OPEN-SOURCE SCRIPT

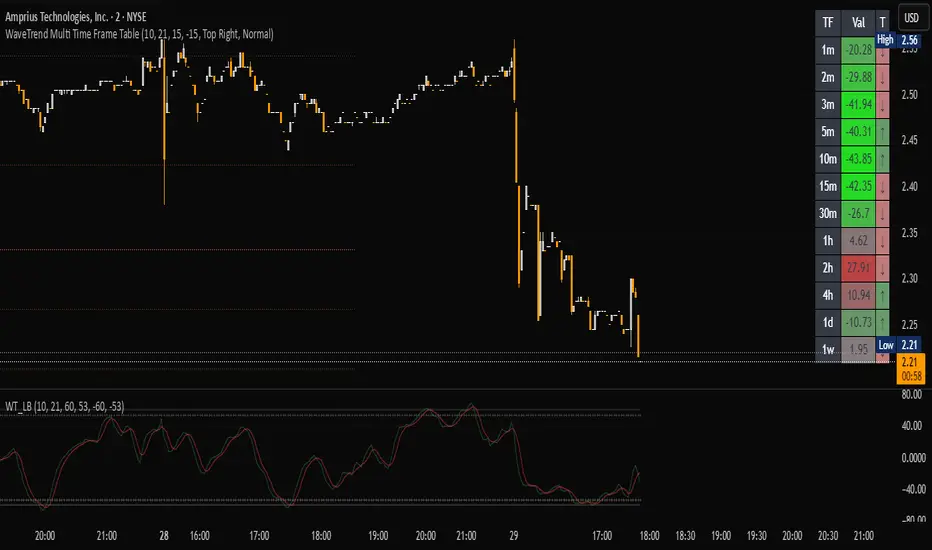

已更新 WaveTrend Matrix (1m-1w) – Custom Thresholds

A visual control panel for momentum exhaustion across ten key time-frames.

—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

🛠 Parameters

🚀 How to use it

1. Apply the indicator to your chart – no extra setup required.

2. Read the matrix top-down before every entry:

• Multiple deep-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

3. Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

- Calculates WaveTrend on ten granularities: 1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 1d, 1w.

- Displays the current oscillator print in a color-coded matrix.

• [color=red]Red[/color] = overbought (≥ high threshold)

• [color=green]Green[/color] = oversold (≤ low threshold)

• [color=gray]Gray[/color] = neutral / in-range - All thresholds are user-adjustable.

- Built on Pine v5, zero repainting, works on any symbol.

🛠 Parameters

- Channel Length – WT “n1” (default 10)

- Average Length – WT “n2” (default 21)

- Red from – overbought cut-off (default +60)

- Green under – oversold cut-off (default –60)

🚀 How to use it

1. Apply the indicator to your chart – no extra setup required.

2. Read the matrix top-down before every entry:

• Multiple deep-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

3. Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

版本注释

A visual control panel for momentum exhaustion across ten key time-frames.—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

- Calculates WaveTrend on ten granularities: 1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 1d, 1w.

- Displays the current oscillator print in a color-coded matrix.

• [color=red]Red[/color] = overbought (≥ high threshold)

• [color=green]Green[/color] = oversold (≤ low threshold)

• [color=gray]Gray[/color] = neutral / in-range - All thresholds are user-adjustable.

- Built on Pine v5, zero repainting, works on any symbol.

🛠 Parameters

- Channel Length – WT “n1” (default 10)

- Average Length – WT “n2” (default 21)

- Red from – overbought cut-off (default +60)

- Green under – oversold cut-off (default –60)

🚀 How to use it

1. Apply the indicator to your chart – no extra setup required.

2. Read the matrix top-down before every entry:

• Multiple deep-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

3. Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

版本注释

A visual control panel for momentum exhaustion across ten key time-frames.—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

- Calculates WaveTrend on ten granularities: 1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 1d, 1w.

- Displays the current oscillator print in a color-coded matrix.

• [color=red]Red[/color] = overbought (≥ high threshold)

• [color=green]Green[/color] = oversold (≤ low threshold)

• [color=gray]Gray[/color] = neutral / in-range - All thresholds are user-adjustable.

- Built on Pine v5, zero repainting, works on any symbol.

🛠 Parameters

- Channel Length – WT “n1” (default 10)

- Average Length – WT “n2” (default 21)

- Red from – overbought cut-off (default +60)

- Green under – oversold cut-off (default –60)

🚀 How to use it

1. Apply the indicator to your chart – no extra setup required.

2. Read the matrix top-down before every entry:

• Multiple deep-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

3. Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

版本注释

A visual control panel for momentum exhaustion across ten key time-frames, now with dual-threshold colours and a movable dashboard.—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

- []Calculates WaveTrend on ten granularities: 1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 1d, 1w.

[]Displays the current oscillator print in a colour-coded matrix.

