OPEN-SOURCE SCRIPT

M2 Liquidity Divergence Model

M2 Liquidity Divergence Model

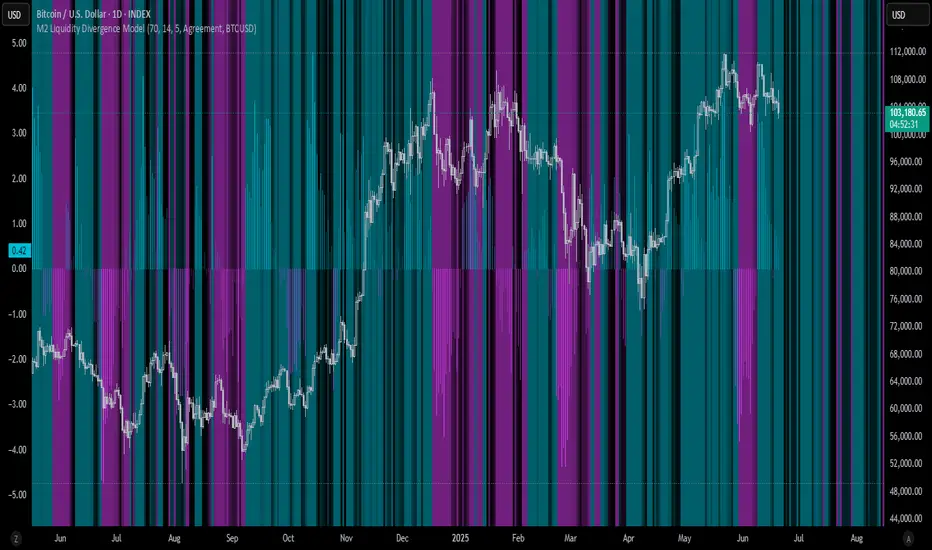

The M2 Liquidity Divergence Model is a macro-aware visualization tool designed to compare shifts in global liquidity (M2) against the performance of a benchmark asset (default: Bitcoin). This script captures liquidity flows across major global economies and highlights whether price action is aligned ("Agreement") or diverging ("Divergence") from macro trends.

🔍 Core Features

M2 Global Liquidity Index (GLI):

Aggregates M2 money supply from major global economies, FX-adjusted, including extended contributors like India, Brazil, and South Africa. The slope of this composite is used to infer macro liquidity trends.

Lag Offset Control:

Allows the M2 signal to lead benchmark asset price by a configurable number of days (Lag Offset), useful for modeling the forward-looking nature of macro flows.

Gradient Macro Context (Background):

Displays a color-gradient background—aqua for expansionary liquidity, fuchsia for contraction—based on the slope and volatility of M2. This contextual backdrop helps users visually anchor price action within macro shifts.

Divergence Histogram (Optional):

Plots a histogram showing dynamic correlation or divergence between the liquidity index and the selected benchmark.

Agreement Mode: M2 and asset are moving together.

Divergence Mode: Highlights break in expected macro-asset alignment.

Adaptive Transparency Scaling:

Histogram and background gradients scale their visual intensity based on statistical deviation to emphasize stronger signals.

Toggle Options:

Show/hide the M2 Liquidity Index line.

Show/hide divergence histogram.

Enable/disable visual offset of M2 to benchmark.

🧠 Suggested Usage

Macro Positioning: Use the background context to align directional trades with macro liquidity flows.

Disagreement as Signal: Use divergence plots to identify when price moves against macro expectations—potential reversal or exhaustion zones.

Time-Based Alignment: Adjust Lag Offset to synchronize M2 signals with asset price behavior across different market conditions.

⚠️ Disclaimer

This indicator is designed for educational and analytical purposes only. It does not constitute financial advice or an investment recommendation. Always conduct your own research and consult a licensed financial advisor before making trading decisions.

The M2 Liquidity Divergence Model is a macro-aware visualization tool designed to compare shifts in global liquidity (M2) against the performance of a benchmark asset (default: Bitcoin). This script captures liquidity flows across major global economies and highlights whether price action is aligned ("Agreement") or diverging ("Divergence") from macro trends.

🔍 Core Features

M2 Global Liquidity Index (GLI):

Aggregates M2 money supply from major global economies, FX-adjusted, including extended contributors like India, Brazil, and South Africa. The slope of this composite is used to infer macro liquidity trends.

Lag Offset Control:

Allows the M2 signal to lead benchmark asset price by a configurable number of days (Lag Offset), useful for modeling the forward-looking nature of macro flows.

Gradient Macro Context (Background):

Displays a color-gradient background—aqua for expansionary liquidity, fuchsia for contraction—based on the slope and volatility of M2. This contextual backdrop helps users visually anchor price action within macro shifts.

Divergence Histogram (Optional):

Plots a histogram showing dynamic correlation or divergence between the liquidity index and the selected benchmark.

Agreement Mode: M2 and asset are moving together.

Divergence Mode: Highlights break in expected macro-asset alignment.

Adaptive Transparency Scaling:

Histogram and background gradients scale their visual intensity based on statistical deviation to emphasize stronger signals.

Toggle Options:

Show/hide the M2 Liquidity Index line.

Show/hide divergence histogram.

Enable/disable visual offset of M2 to benchmark.

🧠 Suggested Usage

Macro Positioning: Use the background context to align directional trades with macro liquidity flows.

Disagreement as Signal: Use divergence plots to identify when price moves against macro expectations—potential reversal or exhaustion zones.

Time-Based Alignment: Adjust Lag Offset to synchronize M2 signals with asset price behavior across different market conditions.

⚠️ Disclaimer

This indicator is designed for educational and analytical purposes only. It does not constitute financial advice or an investment recommendation. Always conduct your own research and consult a licensed financial advisor before making trading decisions.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。