INVITE-ONLY SCRIPT

已更新 VIV 1.0 // AN IDEA BY Sunil Sethi

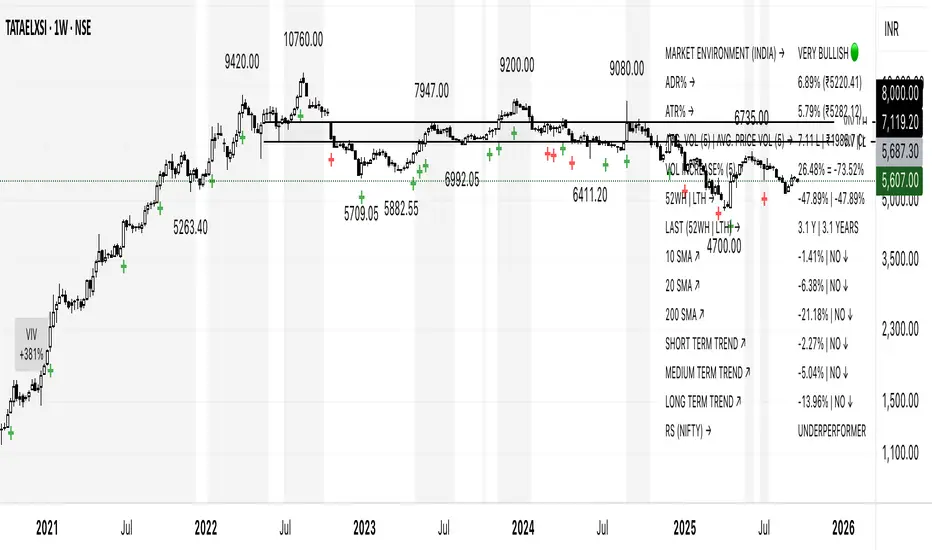

VIV (Very Important Volume) is a custom-built TradingView indicator designed to decode the psychology behind price and volume behavior — whether you are a breakout trader, reversal trader, or use your own discretionary logic. VIV reveals where institutional activity is likely taking place, highlights trend stages, uncovers volume footprints, and identifies high-probability trading zones — all with zero lag & 100% price-action-based logic.

Key Features (Expanded Concepts)

01. Trend-Based Analysis with Stages and Background Colors

VIV breaks down the market into three color-coded stages based on trend confirmation:

Stage 3: Uptrend (Short-Term Trend Confirmation)

Stage 2: Uptrend (Medium-Term Trend Confirmation)

Stage 1: Uptrend (Long-Term Trend Confirmation)

These trend stages reflect the emotional phases of market participants and the shifting balance of power between buyers and sellers. You can toggle trend backgrounds for intraday, daily, weekly, and monthly trends and change their background colors.

Note : If the % difference in Stage 3 exceeds 10%, the stock is considered extended. Such setups should be evaluated with caution before making any trade decisions.

02. . Volume Footprints (➕ Signs)

VIV intelligently identifies past candles with high-volume activity (accumulation/distribution).

03. VIV || H, VIV || L and VIV || C Zones

Automatically plots horizontal levels from high-volume, high-activity candles—revealing the footprints of smart money.

These zones show where price historically reacted due to strong institutional presence. They come with customizable label colors and backgrounds.

04. Price Tightness Detection

Detects when two or more candles compress within the range of a larger parent candle.

Represents indecision, contraction, or coiling behavior before major price moves.

Ideal for both:

Color-coded markers indicate such tight price zones — disabled by default but can be enabled.

05. Technical Stats Panel (Important Data Table)

An insightful dashboard providing:

Trend Data:

Relative Strength vs Benchmark

06. Relative Strength Grade Change Alerts

VIV tracks relative strength changes against a chosen benchmark (e.g., Nifty MidSmallCap).

The above tells us that if the stock is stronger or weaker than the benchmark.

Detects when relative strength shifts from:

These alerts can help in:

07. Smart Alerts (Built-in Conditions)

You can set alerts for (any timeframe)

Set your preferred interval and trigger type in TradingView to stay updated without chart-watching.

08. Pivot Points

VIV allows visualizing pivot highs and lows using a dynamic window (left/right lookback).

09. Customization Options

Toggle modules like trend background, labels, stats, and volume zones.

Customize colors for:

How to Use VIV Effectively

Best Suited For:

Key Features (Expanded Concepts)

01. Trend-Based Analysis with Stages and Background Colors

VIV breaks down the market into three color-coded stages based on trend confirmation:

Stage 3: Uptrend (Short-Term Trend Confirmation)

- Marks early accumulation or consolidation.

- Shows possible reversal zones.

- Short-term traders use this to spot opportunities before a breakout.

Stage 2: Uptrend (Medium-Term Trend Confirmation)

- Highlights the start of a strong directional move.

- Confidence zone for position building and breakout-following strategies.

Stage 1: Uptrend (Long-Term Trend Confirmation)

- Indicates long term strength.

These trend stages reflect the emotional phases of market participants and the shifting balance of power between buyers and sellers. You can toggle trend backgrounds for intraday, daily, weekly, and monthly trends and change their background colors.

Note : If the % difference in Stage 3 exceeds 10%, the stock is considered extended. Such setups should be evaluated with caution before making any trade decisions.

02. . Volume Footprints (➕ Signs)

VIV intelligently identifies past candles with high-volume activity (accumulation/distribution).

- These are not typical breakout volumes, but subtle footprints of smart money.

- Help spot reversal points, liquidity zones, and retest levels.

- Valuable for both breakout and reversal traders to confirm zone strength.

- You can enable or disable these lines, adjust color, style, and width via VIV Line Settings.

03. VIV || H, VIV || L and VIV || C Zones

Automatically plots horizontal levels from high-volume, high-activity candles—revealing the footprints of smart money.

- VIV || H (High) = Top of important bar.

- VIV || L (Low) = Bottom of important bar.

- VIV || C (Close) = Close price of important bar.

- Key levels used by traders for:

- Entries

- Stop-loss placement

- Targets

These zones show where price historically reacted due to strong institutional presence. They come with customizable label colors and backgrounds.

04. Price Tightness Detection

Detects when two or more candles compress within the range of a larger parent candle.

Represents indecision, contraction, or coiling behavior before major price moves.

Ideal for both:

- Breakout traders looking for base formations.

- Reversal traders watching for exhaustion.

Color-coded markers indicate such tight price zones — disabled by default but can be enabled.

05. Technical Stats Panel (Important Data Table)

An insightful dashboard providing:

- ADR% – Volatility-based movement expectations (change period via input).

- ATR – Real volatility indicator.

- Average Volume / Price Volume – Customizable average period and currency unit (INR/USD).

Trend Data:

- 10/20/200 SMAs

- 10-week & 20-week trend stages (custom SMA period/timeframe supported)

Relative Strength vs Benchmark

- RS grade: GREAT, GOOD, FAIR, UNCERTAIN, UNDER PERFORMER, LAGGARD, POOR

- When RS is comparing: BOTH STRONG, BOTH WEEK

- You can also display the benchmark symbol name and change the symbol for relative strength comparison.

06. Relative Strength Grade Change Alerts

VIV tracks relative strength changes against a chosen benchmark (e.g., Nifty MidSmallCap).

The above tells us that if the stock is stronger or weaker than the benchmark.

Detects when relative strength shifts from:

- Strong → Weak (e.g., EXCELLENT → GOOD → FAIR)

- Weak → Strong (e.g., LAGGARD → POOR → FAIR → GOOD)

- Sudden transitions (e.g., WORST → FAIR, BOTH WEAK → GOOD, BOTH GOOD → POOR)

- BOTH WEAK → GOOD or BOTH GOOD → POOR means stock's strength is better/poor than the benchmark

- and more.

These alerts can help in:

- Early trend following

- Exiting when RS degrades

- Adding positions when RS improves

07. Smart Alerts (Built-in Conditions)

You can set alerts for (any timeframe)

- Positive Trend

- Negative Trend

- Rise in Volume

- Relative Strength Changed

Set your preferred interval and trigger type in TradingView to stay updated without chart-watching.

08. Pivot Points

VIV allows visualizing pivot highs and lows using a dynamic window (left/right lookback).

- Customizable label text and background color.

- Helpful in identifying support or resistance zones and breakout points.

09. Customization Options

Toggle modules like trend background, labels, stats, and volume zones.

Customize colors for:

- Labels

- Zones

- Trend backgrounds

- Table text, borders, and alignment

- Adjust visibility per timeframe (inputs tab)

How to Use VIV Effectively

- Use trend background colors to identify phase (base, uptrend, top).

- Look for stage 1, stage 2 and stage 3 for short, medium and long term trend.

- Watch for old high-volume candles (➕ marks) to plan entries/exits.

- Trade around ➕ marks, VIV || H and VIV || L levels.

- Use tight price zones to anticipate explosive moves.

- Monitor table for ATR/ADR, RS grade, and moving averages.

- Use alerts to automate monitoring of trend, volume, or RS shifts.

Best Suited For:

- Reversal traders (demand/supply based)

- Breakout traders using base-building logic

- Systematic or discretionary traders

- Anyone who values price-volume behavior over lagging indicators

版本注释

Updated Text.版本注释

Small text updates.版本注释

1. RENAMED STAGE NAMES TO TREND BASE TO AVOID THE CONFUSIONSTAGE 3 → SHORT TERM TREND

STAGE 2 → MEDIUM TERM TREND

STAGE 3 → LONG TERM TREND

2. NOW AVG. VOL WILL ALSO SHOW LIKE CR/L/K (CRORES/LAKH/THOUSAND) IF AVG. PRICE VOLUME IS INR. EARLIER IT WAS SHOWING IN M/K (MILLION/THOUSAND) ONLY

版本注释

Text Change版本注释

VIV has been upgraded to Version 1.1! We’ve made some key improvements to make your trading experience even smoother:

What’s New in V1.1?

