PROTECTED SOURCE SCRIPT

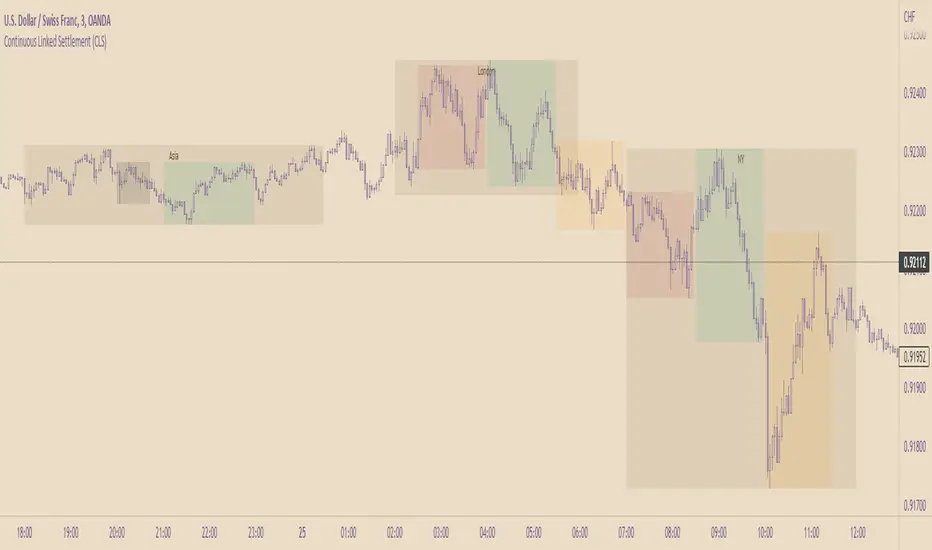

Continuous Linked Settlement (CLS)

Continuous Linked Settlement (CLS) is an international payment system which was launched in September 2002 for the settlement of foreign exchange transactions. In the conventional settlement of a foreign exchange transaction the exchange of the two currencies involved in the trade is not normally synchronous.

For one party to the trade there is therefore a risk that it will transfer the currency it has sold without receiving from the counterparty the currency it has bought (settlement risk). Even if a bank’s risk position vis-à-vis a counterparty is short-term, it may be many times greater than its capital. With CLS, an infrastructure has been created which eliminates settlement risk by means of a payment-versus-payment (PvP)2 mechanism.

For one party to the trade there is therefore a risk that it will transfer the currency it has sold without receiving from the counterparty the currency it has bought (settlement risk). Even if a bank’s risk position vis-à-vis a counterparty is short-term, it may be many times greater than its capital. With CLS, an infrastructure has been created which eliminates settlement risk by means of a payment-versus-payment (PvP)2 mechanism.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。