• [color=red]Deep Red[/color] = extreme overbought (≥ +60)

• [color=#EC7474]Mild Red[/color] = custom early-warning overbought (≥ Custom High)

• [color=#30D430]Mild Green[/color] = custom early-warning oversold (≤ Custom Low)

• [color=#2B9700]Neon Green[/color] = extreme oversold (≤ –60)

• [color=gray]Gray[/color] = neutral / in-range

[]Optional hard-coded ±60 extremes can be switched on/off.

[]Table position is selectable (any corner or centre). - Built on Pine v5, zero repainting, works on any symbol.

🛠 Parameters

- []Channel Length – WT “n1” (default 10)

[]Average Length – WT “n2” (default 21)

[]Custom High – mild-red threshold for early overbought (default +15)

[]Custom Low – mild-green threshold for early oversold (default –15)

[]Always apply ±60 thresholds – forces deep-red / neon-green extremes (toggle)

[]Table Position – anchor the matrix: Top Left / Top Center / … / Bottom Right (default Top Right)

🚀 How to use it

Apply the indicator to your chart – no extra setup required.

Read the matrix top-down before every entry:

• Multiple neon-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

版本注释

A visual control panel for momentum exhaustion across ten key time-frames, now with dual-threshold colours and a movable dashboard.—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

- []Calculates WaveTrend on ten granularities: 1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 1d, 1w.

[]Displays the current oscillator print in a colour-coded matrix.

• [color=red]Deep Red[/color] = extreme overbought (≥ +60)

• [color=#EC7474]Mild Red[/color] = custom early-warning overbought (≥ Custom High)

• [color=#30D430]Mild Green[/color] = custom early-warning oversold (≤ Custom Low)

• [color=#2B9700]Neon Green[/color] = extreme oversold (≤ –60)

• [color=gray]Gray[/color] = neutral / in-range

[]Optional hard-coded ±60 extremes can be switched on/off.

[]Table position is selectable (any corner or centre). - Built on Pine v5, zero repainting, works on any symbol.

🛠 Parameters

- []Channel Length – WT “n1” (default 10)

[]Average Length – WT “n2” (default 21)

[]Apply own thresholds (no gradient) - Disables the default gradient color scheme and applies custom coloring based on these thresholds:

[]Custom High – red threshold for overbought (default +15)

[]Custom Low – green threshold for oversold (default –15)

[]Always apply ±60 thresholds – forces deep-red / neon-green extremes (toggle)

[]Table Position – anchor the matrix: Top Left / Top Center / … / Bottom Right (default Top Right)

🚀 How to use it

Apply the indicator to your chart – no extra setup required.

Read the matrix top-down before every entry:

• Multiple neon-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

版本注释

A visual control panel for momentum exhaustion across ten key time-frames, now with dual-threshold colours and a movable dashboard.—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

- Calculates WaveTrend on ten granularities: 1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 1d, 1w.

- Displays the current oscillator print in a colour-coded matrix.

- Optional hard-coded ±60 extremes can be switched on/off.

- Table position is selectable (any corner or centre).

🛠 Parameters

- Channel Length – WT “n1” (default 10)

- Average Length – WT “n2” (default 21)

- Apply own thresholds (no gradient) - Disables the default gradient color scheme and applies custom coloring based on these thresholds:

- Custom High – red threshold for overbought (default +15)

- Custom Low – green threshold for oversold (default –15)

- Always apply ±60 thresholds – forces deep-red / neon-green extremes (toggle)

- Table Position – anchor the matrix: Top Left / Top Center / … / Bottom Right (default Top Right)

🚀 How to use it

Apply the indicator to your chart – no extra setup required.

Read the matrix top-down before every entry:

• Multiple neon-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

版本注释

A visual control panel for momentum exhaustion across ten key time-frames, now with dual-threshold colours and a movable dashboard.—

🧬 DNA

This is a fork of LazyBear’s original WaveTrend Oscillator.

The oscillator logic is 100 % intact; I simply stream the values into a compact table so that day- and swing-traders can see the “bigger picture” at a glance.

📈 What does it do?

- Calculates WaveTrend on ten granularities: 1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 1d, 1w.

- Displays the current oscillator print in a colour-coded matrix.

- Optional hard-coded ±60 extremes can be switched on/off.

- Table position is selectable (any corner or centre).

- Built on Pine v5, zero repainting, works on any symbol.

🛠 Parameters

- Channel Length – WT “n1” (default 10)

- Average Length – WT “n2” (default 21)

- Apply own thresholds (no gradient) - Disables the default gradient color scheme and applies custom coloring based on these thresholds:

- Custom High – red threshold for overbought (default +15)

- Custom Low – green threshold for oversold (default –15)

- Always apply ±60 thresholds – forces deep-red / neon-green extremes (toggle)

- Table Position – anchor the matrix: Top Left / Top Center / … / Bottom Right (default Top Right)

🚀 How to use it

Apply the indicator to your chart – no extra setup required.

Read the matrix top-down before every entry:

• Multiple neon-green rows → market broadly oversold → watch for longs.

• Multiple deep-red rows → market broadly overbought → watch for shorts or stay flat.

Combine with your trend filter (EMA-stack, VWAP, structure) to avoid counter-trend trades.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。