OPEN-SOURCE SCRIPT

FVG + Bank Level Targeting w/ Alert Trigger

Description:

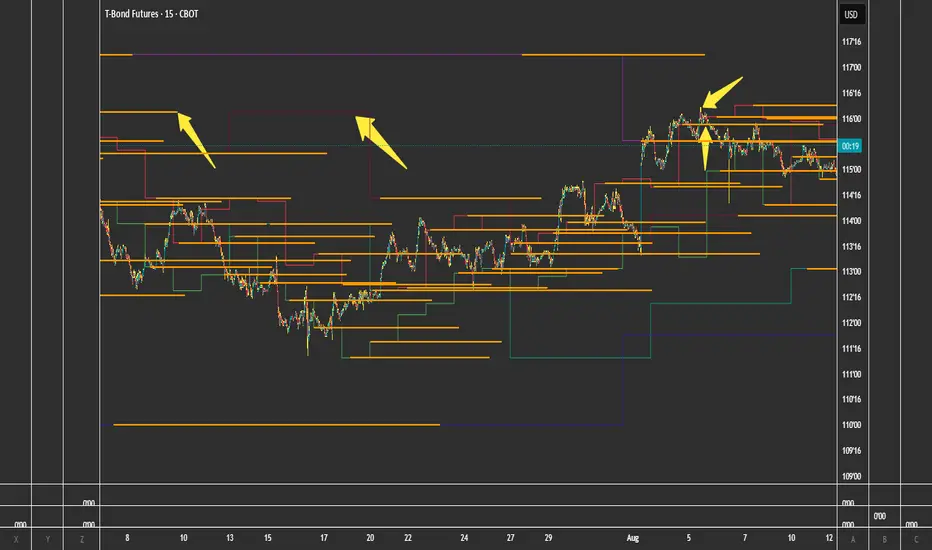

FVG + Bank Level Targeting w/ Alert Trigger is an intraday trading tool that combines Fair Value Gap (FVG) detection with dynamic institutional targeting using prior-day, weekly, and monthly high/low "Bank Levels." When a Fair Value Gap is detected, the script projects a logical target using the closest bank level in price's direction, and visually extends that level on your chart.

This tool is designed to help traders anticipate where price is most likely to move after an FVG appears — and alert them when price breaks through key target zones.

How It Works:

* Bank Level Calculation:

The indicator calculates Daily, Weekly, and Monthly high and low levels from the previous bar of each respective timeframe.

These are optionally plotted on the chart with a slight tick offset to avoid overlap with price.

* FVG Detection:

Bullish FVGs are defined by a gap between the low of the current candle and the high two candles prior, with a confirming middle candle.

Bearish FVGs follow the reverse pattern.

Once detected, the script finds the nearest unbroken institutional level (Bank Level) in the direction of the FVG and anchors a target line at that price level.

* Target Line Projection:

The script draws a persistent horizontal line (not just a plotted value) at the selected bank level.

These lines automatically extend a set number of bars into the future for clarity and trade planning.

* Breakout Detection:

When price crosses above a Bull Target or below a Bear Target, the script triggers a breakout condition.

These breakouts are useful for trade continuation or reversal setups.

* Alerts:

Built-in alert conditions notify you in real time when price crosses above or below a target.

These can be used to set TradingView alerts for your preferred Futures symbols or intraday pairs.

Parameters:

Tick Offset Multiplier: Adds distance between price and plotted levels.

Show Daily/Weekly/Monthly Levels: Toggle for each institutional level group.

FVG Extend Right (bars): Controls how far the target lines extend into the future.

Color Controls: Customize colors for FVG fill and target lines.

Use Case:

This indicator is designed for traders who want to:

Trade continuation or reversal moves around institutional price zones

Integrate Fair Value Gap concepts with more logical, historically anchored price targets

Trigger alerts when market structure evolves around key levels

It is especially useful for intraday Futures traders on the 15-minute chart or lower, but adapts well to any instrument with strong reactionary behavior at prior session highs/lows.

FVG + Bank Level Targeting w/ Alert Trigger is an intraday trading tool that combines Fair Value Gap (FVG) detection with dynamic institutional targeting using prior-day, weekly, and monthly high/low "Bank Levels." When a Fair Value Gap is detected, the script projects a logical target using the closest bank level in price's direction, and visually extends that level on your chart.

This tool is designed to help traders anticipate where price is most likely to move after an FVG appears — and alert them when price breaks through key target zones.

How It Works:

* Bank Level Calculation:

The indicator calculates Daily, Weekly, and Monthly high and low levels from the previous bar of each respective timeframe.

These are optionally plotted on the chart with a slight tick offset to avoid overlap with price.

* FVG Detection:

Bullish FVGs are defined by a gap between the low of the current candle and the high two candles prior, with a confirming middle candle.

Bearish FVGs follow the reverse pattern.

Once detected, the script finds the nearest unbroken institutional level (Bank Level) in the direction of the FVG and anchors a target line at that price level.

* Target Line Projection:

The script draws a persistent horizontal line (not just a plotted value) at the selected bank level.

These lines automatically extend a set number of bars into the future for clarity and trade planning.

* Breakout Detection:

When price crosses above a Bull Target or below a Bear Target, the script triggers a breakout condition.

These breakouts are useful for trade continuation or reversal setups.

* Alerts:

Built-in alert conditions notify you in real time when price crosses above or below a target.

These can be used to set TradingView alerts for your preferred Futures symbols or intraday pairs.

Parameters:

Tick Offset Multiplier: Adds distance between price and plotted levels.

Show Daily/Weekly/Monthly Levels: Toggle for each institutional level group.

FVG Extend Right (bars): Controls how far the target lines extend into the future.

Color Controls: Customize colors for FVG fill and target lines.

Use Case:

This indicator is designed for traders who want to:

Trade continuation or reversal moves around institutional price zones

Integrate Fair Value Gap concepts with more logical, historically anchored price targets

Trigger alerts when market structure evolves around key levels

It is especially useful for intraday Futures traders on the 15-minute chart or lower, but adapts well to any instrument with strong reactionary behavior at prior session highs/lows.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。