draws trendlines connecting the highs and lows of the previous bars

What's it do?

Auto trend lines will let the user know when the line is broken for ease of use.

What is added ?

Break-Out / Break-In Area

What's it do?

The indicator detects major swing highs & lows, then waits for a 1ATR move in the opposite direction. If this occurs then the indicator draws a zone between the wick and body of that high/low until it's violated by a closing price. Once violated, it then begins looking for a new zone. If you have Get Previous Broken Area turned on then the script will also draw the previous support/resistance zone until that gets violated again (support-turned-resistance etc).

Settings in Break-Out / Break-In Area

Get Previous Broken Area : This turns on/off the darker coloured zones which are previous areas.

What is added ?

Support - Resistance with RSI line.

What's it do?

This Indicator has two options, enabling one will have support and resistance lines drawn on the chart having the functionality of

Bollinger bands, and enabling the second will draw 20 SMA line having RSI merged with it, The Overbought and Oversold area is

set to default and is not editable.

Utmost Care is taken to implement the suggestions of users and also tried to keep the chart neat and clean.

版本注释

Another Update !!!!What is Updated ?

1) Intraday Range

2) Fishing The Trend

3) Auto Trend Lines

4) Support and Resistance with RSI Lines

Detail Information on update:

1) Intraday Range is not plotted completely to the whole day when day starts, and the range lines are filled as

day moves ahead with change of colour for breakout or break-in (color of range band changes).

2) Fishing The Trend is having default settings of factor changed to 2.0 for less noise.

3) Auto Trend Lines is now having dashed trend lines instead of dotted, for better confirmation.

4) Support and Resistance with RSI Lines is now having RSI length of 21 and Oversold & Overbough region is buffered to a difference

of 10.

Note:- This Update is made for getting the trend and trade very clear with less noise.

版本注释

Greetings !!!!Update to the settings of the Fishing The Trend Set-Up

What is Updated ?

Intraday Range- updated with band price labels, now price labels will be plotted and the starting of the day, location of label is

at corner of band.

The new feature of grouping into one in settings is implemented, along with tooltip nearby to every essential boxes / options.

This new update will be useful for pairing indicators as per requirements and tooltip to read instructions very easily.

版本注释

What is Updated ?Update requirement after recent Pine changes applied on built-in functions (such as round() function).

The Price Value is rounded off to simplify the look, Long and Short labels are updated.

版本注释

What is Updated ?Some grammatical errors rectified !!

版本注释

Clarifications regarding the update !!The user should enable extended hours function in able to work indicator flawlessly as extended hours is required for Indian Markets (especially!!!)

版本注释

Greeting From GrowMore Indicators !! Fishing the Trend Setup is updated to version 4.2

What is Updated ?

Intrday Range Bands are more colourful for quick eye catching ranges.

Trend Band is updated!!

If market is going far away from band than the band will be contract itself and if market comes near the band it will be expand.

some visual checks are updated so no need to look at different things...

Fishing the Trend is updated - Long, Short is replaced by background coloured L and S, stop loss is now seen in next line.

RSI Line is tweaked with color efficiency for rangebound market.

版本注释

WHAT IS UPDATED ?&

HOW TO USE ?

This is the Version 4.3 of Fishing The Trend - Setup.

3) Fishing The Trend is now have TRAILING STOP_LOSS LINE, it moves along with market trend and trails the price, Last Traded Price is added, 4) Custom VWAP (C-VWAP) is now having the price label. 5) Auto Trend Lines is now drawing only the latest lines, so keeping the chart clear. RSI Line is removed- it will be added in next update.

# 8) = Alert Time !! is added, which will show alerting active reversal for current trend. There are Exclamation mark '!'

which comes above and below candles/ bars of red and green color.

No Financial Advice.

版本注释

WHAT IS UPDATED ?8) Alert Time is now having new alert symbol, and alert can be set for Alert Time !.

