PROTECTED SOURCE SCRIPT

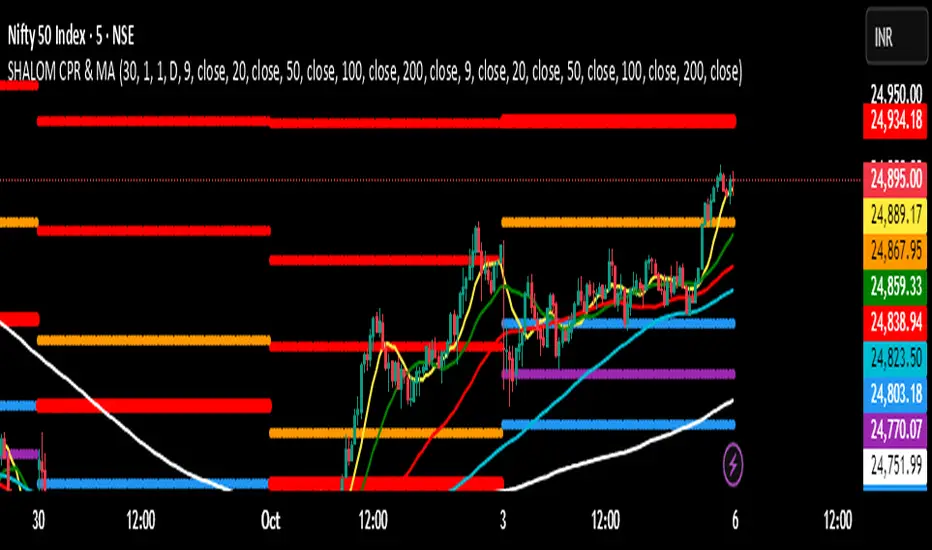

SHALOM TRADING HUB – CPR Camarilla & MA

SHALOM TRADING HUB – CPR Camarilla & MA (v4)

All-in-One Intraday & Swing Toolkit

Daily CPR (Prev Day), Weekly/Monthly Pivots, Prev Day/Week/Month High–Low, EMA/SMA pack, and Camarilla (H1–H4 & L1–L4). Plus Tomorrow CPR preview for next-session planning. 🔥

Features

Daily CPR: TC / PP / BC from previous day (value area & bias).

Floor Pivots: Daily/Weekly/Monthly R1–R4, S1–S4.

Previous High/Low: PDH/PDL, PWH/PWL, PMH/PML lines for breakout/mean-revert reads.

Camarilla Levels: H1–H4 & L1–L4 (popular 1.1 factor variant).

Moving Averages: EMA(9/20/50/100/200) & SMA(9/20/50/100/200) toggles.

Tomorrow CPR (Preview): Next session Pivot / BC / TC / R1 / S1 (D/W/M selectable).

Inputs (Settings)

Number of Daily/Weekly/Monthly pivots – show last N periods.

Show toggles – Daily CPR, Weekly/Monthly pivots, Prev H/L, Camarilla, Inner Camarilla, EMA/SMA.

Tomorrow CPR Type – D / W / M.

MA Lengths – fully customizable.

How to Use (Quick)

Trend bias: Price vs. CPR band & 20/50/200 MA stack.

Value zone: Inside TC–BC → balance; clean break & hold outside → trend continuation.

Reaction zones: Camarilla H3/L3 = bounce areas; H4/L4 = breakout/ breakdown lines.

Higher timeframe confluence: Add Weekly/Monthly pivots for swing levels.

Best Practices

Works on any timeframe; intraday (3–15m) recommended for CPR action.

Lines are derived using security(..., lookahead_on) on previous completed period → no forward repainting of those levels.

If too many lines: reduce “Number of … pivots” or turn off inner Camarilla/extra S/R.

All-in-One Intraday & Swing Toolkit

Daily CPR (Prev Day), Weekly/Monthly Pivots, Prev Day/Week/Month High–Low, EMA/SMA pack, and Camarilla (H1–H4 & L1–L4). Plus Tomorrow CPR preview for next-session planning. 🔥

Features

Daily CPR: TC / PP / BC from previous day (value area & bias).

Floor Pivots: Daily/Weekly/Monthly R1–R4, S1–S4.

Previous High/Low: PDH/PDL, PWH/PWL, PMH/PML lines for breakout/mean-revert reads.

Camarilla Levels: H1–H4 & L1–L4 (popular 1.1 factor variant).

Moving Averages: EMA(9/20/50/100/200) & SMA(9/20/50/100/200) toggles.

Tomorrow CPR (Preview): Next session Pivot / BC / TC / R1 / S1 (D/W/M selectable).

Inputs (Settings)

Number of Daily/Weekly/Monthly pivots – show last N periods.

Show toggles – Daily CPR, Weekly/Monthly pivots, Prev H/L, Camarilla, Inner Camarilla, EMA/SMA.

Tomorrow CPR Type – D / W / M.

MA Lengths – fully customizable.

How to Use (Quick)

Trend bias: Price vs. CPR band & 20/50/200 MA stack.

Value zone: Inside TC–BC → balance; clean break & hold outside → trend continuation.

Reaction zones: Camarilla H3/L3 = bounce areas; H4/L4 = breakout/ breakdown lines.

Higher timeframe confluence: Add Weekly/Monthly pivots for swing levels.

Best Practices

Works on any timeframe; intraday (3–15m) recommended for CPR action.

Lines are derived using security(..., lookahead_on) on previous completed period → no forward repainting of those levels.

If too many lines: reduce “Number of … pivots” or turn off inner Camarilla/extra S/R.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。