INVITE-ONLY SCRIPT

已更新 MATHR3E FLOW DASHBOARD

█ OVERVIEW

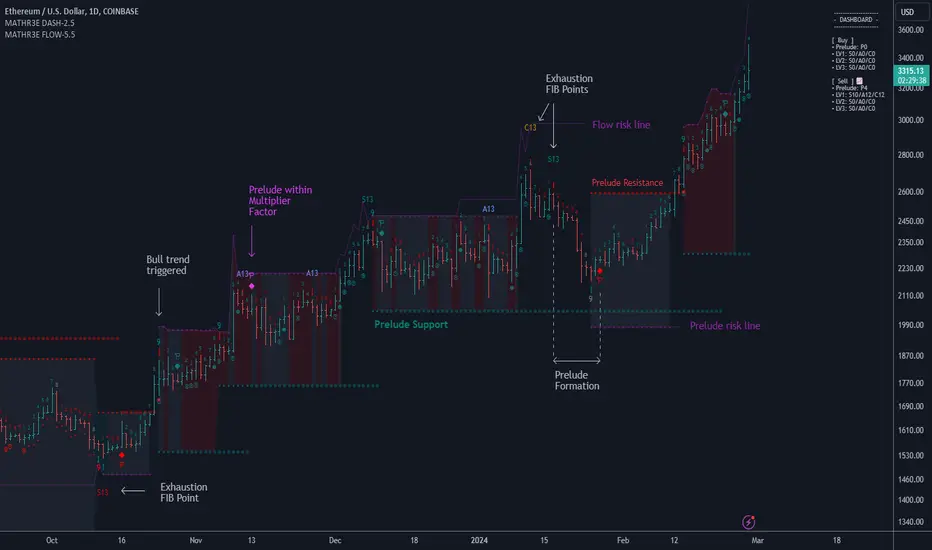

MATHR3E Flow Dashboard is a market timing tool which aims to anticipate trend reversals and highlight potential low risk entries.

█ CONCEPTS

Disclaimer:

MATHR3E Flow Dashboard indicator is intended for advanced traders and may fit your profile, whether you are a day trader or a long-term investor.

It was originally developed by a renowned market analyst and documented in numerous books. Among them is the author Jason Perl.

It is recommended to have read the trading techniques mentioned in the books covering this indicator beforehand.

How to use:

Fibonacci Flow is a very complex tool, the purpose is not to detail it here but rather to introduce it briefly.

For a complete understanding, it is strongly recommended to read the books mentioned in the disclaimer section.

This indicator has two main components:

1 — The Prelude, which relies on momentum to define price ranges.

From a Price Reversal there must be nine consecutive closes;

each one less/greater than the corresponding close four bars earlier.

Preludes are numbered from 1 to 9. A complete Prelude occurs on bar 9.

It can be: Sharped / Flawed / Ignored / Extended

Cross over parameter can also evaluate the slowdown in a price trend's intensity and qualify the inception of Flow

2 — The Flow, which comes into play once the Prelude is complete.

They are trend based, and look for low-risk opportunities to fade established directional moves.

Flows are counts numbered from 1 to 13. There are 3 of them:

• SEQ: compares the current close with the low/high two bars earlier

• AGG: compares the current low/high with the low/high two bars earlier

• CMB: complex set of comparison with 2 available methods (not detailed here)

To handle the large amount of data to be displayed, they have been distributed over two indicators.

This indicator therefore works in pair with its companion: MATHR3E Flow Extension.

The distribution of the display is as follows:

Current indicator:

• Prelude points

• Markers for Extension preludes (E)

• Prelude Risk lines

• Flow Risk lines

• Prelude Trend Support and resistance

• Dashboard for supervision of ongoing counts

Companion indicator:

• Flow points

• Markers for Flows cancelation (X)

• Exhaustions points for:

• SEQ: up to 13 (Identify trend fading)

• AGG: up to 13 (For higher trading frequency)

• CMB: up to 13 (Identify prospective turning points following an abrupt price movement)

█ FEATURES & BENEFITS

Fibonacci Sequence

The number 13 is part of the Fibonacci sequence which is nature’s numbering system.