WHAT IS ADDED ?

9) Value of RSI 14 is added and is placed in box, located at top right corner, with below mentioned colour changing background:

RSI greater than 10 but less than 20 = Dark Red

RSI greater than 20 but less than 40 = Red

RSI greater than 40 but less than 50 = Orange

RSI greater than 50 but less than 60 = Light green

RSI greater than 60 but less than 80 = Green

RSI greater than 80 but less than 90 = Dark green

Alert can be set when RSI value is greater than 80, and Below 20.

版本注释

WHAT IS UPDATED ?Common Update:- Color options have been added to all possible color changing for ease of usage in Dark Theme and to

have user friendly interface as required by user.

Individual Updates :

1) Alerts have been added to 1) IDR Range, 2) Trend Band, 4) C-VWAP, 9) RSI is having alerts when in between 70-80, 20-30

2) FTT is smoothened with tips appearing on labels,

3) the L and S in FTT is replaced with up and down labels

版本注释

WHAT IS UPDATED?Updated to Version 4.6=

3. Fishing The Trend - is now having an option to get the best suitable strike price for CALL & PUT for NSE: BANKNIFTY & Nifty-50.

版本注释

WHAT IS UPDATED ?In version 4.7, the 9th Indicator RSI Table is updated with an option to adjust the location of table along

with the height and width.

版本注释

WHAT IS UPDATED ?1) Intraday range is now having option to change thickness for range lines, filling is removed.

2) trend band is replaced by Baselines for trend, this can be studied as, in this the two different

lines will be plotted where the label is placed showing probable long above that line and the label is placed showing

probable short below that line be considered, along with this, color, thickness, and style of lines can be changed, as required.

3) fishing the trend is having changed in length for more smoothness, default length is 2, one can increase the length for non-intraday learnings, it is now having a log table showing the date, time and probable call/pe strike price in it, user can choose strike price selection for banknifty / nifty50, inorder to avoid more signals the data tobe considered after the current candle is

closed.

4) Thickness, and style of custom vwap line can be changed, as required.

5) RSI table position updates.

Here the Strike Price selection is purely for educational & entertainment purpose only, NO any trading advice be considered.

版本注释

WHAT IS UPDATED ?In this version= 4.9, below is updated,

# The Intraday range is having solid color in upper and lower range lines.

# Baselines for trend is now available from starting of day and ends at the end of the day.

版本注释

What is Updated ?# Changes in input sections, making is easier to use.

# Alerts** have been added to below:-

1) Intraday Range (IDR)

2) Baselines for Trend

3) Fishing the Trend (FTT)

4) CUSTOM VWAP (C-VWAP)

8) Alert Time ! - Alerts for BEAR & BULL.

9) RSI

# Previous Range in Intraday Range is now having an option to Show.

** N.B.:- There may be cases where warning may come during setting the alert, this because

of alert conditions are taken ONLY when the current candle is CLOSED, real-time alerts are

considered as not feasible to get it.

版本注释

What is Updated ?# 2) Baselines for trend is replaced by volatility based BaseBand for Trend, making is easier to identify the most probable current trend.

# 4) C-VWAP is now having Options to choose from Bank Nifty, Nifty 50, Others, just select Bank Nifty if you have Bank Nifty Index Chart, and Nifty 50 for Nifty Index Chart, Others for rest all charts, making it very easy to use.

版本注释

WHAT IS UPDATED ??# In "№ 1. INTRADAY RANGE (IDR)░░▒▒▒▒▒▓▓▓▓▓

Previous IDR Data is removed and mid line for the day is added, manual turning on / off the alert is added.

Custom message can be typed by user when an alert is triggered.

# In № 2. BaseBand for Trend░░░░▒▒▒▒▒▒▓▓▓▓

Baseband is now having color changing effect as soon as there is any possibilities of change in direction of trend,

manual turning on / off the alert is added. Custom message can be typed by user when an alert is triggered.

