INVITE-ONLY SCRIPT

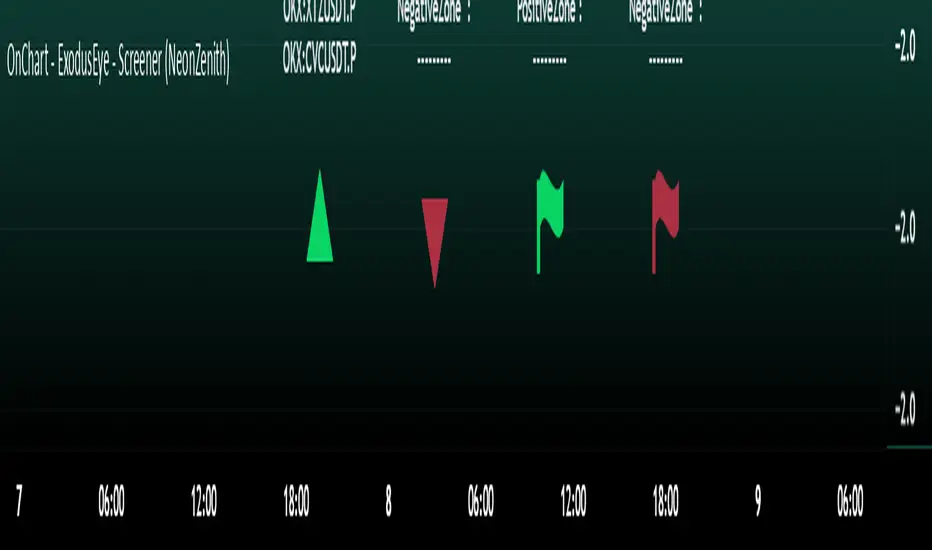

已更新 OnChart - ExodusEye - Screener

Motivation Behind OnChart ExodusEye Screener:

The goal of the ExodusEye Screener is to provide traders with a quick and efficient way to identify trading opportunities across multiple symbols without manually checking each one. By integrating the powerful logic of OnChart features, the screener aims to streamline the analysis process, helping traders find actionable insights in real-time.

█ Overall Explanation

The ExodusEye Screener is a tool that underlays directly onto the chart, using the logic from various OnChart features. It offers 4 modes of operation:

█ How to Use:

█ Detailed Feature Explanations:

--------------🎯CandleSniper --------------

Overview:

The CandleSniper indicator is designed to identify potential turning points in the market by combining various technical analysis tools. It leverages a combination of the MACD indicator, advanced phase analysis technique, and Fibonacci levels to highlight moments where price action may be reversing. This helps traders spot divergence opportunities and set potential target levels.

Explanation

MACD Divergence with Phase Analysis:

Inputs and Settings:

How to Use:

Traders can use the CandleSniper indicator to identify potential decision points by observing the color changes on the bars and the plotted Fibonacci levels:

🟢Bullish Decision Points:

When the indicator detects a bullish divergence, it highlights the bars in purple and plots potential upward Fibonacci levels as targets.

🔴Bearish Decision Points:

When a bearish divergence is detected, the indicator highlights the bars in white and plots downward Fibonacci levels as targets.

--------------🧲MagnetZone Horizon--------------

Overview:

The MagnetZone Horizon indicator is a specialized tool designed to identify potential gaps between two significant changes in the Average True Range (ATR). These gaps, calculated dynamically, serve as areas where the price might react, often acting as smart Fair Value Gaps (FVG). By highlighting these zones, traders can gain insights into where the market might find support, resistance, or potential reversal points.

Settings and Their Impact:

Use Cases:

The MagnetZone Horizon indicator is particularly useful for traders looking to identify significant gaps in market activity that are influenced by volatility. These smart FVGs provide a deeper understanding of where the market might react, offering a valuable tool for enhancing trading strategies and adds another strategic piece to the puzzle in the OnChart Suite.

--------------🟢NeonZenith Indicator--------------

Overview:

NeonZenith is a tool designed to provide traders with a better understanding of market trends and potential decision points by utilising multiple elements, including EMAs and Fibonacci levels. This indicator identifies key structures in recent price movements, helping traders recognize potential trend shifts and generate target levels for their trading strategies.

Key Features:

Settings:

Left and Right Border Width:

These settings control the lookback period for identifying significant price structures. By adjusting these parameters, traders can fine-tune the sensitivity of the indicator to recent price movements.

█ Conclusion

The OnChart ExodusEye Screener simplifies the process of finding trading opportunities by using the logic of OnChart's indicators. By providing real-time insights directly on the chart, it helps traders quickly identify potential setups across multiple symbols.

The goal of the ExodusEye Screener is to provide traders with a quick and efficient way to identify trading opportunities across multiple symbols without manually checking each one. By integrating the powerful logic of OnChart features, the screener aims to streamline the analysis process, helping traders find actionable insights in real-time.

█ Overall Explanation

The ExodusEye Screener is a tool that underlays directly onto the chart, using the logic from various OnChart features. It offers 4 modes of operation:

- MagnetZone Mode: Highlights symbols where new strategic zones have formed, indicating potential areas of interest.

- CandleSniper Mode: Identifies symbols with bullish or bearish decision points, helping traders spot potential turning moments.

- NeonZenith Mode: Displays decision points across four different categories, showing where key levels are being reached live.

- Off Mode: Disables the overlay, allowing traders to use the chart without any active screener logic.

