OPEN-SOURCE SCRIPT

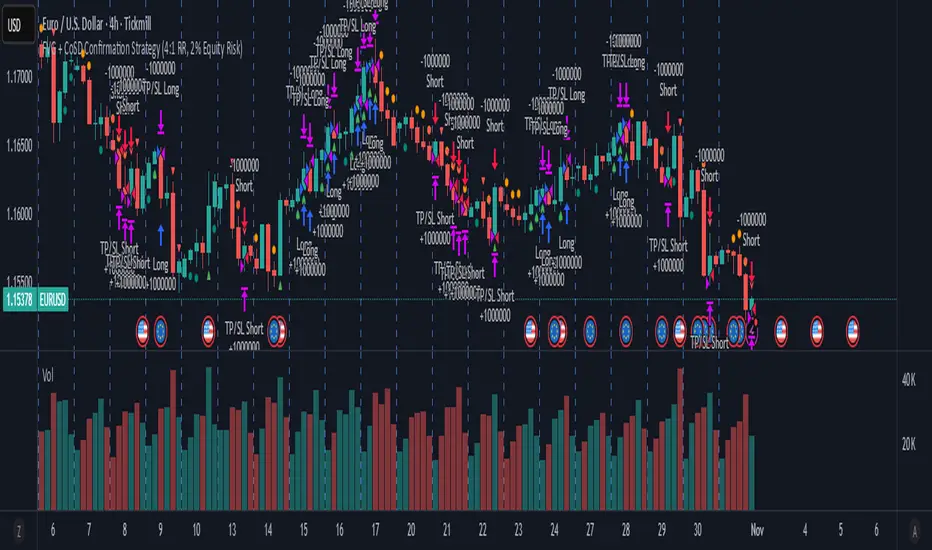

FVG + CoSD Confirmation Strategy (6:1 RR, 2% Equity Risk)

This strategy combines two powerful displacement signals — Fair Value Gaps (FVG) and Change of State of Delivery (CoSD) — to capture high-conviction directional moves. It sets a directional bias when either signal appears, but only enters a trade once both FVG and CoSD confirm in the same direction. This dual-filter approach helps reduce noise and improve entry precision.

Key features:

✅ Bias lock on first signal: Directional bias is set by either FVG or CoSD, but trades only trigger when both align.

✅ 6:1 reward-to-risk targeting: Take profit is set at sixtimes the stop distance, allowing for high-RR setups.

✅ Fixed stop buffer: SL is calculated using a static tick buffer for simplicity and consistency.

✅ Exit on opposing signal: Trades are closed when an opposite FVG or CoSD appears, signaling structural reversal.

📈 Optimized for EURUSD on the 4-hour timeframe, where its structural logic and risk parameters are best aligned with market rhythm and volatility.

This strategy is ideal for traders who want to combine price imbalance with structural confirmation, while maintaining disciplined risk management and directional clarity.

Key features:

✅ Bias lock on first signal: Directional bias is set by either FVG or CoSD, but trades only trigger when both align.

✅ 6:1 reward-to-risk targeting: Take profit is set at sixtimes the stop distance, allowing for high-RR setups.

✅ Fixed stop buffer: SL is calculated using a static tick buffer for simplicity and consistency.

✅ Exit on opposing signal: Trades are closed when an opposite FVG or CoSD appears, signaling structural reversal.

📈 Optimized for EURUSD on the 4-hour timeframe, where its structural logic and risk parameters are best aligned with market rhythm and volatility.

This strategy is ideal for traders who want to combine price imbalance with structural confirmation, while maintaining disciplined risk management and directional clarity.

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。