OPEN-SOURCE SCRIPT

TREND 123

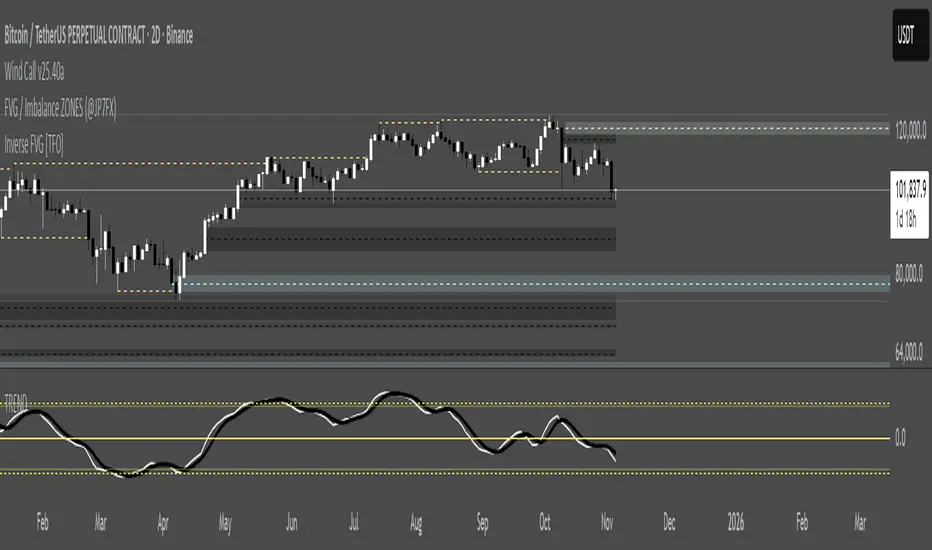

### TREND - Wave Trend Oscillator (Optimized)

This indicator is an optimized version of the classic Wave Trend Oscillator, a powerful tool for identifying market momentum, overbought/oversold conditions, and potential trend shifts. Built on the foundational work of LazyBear, this script has been refined for clarity and enhanced with key features to provide a more comprehensive trading view.

#### Key Features and Functionality

The indicator plots two primary lines, WT1 (Wave Trend 1) and WT2 (Wave Trend 2), in a separate pane below the price chart.

,

Momentum and Trend Identification:

,

WT1 (Blue Line): Represents the faster-moving component, reflecting immediate market momentum.

,

WT2 (Orange Line): Acts as a signal line, a smoothed version of WT1.

,

Crossovers: A cross of WT1 above WT2 is typically interpreted as a bullish signal, while a cross below WT2 suggests a bearish signal.

,

Overbought and Oversold Zones:

The script includes four configurable horizontal lines to define critical zones: two for ,

Overbought (e.g., +60 and +53) and two for Oversold (e.g., -60 and -53).

When the WT lines enter the Overbought zone, it signals that the asset may be due for a pullback. Conversely, entering the Oversold zone suggests a potential bounce.,

,

Sensitivity Control:

A unique ,

Sensitivity Factor input allows users to fine-tune the oscillator's responsiveness to price changes. A lower factor makes the indicator more sensitive, while a higher factor provides smoother, less volatile readings.

,

Visual Enhancements (Configurable):

,

Histogram: An optional histogram plots the difference between WT1 and WT2. This visual aid helps gauge the strength of the current momentum—the larger the bar, the stronger the trend in that direction.

,

Information Table: An optional, dynamic table is displayed on the chart, providing a quick, real-time summary of the indicator's status, including:

,

Current State: Neutral, Overbought (), or Oversold ().

,

Trend: Bullish () or Bearish (), based on the WT1/WT2 crossover.

The current values of WT1 and WT2.,

#### How to Use It

This indicator is best used as a confirmation tool alongside price action or other trend-following indicators.

This indicator is an optimized version of the classic Wave Trend Oscillator, a powerful tool for identifying market momentum, overbought/oversold conditions, and potential trend shifts. Built on the foundational work of LazyBear, this script has been refined for clarity and enhanced with key features to provide a more comprehensive trading view.

#### Key Features and Functionality

The indicator plots two primary lines, WT1 (Wave Trend 1) and WT2 (Wave Trend 2), in a separate pane below the price chart.

,

Momentum and Trend Identification:

,

WT1 (Blue Line): Represents the faster-moving component, reflecting immediate market momentum.

,

WT2 (Orange Line): Acts as a signal line, a smoothed version of WT1.

,

Crossovers: A cross of WT1 above WT2 is typically interpreted as a bullish signal, while a cross below WT2 suggests a bearish signal.

,

Overbought and Oversold Zones:

The script includes four configurable horizontal lines to define critical zones: two for ,

Overbought (e.g., +60 and +53) and two for Oversold (e.g., -60 and -53).

When the WT lines enter the Overbought zone, it signals that the asset may be due for a pullback. Conversely, entering the Oversold zone suggests a potential bounce.,

,

Sensitivity Control:

A unique ,

Sensitivity Factor input allows users to fine-tune the oscillator's responsiveness to price changes. A lower factor makes the indicator more sensitive, while a higher factor provides smoother, less volatile readings.

,

Visual Enhancements (Configurable):

,

Histogram: An optional histogram plots the difference between WT1 and WT2. This visual aid helps gauge the strength of the current momentum—the larger the bar, the stronger the trend in that direction.

,

Information Table: An optional, dynamic table is displayed on the chart, providing a quick, real-time summary of the indicator's status, including:

,

Current State: Neutral, Overbought (), or Oversold ().

,

Trend: Bullish () or Bearish (), based on the WT1/WT2 crossover.

The current values of WT1 and WT2.,

#### How to Use It

This indicator is best used as a confirmation tool alongside price action or other trend-following indicators.

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。