Stage names are now clearer and renamed as “Trend Base” to avoid confusion:

Stage 3 → Short-Term Trend

Stage 2 → Medium-Term Trend

Stage 1 → Long-Term Trend

Improved Volume Display:

If your price/volume is in INR, average volume will now display as CR / L / K (Crore / Lakh / Thousand) instead of just M / K (Million / Thousand).

Makes it easier to read at a glance!

版本注释

// Version 1.2 //Table Positioning – The important values table can now be placed at "Middle Left" or "Middle Right" for better visibility.

Volume Increase% Display – Enhanced volume metric:

- Earlier: 125% or 75%

- Now: 125% (+25%) or 75% (−25%)

This makes it instantly clear whether volume is above or below the average and by how much.

版本注释

1. BUG FIXED - VIV label was showing double value2. UPDATES

Now table will show the selected number of days for Avg. Volume and Volume increase%

i.e. AVG. VOL (5) and VOLUME INCREASE% (5)

版本注释

/ VERSION 1.4 //1. Bug Fix – Corrected Long-Term Trend display (YES/NO) in the table.

2. Price Tightness Enhancements

- Added toggle to show/hide price tightness.

- Option to display or hide horizontal lines on the high and low of the parent candle.

- Customizable line colors for better chart visibility.

版本注释

// VERSION 1.5 // 🔧 FIX: Price Tightness Lines Color

Previously, the option to change the color of Price Tightness lines was available but not functioning correctly. Now, the color customization works as intended.

版本注释

Minor update in V 1.5 - You can now choose if you only want to show price tightness on weekly and monthly charts.版本注释

Small Text update.版本注释

//Version 1.6 Updates//🔥 New Feature: Market Environment

Added Market Environment Analysis.

Market Environment categories:

🟢 Very Bullish

🟢 Bullish

🔵 Be Careful

🟠 Uncertain

🔴 Bearish

🌍 Global Index Support

Added Country Selector dropdown in settings.

Automatically maps major country → benchmark index:

🇮🇳 India → Nifty 50

🇺🇸 America → S&P 500

🇩🇪 Germany → DAX

🇬🇧 United Kingdom → FTSE 100 (UKX)

🇭🇰 Hong Kong → HSI

🇧🇷 Brazil → IBOV

🇷🇺 Russia → IMOEX

🇰🇷 Korea → KOSPI

🇨🇳 China → Shanghai Composite

🇫🇷 France → CAC 40

🇨🇦 Canada → TSX

🎨 UI Enhancements

Market Environment shown on chart table as a clean label.

Round colored icons for conditions (🟢🟢🔵🟠🔴)

Option in settings to Show / Hide Market Environment.

版本注释

Small update in text as well in market environment, now country name will be visible.e.g. MARKET ENVIRONMENT (INDIA) → Very Bullish 🟢

版本注释

Text change.版本注释

FIXED BUG FOR UK & KOREA MARKET ENVIRONMENT.Now market environment is available for world's top 10 economies including USA, China, Germany, Japan, India, UK, France, Italy, Canada and Brazil + Russia (Bonus)

版本注释

🔥 VIV v1.7 Update Released //This update brings ADR% & ATR% improvements:

Adjusted Price Levels → Alongside ADR% & ATR%, VIV now shows the price after applying the % range.

Example: ADR% = 0.5 and Price = 100 → ADR% = 0.5% (99.5)

Practical Stop Usage → These adjusted levels can now be used as dynamic stop-loss references, helping you place stops based on real volatility instead of guesswork.

Makes risk & range more actionable, visible, and trader-friendly.

🚀 Another step in making VIV not just an indicator, but a decision-making toolkit.

版本注释

NOW YOU CAN SET MARKET ENVIRONMENT CHANGE ALERT版本注释

Text Change版本注释

Bug fixed.版本注释

Alert text changeEnd of V1.7 update

版本注释

Alert Update : NEW FOOTPRINT (SET NEW FOOTPRINT AS A ALERT)版本注释

Bug Fixed - Avg. Volume. in K/L/Cr. if ₹ is selected.仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系lifensunil。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

VIV is a paid premium, invite-only indicator.

To access and use the indicator, please visit: https://www.viv.net.in/membership

During the signup process, please provide your exact TradingView username — double-check to ensure smooth access.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系lifensunil。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

VIV is a paid premium, invite-only indicator.

To access and use the indicator, please visit: https://www.viv.net.in/membership

During the signup process, please provide your exact TradingView username — double-check to ensure smooth access.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。