INVITE-ONLY SCRIPT

已更新 QaSH DCA Algorithm 2.0

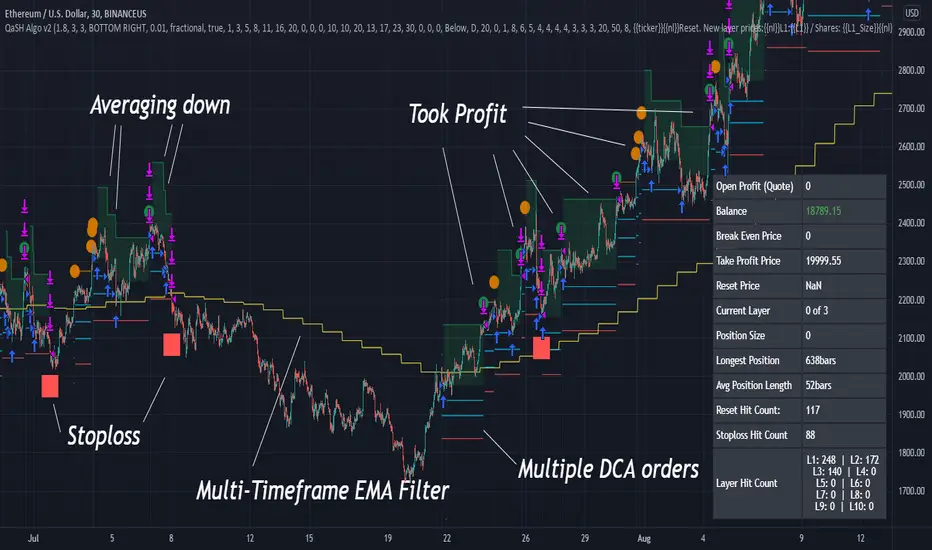

This is the strategy version of the QaSH DCA Algorithm indicator. This strategy version of the script includes live trading alert functionality, so it can be considered as a replacement that makes the indicator version obsolete. With this version, features have been added and also you can take advantage of TradingView's native backtesting system for more detailed backtest results.

QaSH DCA Algorithm implements a DCA strategy that takes advantage of price volatility by buying dips to average down, and adjusting price targets as the break-even price gets lower.

How does the DCA strategy work?

When the specified entry condition has occurred, the indicator will set up several limit orders below the current price. If price goes up a specified amount, then the layers will be overwritten at the higher prices. If price goes down and fills the first layer (limit order), then the Take Profit price is plotted and will be sent in an alert. If more layers are filled, then the TP price will move down accordingly as it’s based on the average entry price (alerts on each TP update). This action of lowering the average entry and TP price mitigates your risk, and increases the likelihood of a Take Profit event happening. This script uses a simple "ASAP" mode, where each deal will start exactly 2 bars after the last trade ended. An EMA filter and stoploss function was also added for risk management.

How does this differ from other DCA bots?

1) The layer placements, order volume , and “take profit %” for each layer or “safety order” is much more customizable than what you get from other services. For example, I can choose to have my TP% change, depending on how big the price dip was. Maybe on safety order 1 I want 10% TP, but on safety order 7 might want a 2% TP.

2) The entry condition is adjustable. For example, this script has an ema filter for entries.

3) Settings optimization. You can take advantage of the replay feature and TradingView's backtest system to see how trades would have played out, and how much PnL you would have made

4) You can use this indicator on more than just crypto. You can easily set up alerts for manual trades on stocks, or you can integrate it with your stock broker API of choice and automate your trades.

5) When combining this with an automation service, you will get unmatched execution speed by running it on your dedicated machine.

6) I can offer a lifetime subscription to the indicator upon request.

What kind of market is it best used on?

QaSH DCA Algorithm is best used on assets that are volatile. That means large and frequent swings up and down. Also I recommend running this on many uncorrelated assets at the same time. Better yet, run it with a variety of different settings simultaneously on the same asset.

What settings should I use?

The default settings are decent for most markets, and provide a good balance between profit potential and downside protection, although you can use a wide variety of settings. In a strong bull market its best to either bring up your layers to catch smaller dips, or you can go big on the first few layers (maybe 4 layers, 25% on each layer for example). In a sideways or brearish market you'll want more downside protection, so you'll want the larger orders to be at lower prices, or possibly use the stoploss and EMA filter.

