OPEN-SOURCE SCRIPT

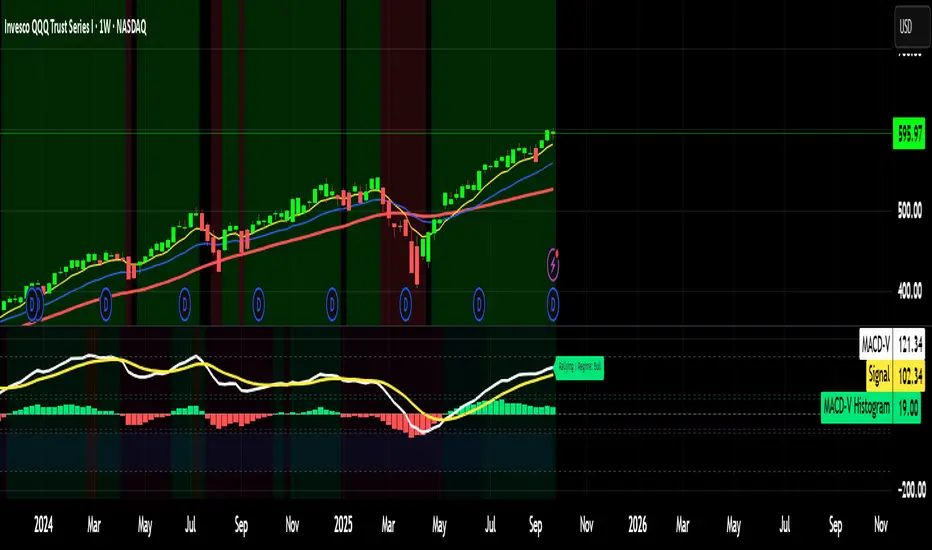

MACD-V Momentum

The MACD-V (Moving Average Convergence Divergence – Volatility Normalized) is an award-winning momentum indicator created by Alex Spiroglou, CFTe, DipTA (ATAA). It improves on the traditional MACD by normalizing momentum with volatility, solving several well-known limitations of classic indicators:

✅ Time stability – readings are consistent across history

✅ Cross-market comparability – works equally on stocks, crypto, forex, and commodities

✅ Objective momentum framework – universal thresholds at +150 / -150, +50 / -50

✅ Cleaner signals – reduces false signals in ranges and lag in high momentum

By dividing the MACD spread by ATR, the indicator expresses momentum in volatility units, allowing meaningful comparison across timeframes and markets.

MACD-V defines seven objective momentum states:

Risk (Oversold): below -150

Rebounding: -150 to +50 and above signal

Rallying: +50 to +150 and above signal

Risk (Overbought): above +150

Retracing: above -50 and below signal

Reversing: -150 to -50 and below signal

Ranging: between -50 and +50 for N bars

Optional background tints highlight the active regime (Bull above 200-MA, Bear below 200-MA).

Rare extremes (e.g., MACD-V < -100 in a bull regime) are tagged for additional context.

Use Cases

Identify and track momentum lifecycles across any market

Spot rare extremes for potential reversal opportunities

Filter out low-momentum whipsaws in ranging conditions

Compare momentum strength across multiple symbols

Support systematic and rule-based strategy development

✅ Time stability – readings are consistent across history

✅ Cross-market comparability – works equally on stocks, crypto, forex, and commodities

✅ Objective momentum framework – universal thresholds at +150 / -150, +50 / -50

✅ Cleaner signals – reduces false signals in ranges and lag in high momentum

By dividing the MACD spread by ATR, the indicator expresses momentum in volatility units, allowing meaningful comparison across timeframes and markets.

MACD-V defines seven objective momentum states:

Risk (Oversold): below -150

Rebounding: -150 to +50 and above signal

Rallying: +50 to +150 and above signal

Risk (Overbought): above +150

Retracing: above -50 and below signal

Reversing: -150 to -50 and below signal

Ranging: between -50 and +50 for N bars

Optional background tints highlight the active regime (Bull above 200-MA, Bear below 200-MA).

Rare extremes (e.g., MACD-V < -100 in a bull regime) are tagged for additional context.

Use Cases

Identify and track momentum lifecycles across any market

Spot rare extremes for potential reversal opportunities

Filter out low-momentum whipsaws in ranging conditions

Compare momentum strength across multiple symbols

Support systematic and rule-based strategy development

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。