OPEN-SOURCE SCRIPT

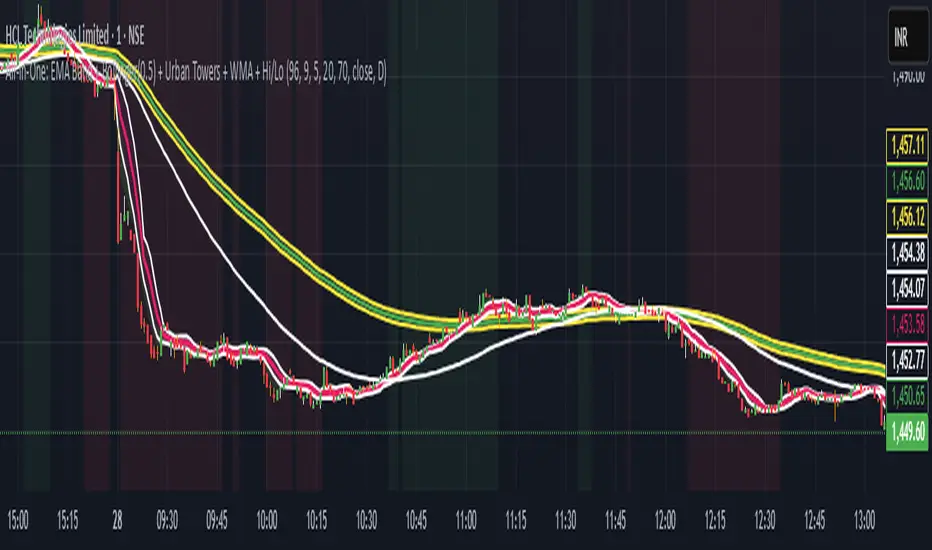

已更新 Scalping, Swing Pro: Urban Towers + Bollinger(0.5)+ WMA by Kidev

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.

Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

版本注释

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

版本注释

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。