Exhaustion points

Potential exhaustion points emerge whenever the individual flows reach Fibonacci number 13.

These points may help traders to identify low-risk buy or sell opportunities.

Risk Lines

Once the trader has selected an entry point, the displayed risk lines should encourage the trader to remain disciplined and apply proper money management.

Position sizing remains the responsibility of the trader.

Available risk lines:

• buy/sell Preludes

• buy/sell Flows

Nested Flows

The indicator can track up to three nested Flows.

Renewing

During the path to reach point number 13, it is very common to trigger other Prelude in the same direction as the previously initiated trend.

MATHR3E Flow will address these potential market renewal with multiples options:

• Prelude range qualifiers

• Renewal Multiplier

Dashboard:

The dashboard makes it easier to monitor multiple buy and sell signals at the same time:

• Prelude: (P from 1 to 9) / Compares the current close with the corresponding close four bars earlier

• SEQ: (S from 1 to 13) / Compares the current close with the low/high two bars earlier

• AGG: (A from 1 to 13) / Compares the current low/high with the low/high two bars earlier

• CMB: (C from 1 to 13) / Requires four conditions to be satisfied simultaneously

Dashboard also provides the possibility to monitor up to 3 levels of flows

Alerts

The indicator also provides programmable alerts whose format can be adapted to be received on Discord servers

Configure your alerts and get notified on:

• Trend changes

• BUY or SELL P9

• BUY or SELL S13

• BUY or SELL A13

• BUY or SELL C13

MATHR3E Flow Dashboard is a market timing tool which aims to anticipate trend reversals and highlight potential low risk entries.

█ CONCEPTS

Disclaimer:

MATHR3E Flow Dashboard indicator is intended for advanced traders and may fit your profile, whether you are a day trader or a long-term investor.

It was originally developed by a renowned market analyst and documented in numerous books. Among them is the author Jason Perl.

It is recommended to have read the trading techniques mentioned in the books covering this indicator beforehand.

How to use:

Fibonacci Flow is a very complex tool, the purpose is not to detail it here but rather to introduce it briefly.

For a complete understanding, it is strongly recommended to read the books mentioned in the disclaimer section.

This indicator has two main components:

1 — The Prelude, which relies on momentum to define price ranges.

From a Price Reversal there must be nine consecutive closes;

each one less/greater than the corresponding close four bars earlier.

Preludes are numbered from 1 to 9. A complete Prelude occurs on bar 9.

It can be: Sharped / Flawed / Ignored / Extended

Cross over parameter can also evaluate the slowdown in a price trend's intensity and qualify the inception of Flow

2 — The Flow, which comes into play once the Prelude is complete.

They are trend based, and look for low-risk opportunities to fade established directional moves.

Flows are counts numbered from 1 to 13. There are 3 of them:

• SEQ: compares the current close with the low/high two bars earlier

• AGG: compares the current low/high with the low/high two bars earlier

• CMB: complex set of comparison with 2 available methods (not detailed here)

To handle the large amount of data to be displayed, they have been distributed over two indicators.

This indicator therefore works in pair with its companion: MATHR3E Flow Extension.

The distribution of the display is as follows:

Current indicator:

• Prelude points

• Markers for Extension preludes (E)

• Prelude Risk lines

• Flow Risk lines

• Prelude Trend Support and resistance

• Dashboard for supervision of ongoing counts

Companion indicator:

• Flow points

• Markers for Flows cancelation (X)

• Exhaustions points for:

• SEQ: up to 13 (Identify trend fading)

• AGG: up to 13 (For higher trading frequency)

• CMB: up to 13 (Identify prospective turning points following an abrupt price movement)

█ FEATURES & BENEFITS

Fibonacci Sequence

The number 13 is part of the Fibonacci sequence which is nature’s numbering system.

Exhaustion points

Potential exhaustion points emerge whenever the individual flows reach Fibonacci number 13.

These points may help traders to identify low-risk buy or sell opportunities.

