PROTECTED SOURCE SCRIPT

已更新 XqKtPvRwSd-Strategy

TradingView Pine Script Suite (v4.0) — General Overview

Purpose

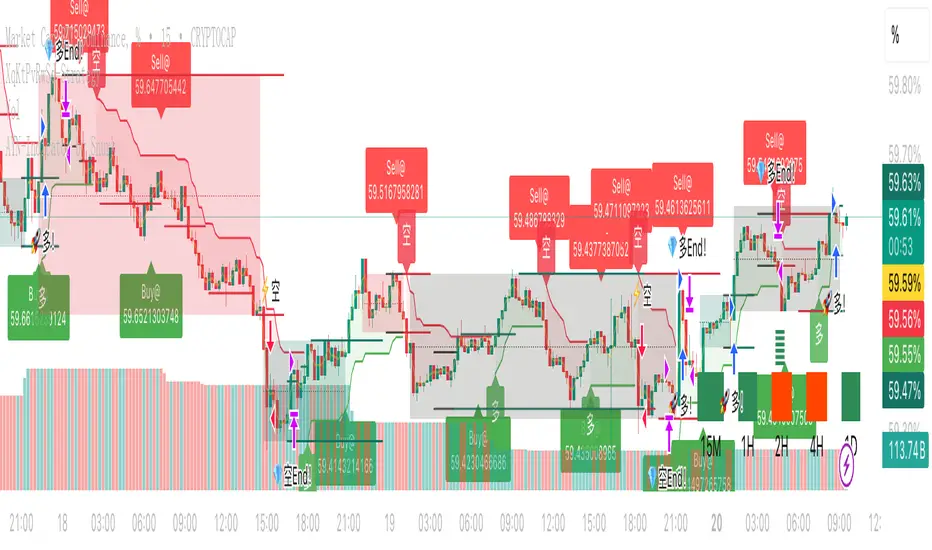

A modular indicator and strategy suite designed for crypto markets, focusing on trend detection, momentum, range visualization, and signal generation. The suite supports popular symbols (BTC, ETH, BNB, SOL, DOGE) and offers flexible visualization and alert options.

Main Components

- v4.0-indicator: Multi-signal display for monitoring market conditions and trend bias.

- v4.0-watch-15m: Watchlist-style indicator with symbol-aware auto-tuning and optional chart timeframe adaptation.

- v4.0-strategy: Backtestable strategy using a unified, SuperTrend-based trend determination for entries/exits.

- v4.0-range: Range and structure visualization with dynamic lines, zones, and basic breakout cues.

- Two Poles.pinescript and fengzi/Two Poles Trend: Low-lag trend and smoothing filters for stability.

- supertrend.pinescript: SuperTrend variations used across the suite for direction and stops.

- fengzi utilities:

- Hann Window FIR Filter: Denoising and smoothing to reduce noise without excessive lag.

- Heatmap + Hann Resonance: Visual heat/energy mapping for momentum and resonance cues.

- Heatmap Trailing Stop with Breakouts: Trailing stop framework with breakout detection.

- Additional modules: super Z, AI JX, v3.2, and 4.0.pinescript (combined or experimental entries).

Key Features

- Unified Trend Logic: Strategy and visual components rely on a consistent SuperTrend-based direction model, improving clarity and consistency.

- Adaptive Timeframe: Option to use the chart’s timeframe; parameters scale from a 15m baseline to maintain relative behavior.

- Symbol Auto-Tuning: Default parameter sets are tailored for common crypto symbols; manual overrides are available.

- RSI Top/Bottom Hints: Optional dynamic cues for potential peaks in uptrends and troughs in downtrends; can contribute to scoring and alerts.

- Visual Customization: Configurable markers (arrows, dots, crosses), colors, line widths, and subtle background highlighting.

- Scoring and Clustering: Combines checks into a simplified score and clusters signals to reduce noise.

- Alerts: Supports TradingView alerts for entries, exits, and RSI hints.

- Compatibility: Designed to compile across common Pine versions and avoid local-scope plotting issues.

Basic Usage

- Add the indicator or strategy to your chart depending on your goal (monitoring vs. backtesting).

- Choose to follow the chart’s timeframe or set a working timeframe manually.

- Keep symbol auto-tuning enabled for a balanced default, or adjust parameters to match your preferences.

- Toggle optional modules (RSI hints, scoring contribution, visualization) based on your needs.

- For strategies, run backtests across your target period and review performance metrics (win rate, drawdown, and trade frequency).

Configuration Guidelines

- For earlier entries: lower SuperTrend period or multiplier; relax RSI thresholds.

