OPEN-SOURCE SCRIPT

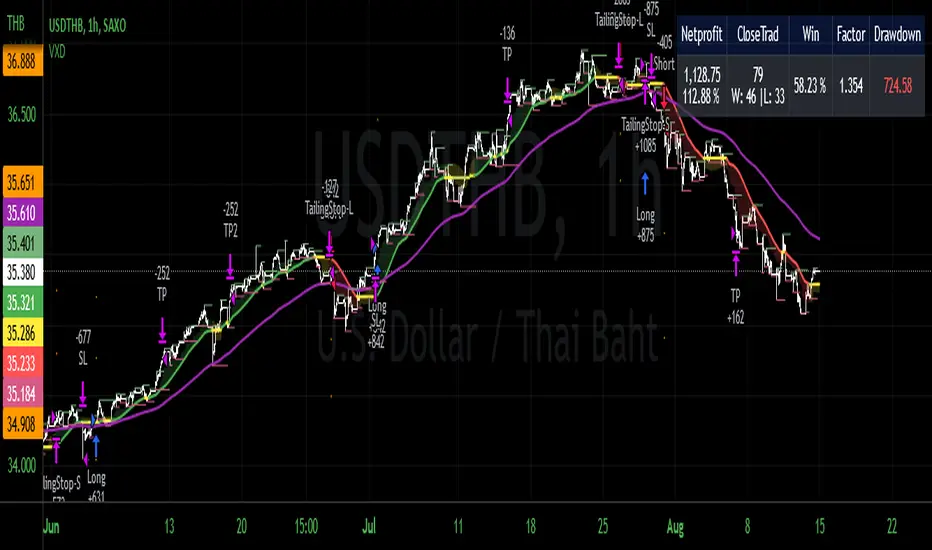

已更新 VXD Cloud Edition

VXD Cloud Edition.

to overcome sideways market conditions this cloud configured for low timeframe.

every TA is same as VXD Supercycle but show as cloud.

Symbols on chart show Premium and Discount Prices

X-Cross = Engulfing Candle with weak volume .

O-circle - Engulfing Candle with strong volume .

Pivot point and Rejected Block

Pivot show last High and low of a price in past bars

Rejected Block show when that High or Low price are important level to determined if it's Hidden Divergence or Divergence (with RSI)

Setting

Momentum: RSI = 25 , RSI MA = 14

Trend: Rolling VWAP and ATR and Subhag (Everthing show as a cloud)

Trailing STOP: ATR 12 x 2.4

Highlight Bars color when volume is above SMA 6

SMA200 act as TP Line

Risk:Reward Calculation

if Buy your Stoploss will be previous Pivot low

if Sell your Stoploss will be previous Pivot high

and TP line will be calculated form there, then show in Orange color line

Buy condition : Close is above Cloud and close above pivot high

Sell condition : Close is below Cloud and close below pivot low

Trip : add this to alerts setting.

Order {{strategy.order.action}} filled on {{ticker}} @ {{strategy.order.price}} {{strategy.order.alert_message}}.

to overcome sideways market conditions this cloud configured for low timeframe.

every TA is same as VXD Supercycle but show as cloud.

Symbols on chart show Premium and Discount Prices

X-Cross = Engulfing Candle with weak volume .

O-circle - Engulfing Candle with strong volume .

Pivot point and Rejected Block

Pivot show last High and low of a price in past bars

Rejected Block show when that High or Low price are important level to determined if it's Hidden Divergence or Divergence (with RSI)

Setting

Momentum: RSI = 25 , RSI MA = 14

Trend: Rolling VWAP and ATR and Subhag (Everthing show as a cloud)

Trailing STOP: ATR 12 x 2.4

Highlight Bars color when volume is above SMA 6

SMA200 act as TP Line

Risk:Reward Calculation

if Buy your Stoploss will be previous Pivot low

if Sell your Stoploss will be previous Pivot high

and TP line will be calculated form there, then show in Orange color line

Buy condition : Close is above Cloud and close above pivot high

Sell condition : Close is below Cloud and close below pivot low

Trip : add this to alerts setting.

Order {{strategy.order.action}} filled on {{ticker}} @ {{strategy.order.price}} {{strategy.order.alert_message}}.

版本注释

What's new?-Rolling VWAP is Removed

-Add Auto Position Sizing

-Add ability to edit cloud color

-Fixed TP line bug (now only show where an order is excuted)

Auto Position Sizing

Is calculate form our SL (Pivot High Low)

you can fixed how much you can lose per trade in the setting, this will helping you minimized your losing trade.

版本注释

Minor Change Swap Position of Code.版本注释

Fixed mistaken text signal.版本注释

-Fixed SMA TP Line not working in some Timeframe.Please comment for future improvement.

版本注释

What's new?+Add Ability to enable/disable SMA TP line separately form RR TP line

+Update Pivot Lookup - now can set up to 20 (This help alot in low timeframe even 1m)

+Improve Setting UI

版本注释

Double TP is working!.https://www.tradingview.com/x/mGAiWcyQ/

版本注释

Minor Change.+Improve Backtest input and Setting UI.