QaSH DCA Algorithm implements a DCA strategy that takes advantage of price volatility by buying dips to average down, and adjusting price targets as the break-even price gets lower.

How does the DCA strategy work?

When the specified entry condition has occurred, the indicator will set up several limit orders below the current price. If price goes up a specified amount, then the layers will be overwritten at the higher prices. If price goes down and fills the first layer (limit order), then the Take Profit price is plotted and will be sent in an alert. If more layers are filled, then the TP price will move down accordingly as it’s based on the average entry price (alerts on each TP update). This action of lowering the average entry and TP price mitigates your risk, and increases the likelihood of a Take Profit event happening. This script uses a simple "ASAP" mode, where each deal will start exactly 2 bars after the last trade ended. An EMA filter and stoploss function was also added for risk management.

How does this differ from other DCA bots?

1) The layer placements, order volume , and “take profit %” for each layer or “safety order” is much more customizable than what you get from other services. For example, I can choose to have my TP% change, depending on how big the price dip was. Maybe on safety order 1 I want 10% TP, but on safety order 7 might want a 2% TP.

2) The entry condition is adjustable. For example, this script has an ema filter for entries.

3) Settings optimization. You can take advantage of the replay feature and TradingView's backtest system to see how trades would have played out, and how much PnL you would have made

4) You can use this indicator on more than just crypto. You can easily set up alerts for manual trades on stocks, or you can integrate it with your stock broker API of choice and automate your trades.

5) When combining this with an automation service, you will get unmatched execution speed by running it on your dedicated machine.

6) I can offer a lifetime subscription to the indicator upon request.

What kind of market is it best used on?

QaSH DCA Algorithm is best used on assets that are volatile. That means large and frequent swings up and down. Also I recommend running this on many uncorrelated assets at the same time. Better yet, run it with a variety of different settings simultaneously on the same asset.

What settings should I use?

The default settings are decent for most markets, and provide a good balance between profit potential and downside protection, although you can use a wide variety of settings. In a strong bull market its best to either bring up your layers to catch smaller dips, or you can go big on the first few layers (maybe 4 layers, 25% on each layer for example). In a sideways or brearish market you'll want more downside protection, so you'll want the larger orders to be at lower prices, or possibly use the stoploss and EMA filter.

版本注释

updated tooltips to explain the placeholders that can go into the alerts版本注释

disabled ATR plot on default settings版本注释

some logic improvements版本注释

added more placeholders for alertsupdated tooltips to describe the placeholders

版本注释

aligned some rulesets with the daytrader script for consistency版本注释

changed {{filled_size}} placeholder from returning 0 on a "take profit" alert to returning what the position size was before the alert occurred. 版本注释

improved alignment with daytrader script for consistencyfixed issue where position size calculation wasn't updating

版本注释

-changed the "bot start" logic a bit. Now, if you pause your alert and then start it again, it will go ahead and start running the first trade. Before, you would have had to change your start time and recreate the alert to get it running again.-fixed layer hit counters on the dashboard

版本注释

After some discussion with people from the PineScript team, I'm changing the way I handle the differences between live data and backtest data. -I removed the "live trades" vs "backtest" input

-backtests and live trades now use exactly the same logic

-added a "killswitch" feature that can kill the script whenever TradingView's servers shut down and reset your alerts. This should resolve any concerns of the script coming out of alignment with your exchange, which was what I was trying to resolve when I had the "backtest" and "live trade" modes

-changed the data table to a more aesthetic format

版本注释

added a "tick overshoot" input for guaranteeing alignment between exchange and indicator.版本注释

updated tooltips and default alert input to better inform users of new features and placeholders版本注释

added a checkbox to the new market dca alert, for consistency版本注释

added support for inverse perpetuals when using the timed market DCA function 版本注释

added support for using "whole shares" input with the "red bag DCA" function版本注释

minor edits to the tooltips版本注释

minor edits to some tooltips and default alert messages版本注释

fixed a bug in the {{TP}} placeholder版本注释

minor edit to how some alerts appear in the input window仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系ParabolicValue。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

For indicator access:

Patreon: https://www.patreon.com/QaSH

For questions and support:

Discord: https://discord.gg/kahPkedYpD

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系ParabolicValue。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

For indicator access:

Patreon: https://www.patreon.com/QaSH

For questions and support:

Discord: https://discord.gg/kahPkedYpD

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。