# In № 3. Fishing The Trend (FTT)░░░▒▒▒▓▓▓▓

Price difference for option strike price selection is added, put Gap of "0" for banknifty and nifty, and for others check

required price difference. manual turning on / off the alert is added. Custom message can be typed by user when an alert is triggered.

# In № 4. CUSTOM VWAP░░░░░░░░▒▒▒▒▒▒▒▒▓▓▓▓

Custom Vwap is now having option to select for banknifty and nifty index, and for others. manual turning on / off the alert is added.

# In "№ 5. Trend Lines░░░░░░▒▒▒▒▒▒▒▒▒▒▒▒▓▓▓▓"

Trend Lines is having cosmetic changes for lines to be solid or dotted.

# In № 6. Break-Out Area░░░░░░▒▒▒▒▒▒▒▓▓▓▓▓▓

manual turning on / off the alert is added.

# In № 7. Support & Resistance Lines░░▒▒▓▓▓

Support and resistance lines is modified to as if the previous support is not broken and another support is made,

the color and style of previous support line is changed, and these is also same for resistance. This helps is good visualising the previous support or resistances.

# In "№ 8. Alert Time !! 🚥░░░░░░▒▒▒▒▒▒▒▓▓▓▓

manual turning on / off the alert is added. Custom message can be typed by user when an alert is triggered.

# In № 9. RSI Table░░░░░░▒▒▒▒▒▒▒▒▒▒▒▒▒▒▓▓▓

rsi table is modified for trend of rsi whether falling or rising be seen with regards of inbetween overbought and oversold.

manual turning on / off the alert is added.

Banknifty nifty Options auto strike price selection settings is added for easy of use for alerts.

Utmost care is taken to simplify the indicator usage with good visuals and easy to understood inputs.

版本注释

What is Updated?# Options in alerts combining.

# Input bugs removed.

# Input options are updated.

# In Fishing the trend, user have an option to reduce the signals for keeping charts clean.

# In RSI table, a probable trend is added along with pullback or reversal till.

版本注释

What is updated ?# Updated to Pine version 5.

# Minor Input tweaks.

版本注释

What is Updated ?# Input tweaks.

# Price specific alert is added, user can add an alert at specified price. If the market is crossing or is equal to that price,

it will trigger a custom message alert.

版本注释

What is Updated ?# The Whole Indicator will be working fine with timeframe greater than seconds and smaller than or equal to daily.

# In IDR, the Gap Box is introduced, which will show the intraday opening and trading-day opening gaps, Midline is removed.

# In Base-Band, the new type of band is introduced for early detection of the reversal trend.

# In RSI Table, the table format is updated.

# Major Input tweaks.

# Alerts have been modified.

# Unnecessary Data from chart is tried to remove, whole indicator will show few weeks/ days data.

# Indicator will be fully functional in trading session only, after trading session some of the parts wont be seen.

版本注释

What is Updated ?In version 5.7 below is updated =

* New Primary Setting for indicator is introduced 'Session Type', in it 'Choose Extended and Index Chart for Bank-Nifty, Nifty & Equities. Choose Regular for others'.

* In No.2 Base-Band, Type 2 is introduced, this can be used during rangebound / sideways market.

* In No.9 RSI Table is replaced by Tech. Analysis Table, consisting of RSI, Trend Info., Daily Gap info.

* In FTT Table, the time will now be in HH:MM.

** Warning !!!

Indicator does not show meaningful data on chart timeframes > 1D.

Indicator does not show meaningful data on chart timeframes in Seconds.

版本注释

What is updated ?New Feature Strangle / Straddle is added in Tech. Analysis Table.

#Straddle/Strangle strategy is assist Nifty / Bank Nifty Option Writers / Sellers to identify the PE / CE legs to Sell for Straddle and Strangle positions.

Primary Idea: First One Hour High and Low works good support and resistance.