- For more conservative behavior: increase SuperTrend period or multiplier; tighten thresholds; use stricter RSI logic.

- For cleaner signals: rely on the unified trend and consider limiting trades during extreme volatility or illiquid sessions.

Outputs

- Trend markers and lines indicating bullish/bearish bias and reversals.

- Range drawings with dynamic line coordinates, zones, and visual cues for consolidations and breakouts.

- Optional multi-timeframe dashboard-style summaries where applicable.

Extensibility

- Parameters and defaults can be extended for additional symbols and styles.

- Optional weighting or neutrality rules can be added to trend logic if you prefer stricter confirmation.

- Additional filters (volatility, session, volume) can be integrated to refine entries and exits.

Notes

- Not financial advice; backtest thoroughly before using any strategy live.

- Performance and signal quality vary by symbol, timeframe, and market conditions; adjust parameters as needed.

- Pine version differences may require minor adjustments; keep your environment up to date.

Purpose

A modular indicator and strategy suite designed for crypto markets, focusing on trend detection, momentum, range visualization, and signal generation. The suite supports popular symbols (BTC, ETH, BNB, SOL, DOGE) and offers flexible visualization and alert options.

Main Components

- v4.0-indicator: Multi-signal display for monitoring market conditions and trend bias.

- v4.0-watch-15m: Watchlist-style indicator with symbol-aware auto-tuning and optional chart timeframe adaptation.

- v4.0-strategy: Backtestable strategy using a unified, SuperTrend-based trend determination for entries/exits.

- v4.0-range: Range and structure visualization with dynamic lines, zones, and basic breakout cues.

- Two Poles.pinescript and fengzi/Two Poles Trend: Low-lag trend and smoothing filters for stability.

- supertrend.pinescript: SuperTrend variations used across the suite for direction and stops.

- fengzi utilities:

- Hann Window FIR Filter: Denoising and smoothing to reduce noise without excessive lag.

- Heatmap + Hann Resonance: Visual heat/energy mapping for momentum and resonance cues.

- Heatmap Trailing Stop with Breakouts: Trailing stop framework with breakout detection.

- Additional modules: super Z, AI JX, v3.2, and 4.0.pinescript (combined or experimental entries).

Key Features

- Unified Trend Logic: Strategy and visual components rely on a consistent SuperTrend-based direction model, improving clarity and consistency.

- Adaptive Timeframe: Option to use the chart’s timeframe; parameters scale from a 15m baseline to maintain relative behavior.

- Symbol Auto-Tuning: Default parameter sets are tailored for common crypto symbols; manual overrides are available.

- RSI Top/Bottom Hints: Optional dynamic cues for potential peaks in uptrends and troughs in downtrends; can contribute to scoring and alerts.

- Visual Customization: Configurable markers (arrows, dots, crosses), colors, line widths, and subtle background highlighting.

- Scoring and Clustering: Combines checks into a simplified score and clusters signals to reduce noise.

- Alerts: Supports TradingView alerts for entries, exits, and RSI hints.

- Compatibility: Designed to compile across common Pine versions and avoid local-scope plotting issues.

Basic Usage

- Add the indicator or strategy to your chart depending on your goal (monitoring vs. backtesting).

- Choose to follow the chart’s timeframe or set a working timeframe manually.

- Keep symbol auto-tuning enabled for a balanced default, or adjust parameters to match your preferences.

- Toggle optional modules (RSI hints, scoring contribution, visualization) based on your needs.

- For strategies, run backtests across your target period and review performance metrics (win rate, drawdown, and trade frequency).

Configuration Guidelines

- For earlier entries: lower SuperTrend period or multiplier; relax RSI thresholds.

- For more conservative behavior: increase SuperTrend period or multiplier; tighten thresholds; use stricter RSI logic.

- For cleaner signals: rely on the unified trend and consider limiting trades during extreme volatility or illiquid sessions.

Outputs

- Trend markers and lines indicating bullish/bearish bias and reversals.

- Range drawings with dynamic line coordinates, zones, and visual cues for consolidations and breakouts.

- Optional multi-timeframe dashboard-style summaries where applicable.

Extensibility

- Parameters and defaults can be extended for additional symbols and styles.

- Optional weighting or neutrality rules can be added to trend logic if you prefer stricter confirmation.

- Additional filters (volatility, session, volume) can be integrated to refine entries and exits.

Notes

- Not financial advice; backtest thoroughly before using any strategy live.

- Performance and signal quality vary by symbol, timeframe, and market conditions; adjust parameters as needed.

- Pine version differences may require minor adjustments; keep your environment up to date.

版本注释

Update UI版本注释

Update UI performance版本注释

Update color style受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。