OPEN-SOURCE SCRIPT

Daily Investments Index Scalp

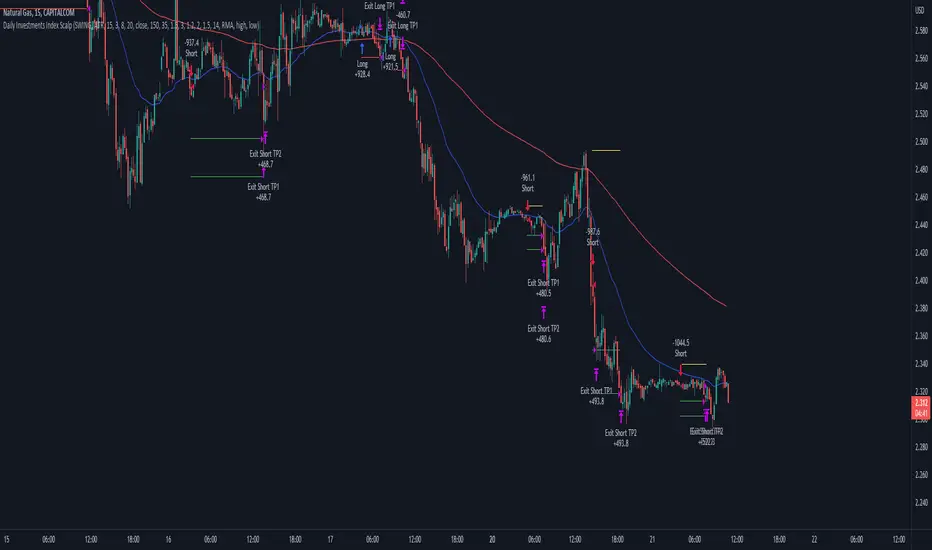

This strategy is based on the DIDI index with our own confirmations and calculated SL/TP .

You can change every setting if you want it to use for another pair, but this is fine tuned for NATURALGAS

The entries are taken when:

Long:

- Buy signal from the DIDI indicator

- Long EMA is underneath the Short EMA

- Price must be Above the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

Short:

- Sell signal from the DIDI indicator

- Long EMA is Above the Short EMA

- Price must be Below the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

It's fairly simple, and i think you can use this base so extend your own strategy

Good luck :)

If you have any questions, feel free to comment

You can change every setting if you want it to use for another pair, but this is fine tuned for NATURALGAS

The entries are taken when:

Long:

- Buy signal from the DIDI indicator

- Long EMA is underneath the Short EMA

- Price must be Above the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

Short:

- Sell signal from the DIDI indicator

- Long EMA is Above the Short EMA

- Price must be Below the Long EMA

- TP1 (default) - ATR based first TP is ATR * 1.2 Multiplier

- TP2 (default) - ATR based first TP is ATR * 2 Multiplier

- TP2 SL is the strategy entry price when we hit the first TP

- SL (default) - Latest swing low with a look back of 17 candles

It's fairly simple, and i think you can use this base so extend your own strategy

Good luck :)

If you have any questions, feel free to comment

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。