STRATEGY version of MACD ReLOADED Indicator:

A different approach to Gerald Appel's classical Moving Average Convergence Divergence.

Appel originaly set MACD with exponential moving averages.

In this version users can apply 11 different types of moving averages which they can benefit from their smoothness and vice versa sharpnesses...

Built in Moving Average type defaultly set as VAR but users can choose from 11 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Moving Average

WMA : Weighted Moving Average

DEMA : Double Exponential Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average a.k.a. VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

HULL : Hull Moving Average

TILL : Tillson T3 Moving Average

In shorter time frames backtest results shows us TILL, WWMA, VIDYA (VAR) could be used to overcome whipsaws because they have less numbers of signals.

In longer time frames like daily charts WMA, Volume Weighted MACD V2, and MACDAS and SMA are more accurate according to backtest results.

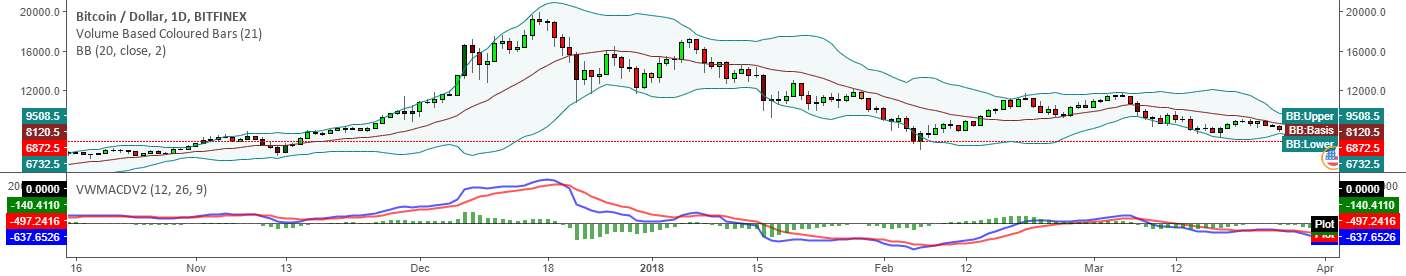

My interpretation of Buff Dormeier's Volume Weighted MACD V2:

Thomas Aspray's MACD: (MACDAS)

A different approach to Gerald Appel's classical Moving Average Convergence Divergence.

Appel originaly set MACD with exponential moving averages.

In this version users can apply 11 different types of moving averages which they can benefit from their smoothness and vice versa sharpnesses...

Built in Moving Average type defaultly set as VAR but users can choose from 11 different Moving Average types like:

SMA : Simple Moving Average

EMA : Exponential Moving Average

WMA : Weighted Moving Average

DEMA : Double Exponential Moving Average

TMA : Triangular Moving Average

VAR : Variable Index Dynamic Moving Average a.k.a. VIDYA

WWMA : Welles Wilder's Moving Average

ZLEMA : Zero Lag Exponential Moving Average

TSF : True Strength Force

HULL : Hull Moving Average

TILL : Tillson T3 Moving Average

In shorter time frames backtest results shows us TILL, WWMA, VIDYA (VAR) could be used to overcome whipsaws because they have less numbers of signals.

In longer time frames like daily charts WMA, Volume Weighted MACD V2, and MACDAS and SMA are more accurate according to backtest results.

My interpretation of Buff Dormeier's Volume Weighted MACD V2:

Thomas Aspray's MACD: (MACDAS)

版本注释:

Backtest parameters updated:

-Backtested with default parameters (26/12/9) of MACD BTCUSDT daily Binance chart

-Backtested initial capital updated to 1000USD

-Order size set as 1000USD

-Commission is set to 0.1% same as this is a Binance chart so 0.1% is the default user level on that exchange

-Slippage set to 100 ticks which could be meaningful

-Moving Average Type selected as Double Exponential Moving Average (DEMA) which can also be changed to a preferred type.

-MACD is a momentum indicator so it's main purpose is to enter positions in trending markets. The weakest part of MACD are false signals when entering sideways market conditions. Also MACD is designed for daily charts, if you

-Users can change and optimize the parameters to get more efficient results if they use MACD rather than daily time frames. If you prefer using MACD on daily charts so you'd better change the moving average type instead of changing parameters.

Note: Parameters advised to be changed proportionally. So, please try to keep (26,12,9) parameter ratios nearly constant.

Kıvanç Özbilgiç

-Backtested with default parameters (26/12/9) of MACD BTCUSDT daily Binance chart

-Backtested initial capital updated to 1000USD

-Order size set as 1000USD

-Commission is set to 0.1% same as this is a Binance chart so 0.1% is the default user level on that exchange

-Slippage set to 100 ticks which could be meaningful

-Moving Average Type selected as Double Exponential Moving Average (DEMA) which can also be changed to a preferred type.

-MACD is a momentum indicator so it's main purpose is to enter positions in trending markets. The weakest part of MACD are false signals when entering sideways market conditions. Also MACD is designed for daily charts, if you

-Users can change and optimize the parameters to get more efficient results if they use MACD rather than daily time frames. If you prefer using MACD on daily charts so you'd better change the moving average type instead of changing parameters.

Note: Parameters advised to be changed proportionally. So, please try to keep (26,12,9) parameter ratios nearly constant.

Kıvanç Özbilgiç

Threads: threads.net/@kivancozbilgic

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld