OPEN-SOURCE SCRIPT

Volatility Zones (STDEV %)

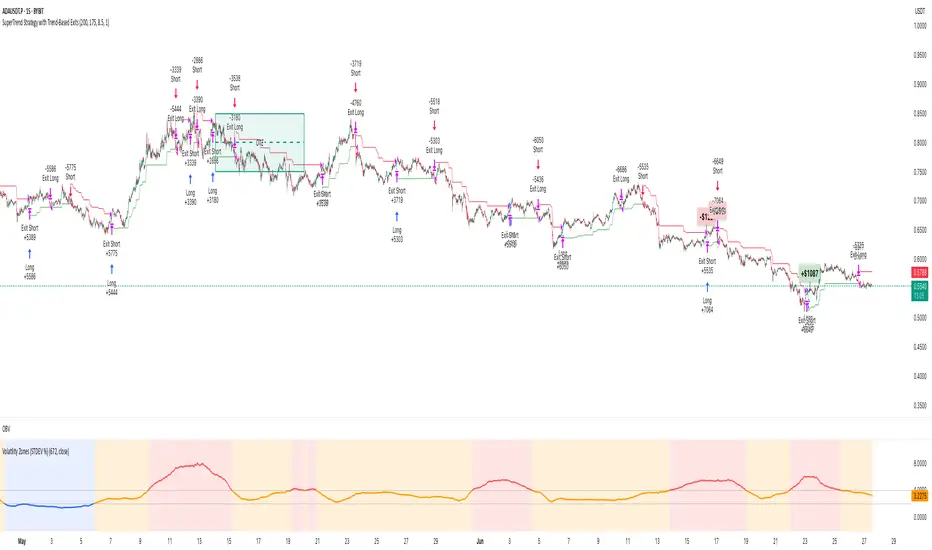

This indicator displays the relative volatility of an asset as a percentage, based on the standard deviation of price over a custom length.

🔍 Key features:

• Uses standard deviation (%) to reflect recent price volatility

• Classifies volatility into three zones:

Low volatility (≤2%) — highlighted in blue

Medium volatility (2–4%) — highlighted in orange

High volatility (>4%) — highlighted in red

• Supports visual background shading and colored line output

• Works on any timeframe and asset

📊 This tool is useful for identifying low-risk entry zones, periods of expansion or contraction in price behavior, and dynamic market regime changes.

You can adjust the STDEV length to suit your strategy or timeframe. Best used in combination with your entry logic or trend filters.

🔍 Key features:

• Uses standard deviation (%) to reflect recent price volatility

• Classifies volatility into three zones:

Low volatility (≤2%) — highlighted in blue

Medium volatility (2–4%) — highlighted in orange

High volatility (>4%) — highlighted in red

• Supports visual background shading and colored line output

• Works on any timeframe and asset

📊 This tool is useful for identifying low-risk entry zones, periods of expansion or contraction in price behavior, and dynamic market regime changes.

You can adjust the STDEV length to suit your strategy or timeframe. Best used in combination with your entry logic or trend filters.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。