OPEN-SOURCE SCRIPT

Earnings Surprise Indicator (Post-Earnings Announcement Drift)

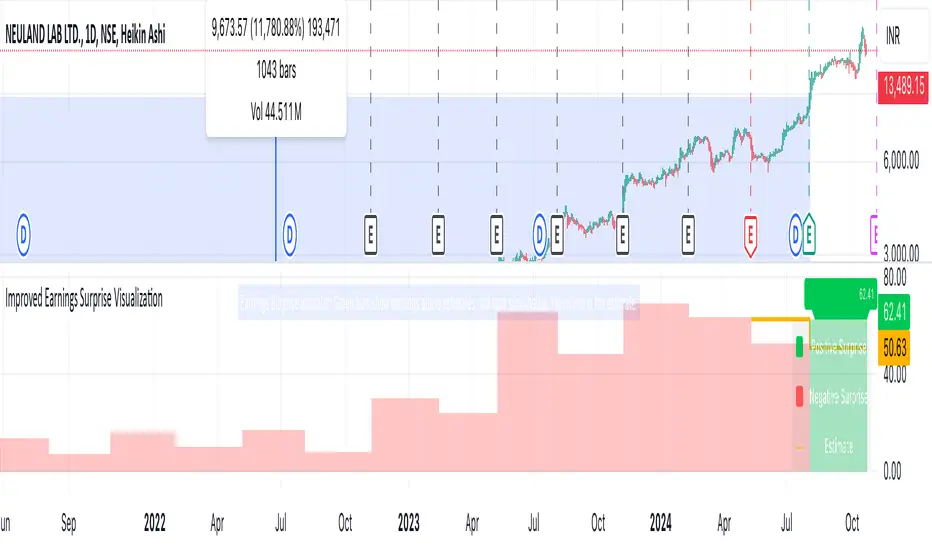

What It Does:

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

- Displays a company's actual earnings vs. analysts' estimates over time

- Shows "earnings surprises" - when actual results beat or miss expectations

- Helps identify trends in a company's financial performance

How It Works:

- Green bars: Positive surprise (earnings beat estimates)

- Red bars: Negative surprise (earnings missed estimates)

- Yellow line: Analysts' earnings estimates

Correlation with Post Earnings Announcement Drift (PEAD): PEAD is the tendency for a stock's price to drift in the direction of an earnings surprise for several weeks or months after the announcement.

Why It Matters:

- Positive surprises often lead to upward price drift

- Negative surprises often lead to downward price drift

- This drift can create trading opportunities

How to Use It:

1. Spot Trends:

- Consistent beats may indicate strong company performance

- Consistent misses may signal underlying issues

2. Gauge Market Expectations:

- Large surprises may lead to significant price movements

3. Timing Decisions:

- Consider long positions after positive surprises

- Consider short positions or exits after negative surprises

4. Risk Management:

- Be cautious of reversal if the drift seems excessive

- Use in conjunction with other technical and fundamental analysis

Key Takeaways:

- Earnings surprises can be fundamental-leading indicators of future stock performance, especially when correlated with analyst projections

- PEAD suggests that markets often underreact to earnings news initially

- This indicator helps visualize the magnitude and direction of surprises

- It can be a valuable tool for timing entry and exit points in trades

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。