OPEN-SOURCE SCRIPT

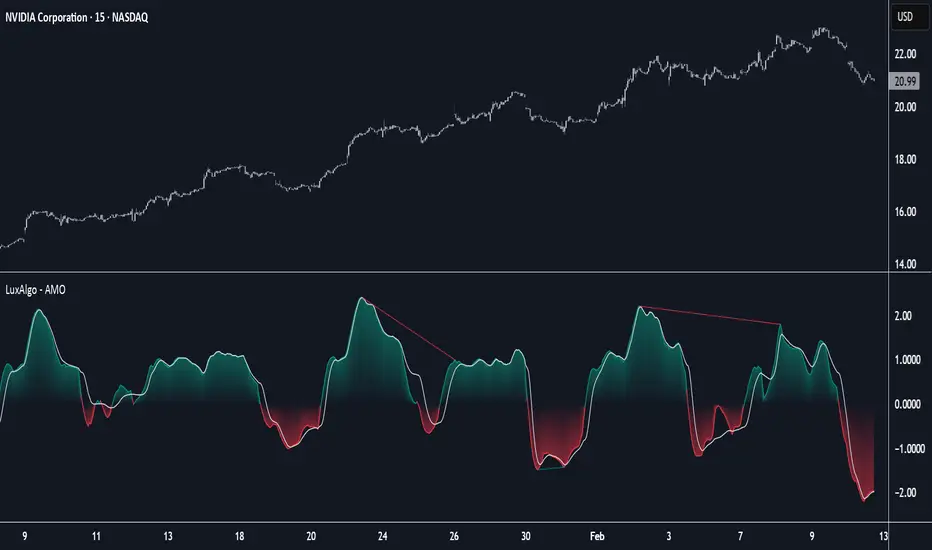

Adaptive Momentum Oscillator [LuxAlgo]

The Adaptive Momentum Oscillator tool allows traders to measure the current relative momentum over a given period using the maximum delta in price.

It features a histogram with gradient color, divergences, and an adaptive moving average that allows traders to clearly see the smoothed trend direction.

🔶 USAGE

This unbounded oscillator has positive momentum when values are above 0 and negative momentum when values are below 0. The adaptive moving average is used as a minimum lag smoothing tool over the momentum histogram.

🔹 Signal Line

There are two main uses for the signal line drawn on the chart above.

🔹 Data Length

On the chart above, we can compare different length sizes and how the tool values change, allowing traders to get a shorter or longer-term view of current market strength.

🔹 Smoothing Length

In the previous figure, we can compare how different Smoothing Length values affect the oscillator output.

🔹 Divergences

The divergence detector is disabled by default. Traders can enable it and adjust the divergence length from the settings panel.

As we can see in the chart above, by changing the length of the divergences, traders can fine-tune their detection, a small number will detect smaller divergences, and use a larger number for larger divergences.

🔶 SETTINGS

It features a histogram with gradient color, divergences, and an adaptive moving average that allows traders to clearly see the smoothed trend direction.

🔶 USAGE

This unbounded oscillator has positive momentum when values are above 0 and negative momentum when values are below 0. The adaptive moving average is used as a minimum lag smoothing tool over the momentum histogram.

🔹 Signal Line

There are two main uses for the signal line drawn on the chart above.

- Momentum crosses above or below the signal line: acceleration in momentum.

- Signal line crosses the 0 value: positive or negative momentum.

🔹 Data Length

On the chart above, we can compare different length sizes and how the tool values change, allowing traders to get a shorter or longer-term view of current market strength.

🔹 Smoothing Length

In the previous figure, we can compare how different Smoothing Length values affect the oscillator output.

🔹 Divergences

The divergence detector is disabled by default. Traders can enable it and adjust the divergence length from the settings panel.

As we can see in the chart above, by changing the length of the divergences, traders can fine-tune their detection, a small number will detect smaller divergences, and use a larger number for larger divergences.

🔶 SETTINGS

- Data: Select data source, close price by default

- Data Length: Select the length for data gathering

- Smoothing Length: Select the length for data smoothing

- Divergences: Enable/Disable divergences detection and length

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。