OPEN-SOURCE SCRIPT

已更新 GRJMOM - Risk-Adjusted Momentum

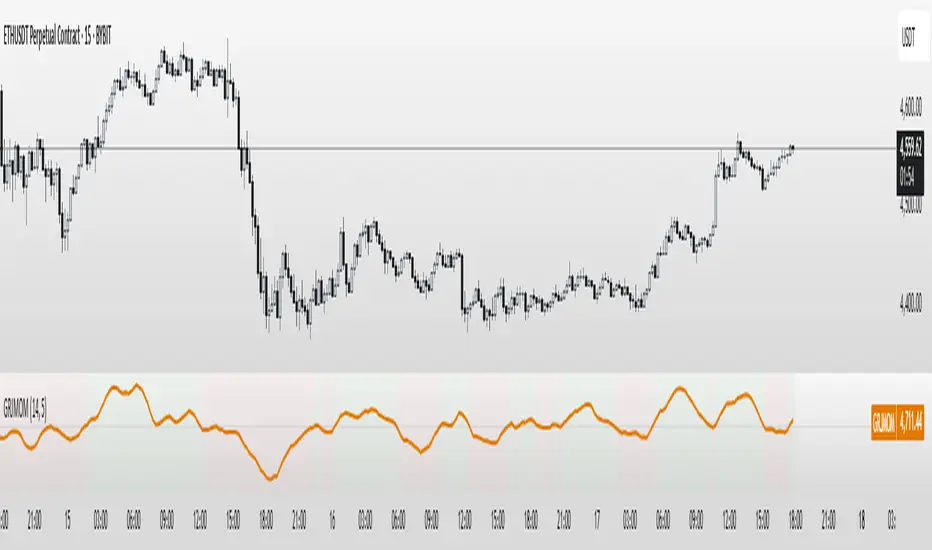

GRJMOM – Risk-Adjusted Momentum

GRJMOM stands for Generalized Risk-Adjusted Momentum. This indicator adjusts traditional momentum by dividing it by realized volatility over the same formation period. The result is a cleaner, more risk-sensitive momentum signal designed to avoid momentum crashes and volatility-driven false breakouts.

How it works:

Calculates raw momentum: Close - Close[N]

Computes realized volatility using standard deviation of log returns

Outputs a risk-adjusted momentum score (Momentum / Volatility)

Optional smoothing can be applied to reduce short-term noise

Background coloring highlights bullish (green) and bearish (red) regimes

Use Cases:

GRJMOM > 0 suggests a bullish risk-adjusted trend

GRJMOM < 0 indicates a weakening or bearish trend

Can be used as a trend confirmation filter

Pairs well with cycle indicators like HHT or FFT for timing

Best for:

Swing traders, trend followers, and systematic strategy builders looking for smarter momentum signals with built-in risk awareness

GRJMOM stands for Generalized Risk-Adjusted Momentum. This indicator adjusts traditional momentum by dividing it by realized volatility over the same formation period. The result is a cleaner, more risk-sensitive momentum signal designed to avoid momentum crashes and volatility-driven false breakouts.

How it works:

Calculates raw momentum: Close - Close[N]

Computes realized volatility using standard deviation of log returns

Outputs a risk-adjusted momentum score (Momentum / Volatility)

Optional smoothing can be applied to reduce short-term noise

Background coloring highlights bullish (green) and bearish (red) regimes

Use Cases:

GRJMOM > 0 suggests a bullish risk-adjusted trend

GRJMOM < 0 indicates a weakening or bearish trend

Can be used as a trend confirmation filter

Pairs well with cycle indicators like HHT or FFT for timing

Best for:

Swing traders, trend followers, and systematic strategy builders looking for smarter momentum signals with built-in risk awareness

版本注释

Updated chart版本注释

GRJMOM - Risk-Adjusted MomentumOverview:

GRJMOM (Generalized Risk-Adjusted Momentum) modifies traditional momentum calculations by normalizing them against realized volatility over the same measurement period. This approach scales momentum relative to the underlying price volatility rather than using absolute price change values.

Technical Methodology:

Raw Momentum Calculation: Current close minus close N periods ago

Realized Volatility: Standard deviation of logarithmic returns over the same N-period window

Risk Adjustment: Momentum value divided by realized volatility to create a normalized ratio

Optional Smoothing: Exponential moving average can be applied to reduce signal noise

Visual Elements: Background coloring indicates positive (green) or negative (red) values

Parameters:

Lookback Period (N): Number of bars used for both momentum and volatility calculations

Smoothing Length: Period for optional exponential moving average smoothing

Color Settings: Background highlighting options for visual interpretation

Calculation Logic:

The indicator attempts to distinguish between momentum driven by genuine price trends versus momentum created by high volatility environments. By dividing momentum by volatility, it theoretically provides context for whether price movement represents consistent directional bias or random price fluctuation.

Interpretation Framework:

Positive values suggest upward momentum relative to recent volatility levels

Negative values indicate downward momentum relative to recent volatility levels

Values near zero may indicate ranging or transitional market conditions

Important Limitations:

Volatility normalization can produce unstable readings during very low volatility periods

The relationship between momentum and volatility varies significantly across different market regimes

Risk adjustment does not eliminate the inherent lagging nature of momentum-based calculations

Effectiveness depends heavily on the chosen lookback period and market characteristics

Should not be used as a standalone trading system without additional confirmation

Technical Considerations:

This indicator modifies momentum calculation methodology but does not predict future price direction. Users should thoroughly backtest across different market conditions and timeframes to understand its behavior patterns before implementation.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。