OPEN-SOURCE SCRIPT

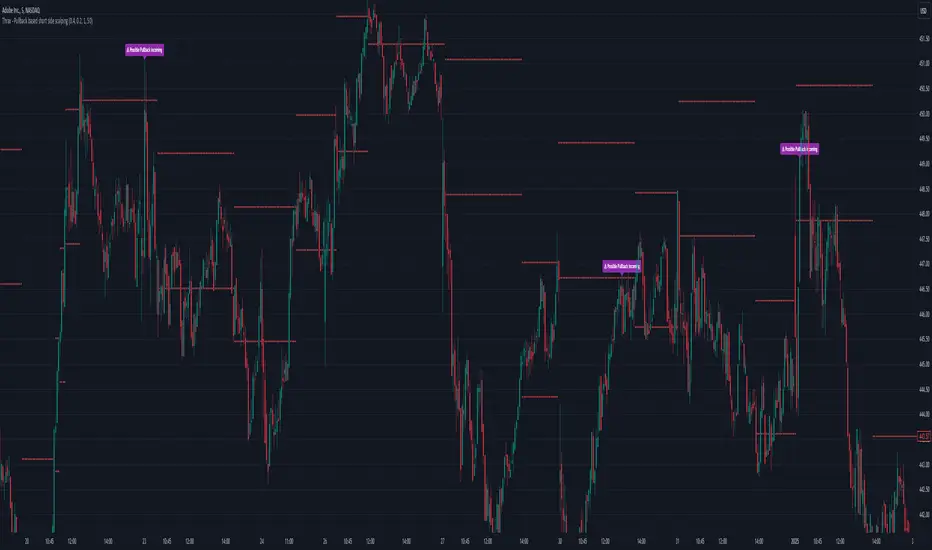

已更新 Thrax - Pullback based short side scalping

⯁ This indicator is built for short trades only.

⤞ Pullback based scalping is a strategy where a trader anticipates a pullback and makes a quick scalp in this pullback. This strategy usually works in a ranging market as probability of pullbacks occurrence in ranging market is quite high.

⤞ The strategy is built by first determining a possible candidate price levels having high chance of pullbacks. This is determined by finding out multiple rejection point and creating a zone around this price. A rejection is considered to be valid only if it comes to this zone after going down by a minimum pullback percentage. Once the price has gone down by this minimum pullback percentage multiple times and reaches the zone again chances of pullback goes high and an indication on chart for the same is given.

⯁ Inputs

⤞ Zone-Top : This input parameter determines the upper range for the price zone.

⤞ Zone bottom : This input parameter determines the lower range for price zone.

⤞ Minimum Pullback : This input parameter determines the minimum pullback percentage required for valid rejection. Below is the recommended settings

⤞ Lookback : lookback period before resetting all the variables

⬦Below is the recommended settings across timeframes

⤞ 15-min : lookback – 24, Pullback – 2, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

⤞ 5-min : lookback – 50, pullback – 1% - 1.5%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

⤞ 1-min : lookback – 100, pullback – 1%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

⤞ Anything > 30-min : lookback – 11, pullback – 3%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

✵ This indicator gives early pullback detection which can be used in below ways

1. To take short trades in the pullback.

2. To use this to exit an existing position in the next few candles as pullback may be incoming.

📌 Kindly note, it’s not necessary that pullback will happen at the exact point given on the chart. Instead, the indictor gives you early signals for the pullback

⯁ Trade Steup

1. Wait for pullback signal to occur on the chart.

2. Once the pullback warning has been displayed on the chart, you can either straight away enter the short position or wait for next 2-4 candles for initial sign of actual pullback to occurrence.

3. Once you have initiated short trade, since this is pullback-based strategy, a quick scalp should be made and closed as price may resume it’s original direction. If you have risk appetite you can stay in the trade longer and trial the stops if price keeps pulling back.

4. You can zone top as your stop, usually zone top + some% should be used as stop where ‘some %’ is based on your risk appetite.

5. It’s important to note that this indicator gives early sings of pullback so you may actually wait for 2-3 candles post ‘Pullback warning’ occurs on the chart before entering short trade.

⤞ Pullback based scalping is a strategy where a trader anticipates a pullback and makes a quick scalp in this pullback. This strategy usually works in a ranging market as probability of pullbacks occurrence in ranging market is quite high.

⤞ The strategy is built by first determining a possible candidate price levels having high chance of pullbacks. This is determined by finding out multiple rejection point and creating a zone around this price. A rejection is considered to be valid only if it comes to this zone after going down by a minimum pullback percentage. Once the price has gone down by this minimum pullback percentage multiple times and reaches the zone again chances of pullback goes high and an indication on chart for the same is given.

⯁ Inputs

⤞ Zone-Top : This input parameter determines the upper range for the price zone.

⤞ Zone bottom : This input parameter determines the lower range for price zone.

⤞ Minimum Pullback : This input parameter determines the minimum pullback percentage required for valid rejection. Below is the recommended settings

⤞ Lookback : lookback period before resetting all the variables

⬦Below is the recommended settings across timeframes

⤞ 15-min : lookback – 24, Pullback – 2, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

⤞ 5-min : lookback – 50, pullback – 1% - 1.5%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

⤞ 1-min : lookback – 100, pullback – 1%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

⤞ Anything > 30-min : lookback – 11, pullback – 3%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

✵ This indicator gives early pullback detection which can be used in below ways

1. To take short trades in the pullback.

2. To use this to exit an existing position in the next few candles as pullback may be incoming.

📌 Kindly note, it’s not necessary that pullback will happen at the exact point given on the chart. Instead, the indictor gives you early signals for the pullback

⯁ Trade Steup

1. Wait for pullback signal to occur on the chart.

2. Once the pullback warning has been displayed on the chart, you can either straight away enter the short position or wait for next 2-4 candles for initial sign of actual pullback to occurrence.

3. Once you have initiated short trade, since this is pullback-based strategy, a quick scalp should be made and closed as price may resume it’s original direction. If you have risk appetite you can stay in the trade longer and trial the stops if price keeps pulling back.

4. You can zone top as your stop, usually zone top + some% should be used as stop where ‘some %’ is based on your risk appetite.

5. It’s important to note that this indicator gives early sings of pullback so you may actually wait for 2-3 candles post ‘Pullback warning’ occurs on the chart before entering short trade.

版本注释

Update: For the US/EU markets, below inputs are recommended:

- 15-min : lookback – 24, Pullback – (0.5-1%), Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

- 5-min : lookback – 50, pullback – (0.1-0.5%) - 1.5%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

- 1-min : lookback – 100, pullback – (0.05%), Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

- Anything > 30-min : lookback – 11, pullback – 1%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

Note: Play around minimum pullback percentage values to figure out the best value for the chart.

For Indian stock markets, below inputs are recommended:

- 15-min : lookback – 24, Pullback – 2, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

- 5-min : lookback – 50, pullback – 1% - 1.5%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

- 1-min : lookback – 100, pullback – 1%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

- Anything > 30-min : lookback – 11, pullback – 3%, Zone Top Size %– 0.4, Zone Bottom Size % – 0.2

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。