OPEN-SOURCE SCRIPT

已更新 Strongest Trendline

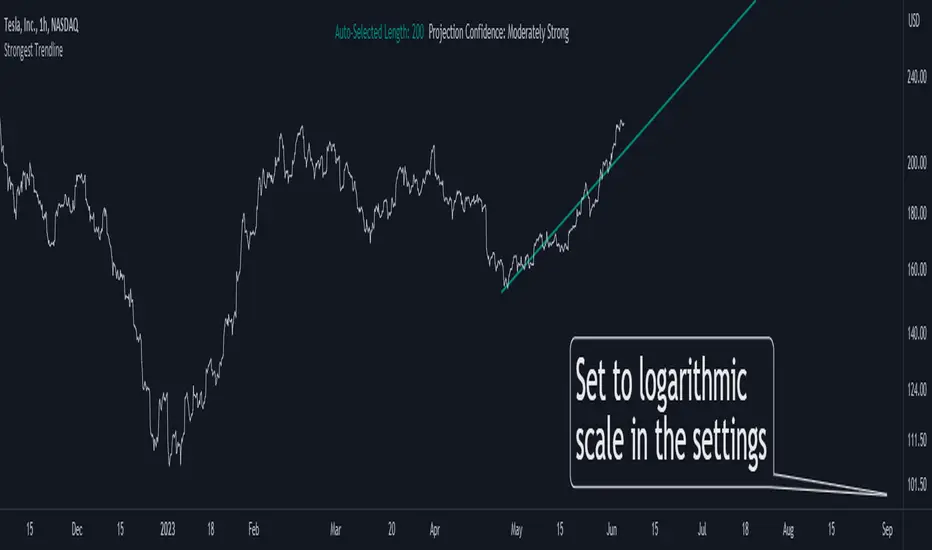

Unleashing the Power of Trendlines with the "Strongest Trendline" Indicator.

Trendlines are an invaluable tool in technical analysis, providing traders with insights into price movements and market trends. The "Strongest Trendline" indicator offers a powerful approach to identifying robust trendlines based on various parameters and technical analysis metrics.

When using the "Strongest Trendline" indicator, it is recommended to utilize a logarithmic scale. This scale accurately represents percentage changes in price, allowing for a more comprehensive visualization of trends. Logarithmic scales highlight the proportional relationship between prices, ensuring that both large and small price movements are given due consideration.

One of the notable advantages of logarithmic scales is their ability to balance price movements on a chart. This prevents larger price changes from dominating the visual representation, providing a more balanced perspective on the overall trend. Logarithmic scales are particularly useful when analyzing assets with significant price fluctuations.

In some cases, traders may need to scroll back on the chart to view the trendlines generated by the "Strongest Trendline" indicator. By scrolling back, traders ensure they have a sufficient historical context to accurately assess the strength and reliability of the trendline. This comprehensive analysis allows for the identification of trendline patterns and correlations between historical price movements and current market conditions.

The "Strongest Trendline" indicator calculates trendlines based on historical data, requiring an adequate number of data points to identify the strongest trend. By scrolling back and considering historical patterns, traders can make more informed trading decisions and identify potential entry or exit points.

When using the "Strongest Trendline" indicator, a higher Pearson's R value signifies a stronger trendline. The closer the Pearson's R value is to 1, the more reliable and robust the trendline is considered to be.

In conclusion, the "Strongest Trendline" indicator offers traders a robust method for identifying trendlines with significant predictive power. By utilizing a logarithmic scale and considering historical data, traders can unleash the full potential of this indicator and gain valuable insights into price trends. Trendlines, when used in conjunction with other technical analysis tools, can help traders make more informed decisions in the dynamic world of financial markets.

Trendlines are an invaluable tool in technical analysis, providing traders with insights into price movements and market trends. The "Strongest Trendline" indicator offers a powerful approach to identifying robust trendlines based on various parameters and technical analysis metrics.

When using the "Strongest Trendline" indicator, it is recommended to utilize a logarithmic scale. This scale accurately represents percentage changes in price, allowing for a more comprehensive visualization of trends. Logarithmic scales highlight the proportional relationship between prices, ensuring that both large and small price movements are given due consideration.

One of the notable advantages of logarithmic scales is their ability to balance price movements on a chart. This prevents larger price changes from dominating the visual representation, providing a more balanced perspective on the overall trend. Logarithmic scales are particularly useful when analyzing assets with significant price fluctuations.

In some cases, traders may need to scroll back on the chart to view the trendlines generated by the "Strongest Trendline" indicator. By scrolling back, traders ensure they have a sufficient historical context to accurately assess the strength and reliability of the trendline. This comprehensive analysis allows for the identification of trendline patterns and correlations between historical price movements and current market conditions.

The "Strongest Trendline" indicator calculates trendlines based on historical data, requiring an adequate number of data points to identify the strongest trend. By scrolling back and considering historical patterns, traders can make more informed trading decisions and identify potential entry or exit points.

When using the "Strongest Trendline" indicator, a higher Pearson's R value signifies a stronger trendline. The closer the Pearson's R value is to 1, the more reliable and robust the trendline is considered to be.

In conclusion, the "Strongest Trendline" indicator offers traders a robust method for identifying trendlines with significant predictive power. By utilizing a logarithmic scale and considering historical data, traders can unleash the full potential of this indicator and gain valuable insights into price trends. Trendlines, when used in conjunction with other technical analysis tools, can help traders make more informed decisions in the dynamic world of financial markets.

版本注释

I have removed the display of Pearson's correlation coefficient and replaced it with confidence levels in the strength of the trend.版本注释

Minor bugs fixed版本注释

Minor bug fixed版本注释

Just added the phrase "Set to logarithmic scale in the settings" to the chart :)版本注释

Updated trend strength levels denominations版本注释

Colors updated版本注释

Added option to display the second strongest trendline.版本注释

Multiple levels of trend strength added版本注释

I have added more lengths to find the best trendline further back in time.I have removed the calculation for the second-best trendline, as it was incorrect.

However, please note that the indicator may take a few seconds to calculate and display the strongest trendline because it utilizes a significant amount of resources.

版本注释

Auto-Selected Length added at the bottom right of the chart.版本注释

Minor adjustments版本注释

adjustments to the position of the tables and the colors版本注释

Added option for plotting deviation bands.版本注释

Default channel visibility added and intermediate deviation bands included.版本注释

I have finally removed the default channel visibility, allowing everyone to add it if desired :)版本注释

Improved version in terms of calculation speed.版本注释

Minor update版本注释

major update- new ultra-fast version

- bug fixed regarding the longest selected length, which now automatically fits into the available history

Don't forget to use logarithmic scale.

版本注释

Minor Update版本注释

The Annualized performance corresponding to the period of the Strongest Trendline drawn by the indicator has been added (only displayed in the Daily timeframe).版本注释

Major Update: This update introduces the 'Most Active Levels' feature. Users can now visualize the price level with the highest trading activity within the trend channel.

This level is calculated based on either the number of price touches or trading volume.

The new options allow users to toggle this feature on/off, choose the calculation method, and customize the line's appearance.

Additionally, users can adjust the channel to center around this most active level for a more refined trend representation.

版本注释

Minor Update: Two new checkboxes were added to enable or disable the display of the Auto-Selected Period and Projection Confidence table lines.版本注释

Minor Update: Enabled CAGR calculation for both daily and weekly timeframes.开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Plan the trade ⚡ Trade the plan

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Plan the trade ⚡ Trade the plan

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。