Once First One Hour is over, there will be Strangle High (CE), Strangle Low (PE) and Straddle (CE/PE).

For Straddle: Sell at the money strike (CE/PE) when price comes near to the Strike Price in table

For Strangle: Sell Strangle High (CE) and Strangle Low (PE) when price comes near to the Strike Price in table.

Both Strangle High and Low will be out of the money when price near to the straddle CE / PE Price.

Alteration: option changing to be done based on the price movement by the user / trader.

Caution: If first hour not giving wide High / Low, don’t use strangle strike based on this. Straddle can be done any day with require adjustment / hedge. This is purely for education purpose, user / trader has to be back-tested before their start using it.

# Major Input Tweaks and grammatical corrections.

版本注释

What is Updated ?Version = 6.0 update.

# in 1) Intraday Range is Named as Daily Support & Resistance Area - DSRA.

# Gap Box is enabled as default.

# in 3) FTT, At-The-Money, In-The-Money, Out of-The-Money is added.

# in 7) Support & Resistance Lines, Type-2 is also added for making the chart clean.

版本注释

What is Updated ?In this Version 6.1..

# Comparative Symbol Table is added, for comparing different calls.

# ATM, ITM, OTM added, (all these are basic terms)

# General Input Tweaks.

版本注释

What is Updated ?Updated to v.6.2

## In TrendLines, a new option to select the second type is introduced.

## Input Tweaks.

版本注释

What is updated ?In this version 6.3

# More stringent restrictions about the futures in Banknifty and Nifty.

# No 4. CVwaP auto detects the input.

版本注释

What is updated ?In version 6.4 following are updates=

# Daily Support & Resistance Area is now having visual update, levels in range itself.

# BaseBand is now having trend based color.

# Major Cosmetic updates in each part.

版本注释

What is updated ?In version 6.5 below updates is explained :-

# Now Futures chart for BankNifty or Nifty is not supported, settings can be changed.

# In No. 3, user can get signals for different symbol, other than chart, but not similar to chart.

# In no. 3, futures in Banknifty / Nifty is not supported.

# Input Tweaks in every sections.

# Cosmetic changes as requested by some users.

# Texts in tables is shortened.

版本注释

What is Updated ?In this version 6.6-

# Input tweaks in all.

# Label texts are smoothened.

# Labels have accurate precision in numbers.

版本注释

What is Updated ?In version 6.7 below is updated=

# All confusing options are removed, making it clean to understand the settings.

# Color Mode is introduced for Dark or Light Chart Theme.

# All input cosmetic tweaks.

# Indicator will not work after market is closed.

版本注释

What is updated ?In version 6.8

# Input restrictions were removed.

# solved a bug, which was making chart blocked.

# Input tweaks.

版本注释

What is updated ?In version 6.9

# The Charts were not seen, a bug solved.

# Input Tweaks.

# After market restrictions removed.

版本注释

What is Updated ?In Version 7.0

# User Friendly Input is tried to maintain.

# Less Options in Settings.

版本注释

What is Updated ?in version 7.1 -

# Baseband Color is updated.

# Input Tweaks.

# Alerts are refreshed.

# Restrictions are more refined.

# Tooltips are updated.

# Tech. Analysis is having Trend info, now if ranging comes, area will be highlighted, more alertness.

版本注释

What is updated?# Minor Input changes to the alerts as compared to previous verison.

版本注释

What is Updated ?In version 7.2

# Band Color tweaks.

# Strike Price is detected by chart symbol.

版本注释

What is updated ?In version 7.3 below is updated-

# Major Alert Tweaks.

# Stock / Equity Options is added.

# Cosmetic Updates to previous version.

版本注释

What is Updated ?In this Version 7.4, below is updated=

# Input Tweaks.

## Exit the same previous call.

### Minor Grammatical errors solved.

版本注释

What is updated?In version 7.5, below is updated=

# Minor input tweaks.

# Cleaner option settings of the indicator.

# Entry / Exit Symbols to be entered manually.

# Auto exit for all in this new version.

# Disclaimer to usage and automation.

版本注释

What is Updated?*In Version 7.6 below is updated--

# Time Session is added, for sending alerts in a particular time range, as of now it won't fire alerts outside the range.