+Delete no used part of code.

https://www.tradingview.com/x/VXHXMDC8/

版本注释

What's new?+ Cloud MA New tool! to overcome sideway market. This option can be allowed by select Order Condition : "Cloud MA" in the setting.

+ Option to plot pivot where it is detected in the setting ( give the option for script users to turn on plotting in the past through inputs, so they are necessarily aware of what the script is doing)

- Limit Pivot Lookup up to 8

- X-Cross = Engulfing Candle with weak volume . and O-circle - Engulfing Candle with strong volume . is removed (The display looks great, but it can be misleading.)

-RSI-MA cross 50 trigger order is removed

https://www.tradingview.com/x/15VxJP7D/

版本注释

Minor change.+Fixed alert stoped calculator error bug. by replaced subhag with linear regression curve.

版本注释

Minor ChangeBTCUSDTPREP Binance require a minimun lots size of 0.001 BTC

Using BTCUSD Index instead or Just increase losing trade size. to sloved "Pine cannot determine the referencing length of a series."

+ Improved input default setting.

+ Extreme minimized drawdown.

https://www.tradingview.com/x/JpqhErxx/

版本注释

How I can minimized drawdown?+ I decided to use lowest and highest of 3 pivot back to calculate a size and target.

版本注释

Minor Change!+ Fixed "Pine cannot determine the referencing length of a series. Try using max_bars_back' error" When using chart replay mode by adding Variable assignment to pullprice line.

+ Sizing now calculated form highest and lowest Pivotpoint up to 100 bars back(This can be changed in pivot setting)

+ ATR now calculated with alphatrend formula(replaced to ta.supertrend)

版本注释

Minor Change.Alphatrend have improved Cloud MA but worsen the old condition.

So I Decided to make ATR a dynamic variable.

1. When Could MA is in use ATR will calculated with Alphatrend Formula

2. When Old condition is in use ATR will calculated with Supertrend Formula

版本注释

Some folk told me that they have changed properties and position size and drawdown does not changed That Right!. Coz Position Size is in the Input Setting! NOT Properties!Please READ!

-Position size setting is in the input NOT properties!

โปรดอ่านเถอะ ขอร้อง

-การตั้ง Position size อยู่ใน Input ไม่ใช่ properties!

https://www.tradingview.com/x/w4Ck5vhg/

版本注释

+Adding more Variable assignment to avoid code using too much buffer size.版本注释

Fixed TP-MA being excuted when open order.https://www.tradingview.com/x/mo2ZqNFH/

版本注释

Fixed TP-MA on lossing trade.thank to chaiyapruekr commented this issue.

https://www.tradingview.com/x/5AhF2fnb/

版本注释

Minor update.-Show TP line on the same candle of order.

-ADD Transparent setting for cloud.

อัพเดตย่อย

-แสดง TP ที่แท่งออเดอร์

-เพิ่มการตั้งค่าความโปร่งใสของเมฆ

版本注释

Minor Change.+Stoploss setting - So we won't loss more than Losing per Trade in the setting

+New Description for order comment.

+เพิ่มตัวเลือกว่าจะตั้ง Stoploss (เพื่อแก้ไขระบบไม่ได้ Stoploss ตามที่เรากำหนดจำนวนเงินไว้ ซึ่งมีบางครั้งโดนลากยาว)

+แก้ตัวย่อสัญญาณที่เกิดขึ้นบนกราฟให้ระเอียดขึ้น

https://www.tradingview.com/x/UbZhcTXY/

版本注释

+Fixed missing TP.+Renew strategy order code.

++TP/SL Work greater than before.

https://www.tradingview.com/x/uF4wSCDe/

版本注释

-SMA200 are not TP line any more. +better ATR Periods.

I think it's time to working on Bots version!

-เอา TP SMA200 ออก

+ปรับค่า ATR

ตอนนี้คิดว่าระบบพร้อมสำหรับทำบอทแล้ว รอชมกันครับ :D

版本注释

+Another idea to show TP and SL when order is excuted.https://www.tradingview.com/x/CQy4Pcj6/

版本注释

+New RRR setting.版本注释

+Fixed avoid take position after TP 100% . 版本注释

Minor change.+Improve Cloud MA with Andean Oscillator. Bull and Bear component.

版本注释

Update.+Limit position size to not larger than Equity if not using leverage.

+Risk of Ruin Setting can now selected between Fixed $ or %

+TP level 2

+Show Backtest window table.

อัพเดต.

+จำกัดการเปิด position ที่ ใหญ่เกินเงินที่มี หากไม่ใช้ Leverage

+การตั้งค่า Risk of Ruin เพิ่มตัวเลือกระหว่าง Fixed $ หรือ จะใช้เป็น %

+ TP ขั้นที่ 2

+ตารางแสดงผล Backtest

版本注释

edit alert message.版本注释

+Improve TP/SL work more accurate. 开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。