OPEN-SOURCE SCRIPT

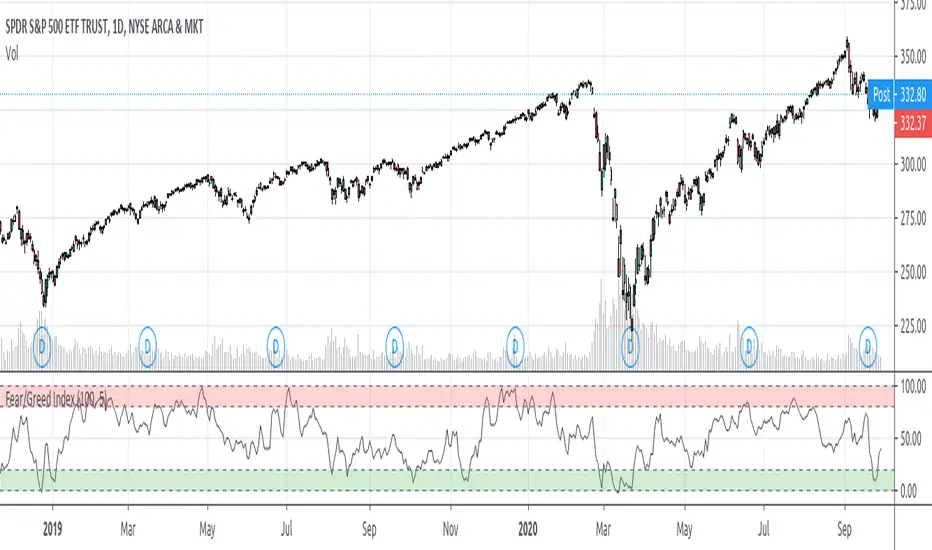

Fear/Greed Index

My goal was to create something akin to the Fear & Greed Index (https://money.cnn.com/data/fear-and-greed/) that CNN and others do.

A Fear/Greed Index can be used by any trader or investor but I believe it's best viewed with a contrarian's eye--

The script draws from several other tickers which I have read and personally observed to be decent macro correlations for the stock market (specifically the SP500). For the state of each of these metrics I gave a rating, good or bad, then added them together and put it into your standard Stochastic.

These macro correlations include--

A Fear/Greed Index can be used by any trader or investor but I believe it's best viewed with a contrarian's eye--

- When the market appears to be signalling Extreme Fear, that is a good place to start buying from emotional players who want to sell no matter the price

- When signalling Extreme Greed, that may be a good place to start taking profits off or getting hedged, as there may be too much exuberance in the air

- Important to note and remember, however, is that there can often times be fear in the air for good reasons! I like to see this as if we dip into extreme fear and return shortly after, the fear may warrant constraint from buying, or returning back to extreme greed may be a very strong market extension

The script draws from several other tickers which I have read and personally observed to be decent macro correlations for the stock market (specifically the SP500). For the state of each of these metrics I gave a rating, good or bad, then added them together and put it into your standard Stochastic.

These macro correlations include--

- The % of stocks in the SP500 above multiple Simple Moving Average lengths

- VIX and its term-structure (contango, backwardation)

- Treasury Bonds

- Gold

- Junk/High Yield Bonds

- The Put/Call Ratio

- The SP500 Options Skew

- Advancing and Declining Issues

On some of these I opted to use a function for the Relative Momentum Index instead of RSI, as the RMI oscillates better (in my opinion). I also used a Band-Pass Filter/Double EMA for smoothing the results of the stochastic.

A LOT of these numbers were made to my own observation and discretion and can get out-dated over time. With that said, PLEASE feel free to revise, fine tune, modify this as you wish to optimize yours. And please let me know if I have made any mistakes here or something should be added.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。