INVITE-ONLY SCRIPT

Crypto Breadth [MarktQuant]

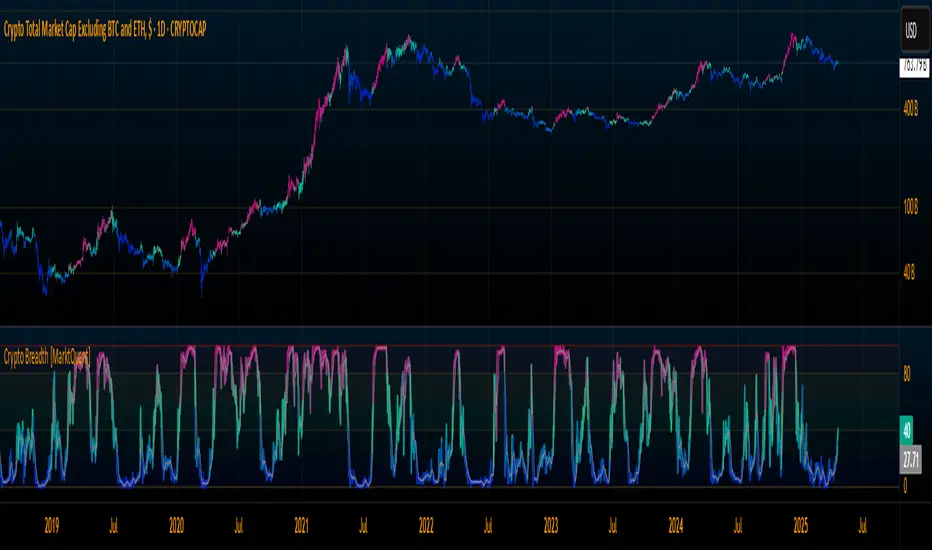

The Crypto Breadth indicator inspired by Capriole Investments is a custom market breadth tool designed to gauge the overall health and momentum of the cryptocurrency market using a diversified basket of 40 altcoins. Inspired by traditional equity market breadth models, this indicator quantifies how many assets are trading above their respective 50-period simple moving averages (SMAs), offering a high-level signal of strength or weakness in the altcoin segment.

Core Logic

Constituent Universe: The model tracks 40 prominent crypto assets including legacy names (e.g., LTC, XRP, DASH), Ethereum-based tokens (e.g., LINK, ZRX), and next-gen altcoins (e.g., RUNE, DOGE).

Breadth Score Calculation

Each asset contributes a score of 1 if it is trading above its 50-period SMA, and 0 otherwise.

Aggregate Market Breadth

The scores are summed and scaled (total_score × 2.5) to produce a final breadth reading ranging from 0 to 100.

Visual Components

Displays the scaled breadth score (0–100), colored via a gradient to highlight strength (green to red) and weakness (blue to green).

7-Day Moving Average

A smoothed trendline of breadth over the past week, useful for identifying inflections in underlying market momentum.

Market Regime Zones

Use Cases

Risk-On/Risk-Off Allocation: The breadth score acts as a tactical input for rotating between aggressive and conservative crypto exposure.

Trend Confirmation

High breadth during price rallies signals sustainable moves, while narrow participation may indicate fragility.

Bottom Fishing

Extremely low breadth levels (e.g., <20) often coincide with capitulation-like conditions, potentially highlighting accumulation opportunities.

Customization

Lookback Period: Users can adjust the SMA period to fine-tune the sensitivity of the model to price changes.

Toggle 7D MA : Enables/disables visualization of the short-term breadth average.

Remarks

This indicator is particularly useful for discretionary and systematic crypto traders looking to understand when altcoins as a group are trending or consolidating. Its visual and quantitative design offers intuitive yet robust insights for tactical decision-making.

Core Logic

Constituent Universe: The model tracks 40 prominent crypto assets including legacy names (e.g., LTC, XRP, DASH), Ethereum-based tokens (e.g., LINK, ZRX), and next-gen altcoins (e.g., RUNE, DOGE).

Breadth Score Calculation

Each asset contributes a score of 1 if it is trading above its 50-period SMA, and 0 otherwise.

Aggregate Market Breadth

The scores are summed and scaled (total_score × 2.5) to produce a final breadth reading ranging from 0 to 100.

Visual Components

Displays the scaled breadth score (0–100), colored via a gradient to highlight strength (green to red) and weakness (blue to green).

7-Day Moving Average

A smoothed trendline of breadth over the past week, useful for identifying inflections in underlying market momentum.

Market Regime Zones

- 0–20: Distressed Zone (deep risk-off)

- 20–40: Defensive Zone (caution warranted)

- 40–60: Equilibrium Zone (neutral/transitionary)

- 60–80: Accumulation Zone (early-stage strength)

- 80–100: Expansion Zone (broad bullish participation)

Use Cases

Risk-On/Risk-Off Allocation: The breadth score acts as a tactical input for rotating between aggressive and conservative crypto exposure.

Trend Confirmation

High breadth during price rallies signals sustainable moves, while narrow participation may indicate fragility.

Bottom Fishing

Extremely low breadth levels (e.g., <20) often coincide with capitulation-like conditions, potentially highlighting accumulation opportunities.

Customization

Lookback Period: Users can adjust the SMA period to fine-tune the sensitivity of the model to price changes.

Toggle 7D MA : Enables/disables visualization of the short-term breadth average.

Remarks

This indicator is particularly useful for discretionary and systematic crypto traders looking to understand when altcoins as a group are trending or consolidating. Its visual and quantitative design offers intuitive yet robust insights for tactical decision-making.

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系MarktQuant。

请注意,此私密、仅限邀请脚本未经脚本版主审核,是否符合网站规则尚未确定。 TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Included in Basic and Premium MarktQuant memberships—enjoy analyzing trends and spotting key levels! https://marktquant.com/products/membership

🔍 Access Investing Strategies & Indicators

📊 whop.com/marktquant

🌐 marktquant.com

Nothing shared on this page constitutes financial advice. All information, tools, and analyses are provided solely for informational and educational purposes.

📊 whop.com/marktquant

🌐 marktquant.com

Nothing shared on this page constitutes financial advice. All information, tools, and analyses are provided solely for informational and educational purposes.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系MarktQuant。

请注意,此私密、仅限邀请脚本未经脚本版主审核,是否符合网站规则尚未确定。 TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Included in Basic and Premium MarktQuant memberships—enjoy analyzing trends and spotting key levels! https://marktquant.com/products/membership

🔍 Access Investing Strategies & Indicators

📊 whop.com/marktquant

🌐 marktquant.com

Nothing shared on this page constitutes financial advice. All information, tools, and analyses are provided solely for informational and educational purposes.

📊 whop.com/marktquant

🌐 marktquant.com

Nothing shared on this page constitutes financial advice. All information, tools, and analyses are provided solely for informational and educational purposes.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。