Risk Lines

Once the trader has selected an entry point, the displayed risk lines should encourage the trader to remain disciplined and apply proper money management.

Position sizing remains the responsibility of the trader.

Available risk lines:

• buy/sell Preludes

• buy/sell Flows

Nested Flows

The indicator can track up to three nested Flows.

Renewing

During the path to reach point number 13, it is very common to trigger other Prelude in the same direction as the previously initiated trend.

MATHR3E Flow will address these potential market renewal with multiples options:

• Prelude range qualifiers

• Renewal Multiplier

Dashboard:

The dashboard makes it easier to monitor multiple buy and sell signals at the same time:

• Prelude: (P from 1 to 9) / Compares the current close with the corresponding close four bars earlier

• SEQ: (S from 1 to 13) / Compares the current close with the low/high two bars earlier

• AGG: (A from 1 to 13) / Compares the current low/high with the low/high two bars earlier

• CMB: (C from 1 to 13) / Requires four conditions to be satisfied simultaneously

Dashboard also provides the possibility to monitor up to 3 levels of flows

Alerts

The indicator also provides programmable alerts whose format can be adapted to be received on Discord servers

Configure your alerts and get notified on:

• Trend changes

• BUY or SELL P9

• BUY or SELL S13

• BUY or SELL A13

• BUY or SELL C13

版本注释

Label: MATHR3E DASH-2.5New:

Prelude completion is displayed with a new markup Ƥ.

This feature will reflect that Preludes can extend past the minimum number of nine consecutive closes

less/greater than the close four days earlier. i.e. till Price Reversal

Markup will have different colors depending of the Prelude Criteria:

◾ Gray if option "Trigger on Entrapped Prelude" is unselected and condition is met.

◾ Gray if option "Trigger on Compressed Prelude" is unselected and condition is met.

◾ Fuchsia if Prelude is Extended

◾ Otherwise Red after a Buy Prelude/ Green after a Sell Prelude.

New:

Intermediate Prelude Trend Lines appears when:

◾ a prelude is being formed after confirmation of the 9th bar and before price reversal.

◾ the prelude is not considered valid because it is either Entrapped/Compressed if option selected

Fix:

CrossOver Parameter has been improved. FLOW is now deferred until the condition is met:

The high(low) of at least one of the latest 2 days of the Prelude be greater(less) than or equal

to the low(high) three or more trading days earlier.

Fix:

Strict and Ending precision parameters have been replaced by a more flexible bar source selection.

Source Selection is now available for

◾ Bars 5/8/13

◾ FLOW ending (2 bars prior to Bar 13)

FLOW differal can be applied for Bar 8/13.

This improvement is available for SEQ/AGG/CMB FLOWS

版本注释

📌 [MATHR3E] DASH-3.1 Update 🚀🔥 New Features

🔸 Upgraded to Pine Script V6

🛠 Fixes & Improvements

🔸 Prelude Effect Options

◽ SmallCap option removed

🔸 Alerts

◽ Now triggered upon Prelude completion

🔸 Fix

◽ Prelude bars at the start of the chart

🟩➖➖➖➖➖➖➖➖➖➖➖➖➖➖🟩

⬛ Access to MATHR3E Indicators 📈🔓:

⬛ patreon.com/MATHR3E/

🟩➖➖➖➖➖➖➖➖➖➖➖➖➖➖🟩

⬛ Access to MATHR3E Indicators 📈🔓:

⬛ patreon.com/MATHR3E/

🟩➖➖➖➖➖➖➖➖➖➖➖➖➖➖🟩

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

🟩➖➖➖➖➖➖➖➖➖➖➖➖➖➖🟩

⬛ Access to MATHR3E Indicators 📈🔓:

⬛ patreon.com/MATHR3E/

🟩➖➖➖➖➖➖➖➖➖➖➖➖➖➖🟩

⬛ Access to MATHR3E Indicators 📈🔓:

⬛ patreon.com/MATHR3E/

🟩➖➖➖➖➖➖➖➖➖➖➖➖➖➖🟩

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。