INVITE-ONLY SCRIPT

已更新 ZERE Majors System [FahimK3]

ZERE Majors System [FahimK3]

This system introduces an innovative approach to crypto portfolio management through a dynamic matrix-based rotation methodology. At its core, the system utilizes a proprietary scoring matrix that directly compares the relative strength between BTC, ETH, and SOL, creating a more nuanced understanding of asset relationships than traditional indicators alone could provide.

The fundamental innovation lies in how the system evaluates cryptocurrencies. Rather than analyzing each asset independently, it employs a comprehensive matrix where each asset is scored against others through direct pair-wise comparisons. This creates a network of relationships that reveals underlying strength patterns that might be missed by conventional analysis methods. The scoring process incorporates both momentum and relative performance metrics, ensuring that capital is allocated to the truly strongest asset rather than just the one showing temporary strength.

While the exact scoring calculations remain proprietary, the system's framework combines relative strength principles with adaptive thresholds that automatically adjust to changing market conditions. This differs from standard relative strength approaches by considering the complete web of relationships between assets rather than isolated comparisons.

The regime filter serves as a secondary confirmation layer, using volatility and momentum metrics to validate the primary matrix signals. When market conditions become unfavorable, the system automatically moves to cash, providing an additional layer of capital protection.

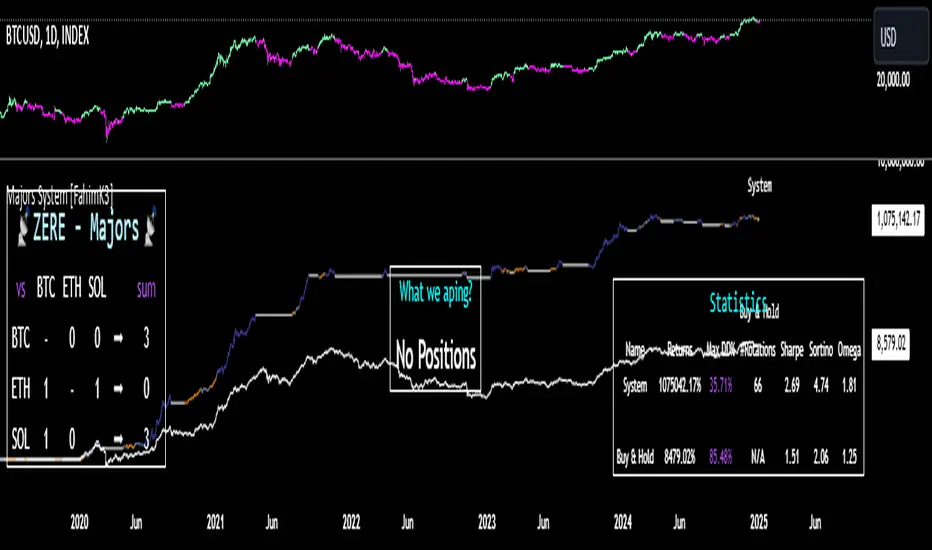

Performance tracking includes comprehensive metrics comparing the rotation strategy against a standard buy-and-hold approach. The visual interface displays the scoring matrix, current positions, and equity curves, allowing traders to understand position rationale in real-time.

Recommended Usage:

- Timeframe: Daily chart

- Starting Capital: Customizable for portfolio size

- Scoring Method: Choice between UNI.v2 and UNI.v3

Note: While this system incorporates some standard technical elements, its value lies in the unique matrix-based rotation methodology that provides a more complete picture of relative strength than traditional indicators used in isolation.

This system introduces an innovative approach to crypto portfolio management through a dynamic matrix-based rotation methodology. At its core, the system utilizes a proprietary scoring matrix that directly compares the relative strength between BTC, ETH, and SOL, creating a more nuanced understanding of asset relationships than traditional indicators alone could provide.

The fundamental innovation lies in how the system evaluates cryptocurrencies. Rather than analyzing each asset independently, it employs a comprehensive matrix where each asset is scored against others through direct pair-wise comparisons. This creates a network of relationships that reveals underlying strength patterns that might be missed by conventional analysis methods. The scoring process incorporates both momentum and relative performance metrics, ensuring that capital is allocated to the truly strongest asset rather than just the one showing temporary strength.

While the exact scoring calculations remain proprietary, the system's framework combines relative strength principles with adaptive thresholds that automatically adjust to changing market conditions. This differs from standard relative strength approaches by considering the complete web of relationships between assets rather than isolated comparisons.

The regime filter serves as a secondary confirmation layer, using volatility and momentum metrics to validate the primary matrix signals. When market conditions become unfavorable, the system automatically moves to cash, providing an additional layer of capital protection.

Performance tracking includes comprehensive metrics comparing the rotation strategy against a standard buy-and-hold approach. The visual interface displays the scoring matrix, current positions, and equity curves, allowing traders to understand position rationale in real-time.

Recommended Usage:

- Timeframe: Daily chart

- Starting Capital: Customizable for portfolio size

- Scoring Method: Choice between UNI.v2 and UNI.v3

Note: While this system incorporates some standard technical elements, its value lies in the unique matrix-based rotation methodology that provides a more complete picture of relative strength than traditional indicators used in isolation.

版本注释

Updated the scoring system to take into account every ratio variable for a more robust approach.版本注释

Updated the scoring system to take into account every ratio variable for a more robust approach.免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。