█ How to Use:

- Modes: Select the mode that aligns with your current strategy. Each mode focuses on a specific aspect of the market, providing insights tailored to different trading approaches.

- Symbols: Choose the symbols you want the screener to analyze. The screener will automatically update and show relevant information for each selected symbol based on the active mode.

█ Detailed Feature Explanations:

--------------🎯CandleSniper --------------

Overview:

The CandleSniper indicator is designed to identify potential turning points in the market by combining various technical analysis tools. It leverages a combination of the MACD indicator, advanced phase analysis technique, and Fibonacci levels to highlight moments where price action may be reversing. This helps traders spot divergence opportunities and set potential target levels.

Explanation

MACD Divergence with Phase Analysis:

- The indicator leverages the MACD (Moving Average Convergence Divergence) to identify divergences, which can indicate potential reversal points in the market. The MACD is computed using standard short and long lengths, along with a signal line.

- An advanced phase analysis technique is employed to measure the difference between price and its moving averages, enabling the identification of cyclical turning points in the market

- A potential bullish decision point is identified when the MACD line crosses above the signal line during a cyclical turning point. Conversely, a potential bearish decision point is identified when the MACD line crosses below the signal line during a cyclical turning point.

Inputs and Settings:

- lookbackPeriod: Defines the period over which the indicator looks back to calculate the Fibonacci levels. Adjusting this setting can change the sensitivity of the decision points.

- Dimmer and DimmerPeriod: These settings control the smoothing applied to the price data before the phase calculation. They help in reducing noise and ensuring that only significant price movements are considered for decision points.

How to Use:

Traders can use the CandleSniper indicator to identify potential decision points by observing the color changes on the bars and the plotted Fibonacci levels:

🟢Bullish Decision Points:

When the indicator detects a bullish divergence, it highlights the bars in purple and plots potential upward Fibonacci levels as targets.

🔴Bearish Decision Points:

When a bearish divergence is detected, the indicator highlights the bars in white and plots downward Fibonacci levels as targets.

These decision points can help traders identify when the market might be ready for a reversal or continuation or even use as a start point from where the trader can start his own analysis

--------------🧲MagnetZone Horizon--------------

Overview:

The MagnetZone Horizon indicator is a specialized tool designed to identify potential gaps between two significant changes in the Average True Range (ATR). These gaps, calculated dynamically, serve as areas where the price might react, often acting as smart Fair Value Gaps (FVG). By highlighting these zones, traders can gain insights into where the market might find support, resistance, or potential reversal points.

Settings and Their Impact:

- Factor:This setting multiplies the ATR to scale the detected gaps. A higher factor results in broader zones, which might capture more significant market movements, while a lower factor creates tighter zones for more precise analysis.

- Division:This setting works in conjunction with the Factor to further refine the gap calculations. Adjusting the Division setting allows traders to fine-tune how sensitive the indicator is to ATR changes, which can help in pinpointing more precise smart FVGs.

Use Cases:

- Gap Trading:

Traders can use the identified gaps as potential areas to enter or exit trades, particularly if the price approaches these smart FVGs. The idea is to capitalize on the likelihood that the market will react to these gaps. - Reversal Identification:

The zones marked by the MagnetZone Horizon can indicate potential reversal points, especially in volatile markets where significant ATR changes suggest a shift in market sentiment. - Trend Continuation or Rejection:

By monitoring how the price interacts with these dynamically calculated zones, traders can assess whether a trend is likely to continue or reverse, aiding in more informed trading decisions.

The MagnetZone Horizon indicator is particularly useful for traders looking to identify significant gaps in market activity that are influenced by volatility. These smart FVGs provide a deeper understanding of where the market might react, offering a valuable tool for enhancing trading strategies and adds another strategic piece to the puzzle in the OnChart Suite.

--------------🟢NeonZenith Indicator--------------

Overview:

NeonZenith is a tool designed to provide traders with a better understanding of market trends and potential decision points by utilising multiple elements, including EMAs and Fibonacci levels. This indicator identifies key structures in recent price movements, helping traders recognize potential trend shifts and generate target levels for their trading strategies.

Key Features:

- Trend Direction Identification:

NeonZenith uses EMAs to help traders gauge the overall trend direction. By analysing the relationship between different EMAs, the tool highlights potential points where trends may strengthen or reverse, offering decision points for traders to consider in their strategies. - Decision Points:

The tool generates decision points based on EMA interactions, providing traders with crucial levels that may indicate potential market entries or exits. These decision points are derived from the intersection of EMAs, which are known for their reliability in identifying trend shifts.

Settings:

Left and Right Border Width:

These settings control the lookback period for identifying significant price structures. By adjusting these parameters, traders can fine-tune the sensitivity of the indicator to recent price movements.

█ Conclusion

The OnChart ExodusEye Screener simplifies the process of finding trading opportunities by using the logic of OnChart's indicators. By providing real-time insights directly on the chart, it helps traders quickly identify potential setups across multiple symbols.

版本注释

Update 1.1: Predefined Symbol Adjustment

We've resolved an issue caused by the delisting of DAR from Binance, which affected the scanner's functionality. To ensure seamless performance, we've replaced DAR with BTC as a predefined symbol.

版本注释

Bug Fix - Non-existing symbol仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系OnChart_Labs。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

For access requests visit our website: onchart.ai

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系OnChart_Labs。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

For access requests visit our website: onchart.ai

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。