# Call Table / Message Table will have finely tuned strike prices.

# Cosmetic changes with grammatical bugs removed.

版本注释

What is Updated?In this set-up version v7.7, below is updated-

# BaseBand is now DUAL, so dual bands of limited data with colour changing is added, cross overs and cross under helps following the trend at an ease.

# Now daily timeframes is supported, but weekly, monthly is not.

# Cosmetic updates.

版本注释

What is Updated?In version 7.8-

# Strike Price selection is finely tuned for exact price match on chart.

# Alerts updated.

版本注释

What is updated ?This 79th Update contains=

# Table data bug removal.

# Band Fine tunings.

# Input settings.

# Quick application.

# Cosmetics updates in general.

版本注释

What is Updated ?In v7.9 below is updated-

# Cosmetic Updates to previous version.

# Input bugs removed.

# Tables made clearer.

版本注释

What is updated ?In this version 8.0, below is updated-

# Fixed issue caused due to pine updates on memory.

版本注释

What is updated ??In this Version 8.1, if user tries to change candle chart / bar chart from standard type to others, indicator will stop working.

This makes user to follow the standard charts instead of derived one.

版本注释

What is Updated ?In this Version 8.2-A, below is updated-

# A in version name represents Automation Supported.

# Now Automation Supported Version will work in Time Frame of 3 or 5 minutes only.

# This version will work with regular and extended trading hours.

# VWap is updated.

# Finvasia Broker is updated and added as broker.

# Alert added, now one can exit when specific time passes.

# Minor cosmetics update.

# Many restrictions removed, as compared to previous version.

Caution !!- The results in regular and extended trading hours are different.

版本注释

What is Updated ?In version 8.3-A, below is updated=

# Syntax Generator for brokers is updated.

# Exit symbol is now removed.

# Exit at traffic signal is corrected.

# Auto detection of Symbols for automation.

# Minor cosmetic updates.

版本注释

What is updated ?In this version 8.4-A, below is updated=

# Corrected the alert message for different predefined brokers.

# Minor cosmetic Updates.

版本注释

What is updated ?Name = Fishing the Trend Setup v8.5-A, below is updated=

# Exit Symbol is added.

# Minor cosmetic update.

# Alert management is updated.

版本注释

What is updated ?In this version v8.6-A, below is updated-

# Moving average band was corrected to much extent that it will be very accurate in live market.

# Automation is updated.

# Some cosmetic updates.

版本注释

What is updated ?In this version v8.7 below is updated=

$ Corrected the alert message for Kotak.

$ some cosmetic changes.

版本注释

What is updated ?In this version 8.8-A, below mention in updated=

# Alert for specific broker is updated.

# Kotak alert updated.

# Some cosmetic changes.

版本注释

What is updated ?In this version 8.9-A, below is updated..

# Banknifty Quantities recitified.

# Finvasia Syntax updated.

# Some cosmetic changes.

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系GrowMore_Indicators。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

For Questions, Discussions, Access :: Drop a Text/WhatsApp message to = +917016549487, Telegram: https://t.me/GrowMore_Official

For Questions, Discussions, Access :: Drop a Text/WhatsApp message to = +919173314655, e-mail to growmoreindicators@gmail.com or Telegram: t.me/GrowMore_Official

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系GrowMore_Indicators。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

For Questions, Discussions, Access :: Drop a Text/WhatsApp message to = +917016549487, Telegram: https://t.me/GrowMore_Official

For Questions, Discussions, Access :: Drop a Text/WhatsApp message to = +919173314655, e-mail to growmoreindicators@gmail.com or Telegram: t.me/GrowMore_Official

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。