OPEN-SOURCE SCRIPT

Diodato 'All Stars Align' Signal

Description:

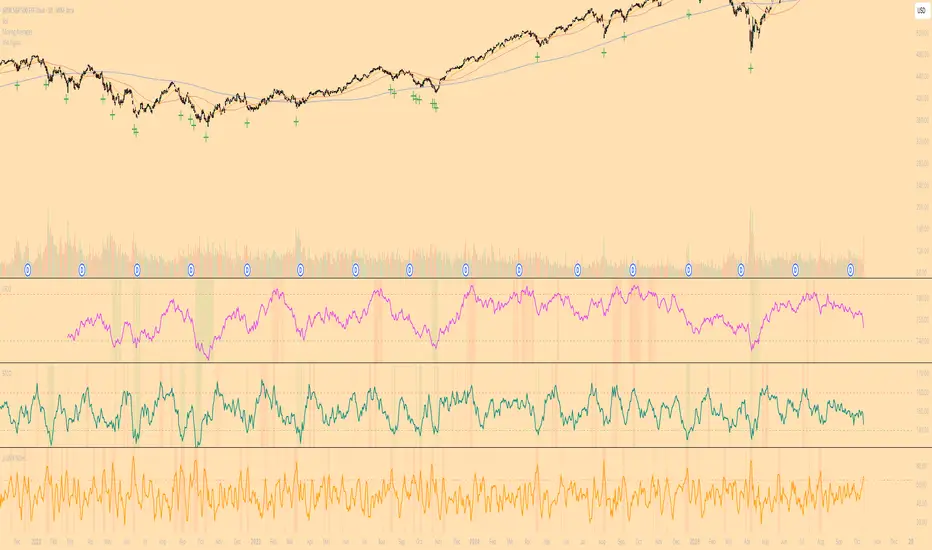

This indicator is an overlay that plots the "All Stars Align" buy signal from Chris Diodato's 2019 CMT paper, "Making The Most Of Panic." It is designed to identify high-conviction, short-term buying opportunities by requiring a confluence of both price-based momentum and market-internal weakness.

What It Is

This script works entirely in the background, calculating three separate indicators: the 14-day Slow Stochastic, the Short-Term Capitulation Oscillator (STCO), and the 3-DMA of % Declining Issues. It then plots a signal directly on the main price chart only when the specific "All Stars Align" conditions are met.

How to Interpret

A green cross (+) appears below a price bar when a high-conviction buy signal is generated. This signal triggers only when two primary conditions are true:

The 14-day Slow Stochastic is in "oversold" territory (e.g., below 20).

AND at least one of the market internal indicators shows a state of panic:

Either the STCO is oversold (e.g., below 140).

Or the 3-DMA % Declines shows a panic spike (e.g., above 65).

This confluence signifies a potential exhaustion of sellers and can mark an opportune moment to look for entries.

Settings

Trigger Thresholds: You can customize the exact levels that define an "oversold" or "panic" state for each of the three underlying indicators.

Data Sources: Allows toggling the use of "Unchanged" data for the background calculations.

Stochastic Settings: You can adjust the parameters for the Slow Stochastic calculation.

This indicator is an overlay that plots the "All Stars Align" buy signal from Chris Diodato's 2019 CMT paper, "Making The Most Of Panic." It is designed to identify high-conviction, short-term buying opportunities by requiring a confluence of both price-based momentum and market-internal weakness.

What It Is

This script works entirely in the background, calculating three separate indicators: the 14-day Slow Stochastic, the Short-Term Capitulation Oscillator (STCO), and the 3-DMA of % Declining Issues. It then plots a signal directly on the main price chart only when the specific "All Stars Align" conditions are met.

How to Interpret

A green cross (+) appears below a price bar when a high-conviction buy signal is generated. This signal triggers only when two primary conditions are true:

The 14-day Slow Stochastic is in "oversold" territory (e.g., below 20).

AND at least one of the market internal indicators shows a state of panic:

Either the STCO is oversold (e.g., below 140).

Or the 3-DMA % Declines shows a panic spike (e.g., above 65).

This confluence signifies a potential exhaustion of sellers and can mark an opportune moment to look for entries.

Settings

Trigger Thresholds: You can customize the exact levels that define an "oversold" or "panic" state for each of the three underlying indicators.

Data Sources: Allows toggling the use of "Unchanged" data for the background calculations.

Stochastic Settings: You can adjust the parameters for the Slow Stochastic calculation.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。