PROTECTED SOURCE SCRIPT

Order Imbalance Radar

🧭 Overview

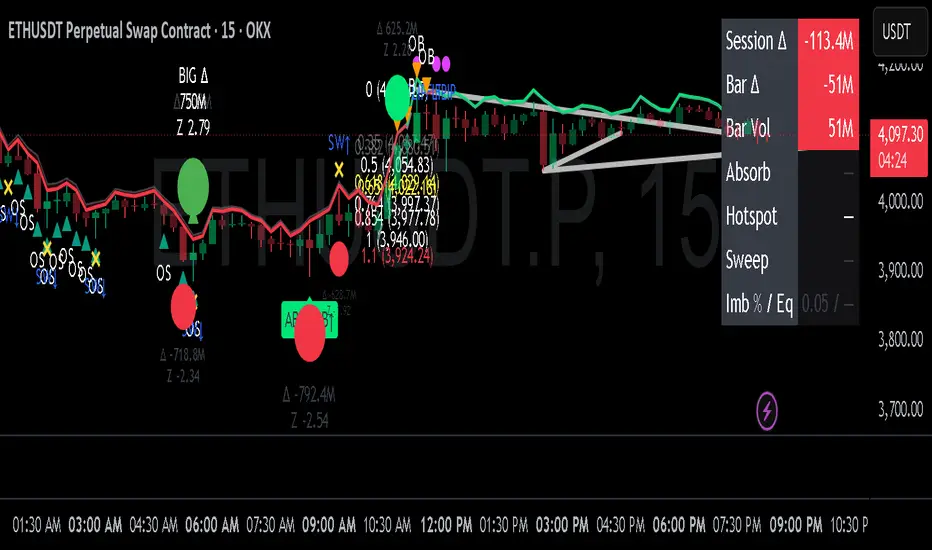

Order Imbalance Radar is a sophisticated volume–flow and imbalance detection system designed to visualize real-time shifts in buyer–seller dominance, absorption events, and market equilibrium. It combines delta-volume analysis, volatility filtering, and orderflow-style signals to help identify high-probability zones of reversal, continuation, or liquidity imbalance.

The indicator includes a top-right analytical dashboard, visual imbalance bubbles, and multiple overlays (absorption, overbought/oversold hotspots, equilibrium ribbon, liquidity sweeps, and session delta tracking).

⚙️ Core Logic & Signal Framework

1. Delta Volume Z-Score Model

Calculates delta (buy vs. sell volume) per bar based on directional close changes.

Uses a z-score normalization of delta over a user-defined lookback (zLookback) to detect statistically significant imbalances.

Highlights two tiers of imbalance:

Normal Imbalance (|z| ≥ zThresh1)

Big Imbalance (|z| ≥ zThresh2)

Filters results by requiring volume ≥ moving average × minVolMul.

Optionally limits signals to volatility squeeze conditions (via Bollinger Band width).

Visual Output:

✅ Green/red bar tints show intensity of buyer/seller imbalance.

🟢/🔴 Circle bubbles with Δ and Z-score values mark detected imbalances.

2. Absorption Detection

Detects bars where price rejects continuation despite high delta extremes, suggesting absorption of aggressive orders by passive liquidity.

Conditions:

|zΔ| exceeds absorbZ threshold

Candle body ≤ % of total range

Opposite wick ≥ % of range

Markers:

🟢 “ABSORB↑” below bars = buyer absorption (sellers absorbed)

🔴 “ABSORB↓” above bars = seller absorption (buyers absorbed)

3. OB/OS Hotspots

Integrates RSI and Bollinger Band positioning to identify volume-confirmed overbought/oversold zones.

Overbought → RSI ≥ rsiOB and price above upper band or high volume.

Oversold → RSI ≤ rsiOS and price below lower band or high volume.

Markers:

🔶 “OB” for overbought zones

🟩 “OS” for oversold zones

These can indicate short-term exhaustion points, particularly when confluenced with imbalance or absorption.

4. Liquidity Sweeps

Identifies stop-hunts / failed breakouts within recent swing lookback:

Sweep Up: Price makes a higher high but closes below previous swing → likely liquidity grab above highs.

Sweep Down: Price makes a lower low but closes above previous swing → liquidity grab below lows.

Markers:

“SW↑” (yellow) = bullish sweep

“SW↓” (yellow) = bearish sweep

5. Equilibrium Map & Ribbon

Analyzes rolling imbalance ratio (Δ / total volume) over a sliding window to gauge market equilibrium vs. imbalance bias.

Plots a dynamic ribbon above price scaled by ATR.

Ribbon color:

🟢 = buyer-dominant imbalance

🔴 = seller-dominant imbalance

Gray band marks the equilibrium zone (|imbalance| ≤ eqBand).

Fuchsia “FLIP” marker signals a change in imbalance polarity.

This provides a macro order-flow bias visualization.

6. Session Dashboard (Top-Right)

Compact dashboard showing real-time flow metrics within a defined trading session (e.g., 09:30–16:00):

Metric Description

Session Δ Total cumulative delta since session start

Bar Δ Current bar delta (buy vs. sell flow)

Bar Vol Bar volume relative to average

Absorb “BUY” / “SELL” / “—”

Hotspot “OB” / “OS” / “—”

Sweep “UP” / “DN” / “—”

Imb % / Eq Imbalance ratio & equilibrium state

Colors dynamically adapt to flow direction (green/red/fuchsia/gray).

7. CumDelta Line

Optional cumulative delta plot for continuous volume-flow tracking.

Helps confirm bias shifts and divergence vs. price.

🧩 Alerts

Pre-built alert conditions for all key events:

Buyer/Seller Imbalances

BIG Buyer/Seller Imbalances

Absorption (Buy/Sell)

Hotspot Overbought/Oversold

Liquidity Sweeps (Up/Down)

Equilibrium Flips

These allow automated alerts for advanced orderflow setups or backtesting triggers.

For More Premium Indicators please visit whop.com/ztcryptolab

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

Make your Money work for you !

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用它,没有任何限制 — 在此处了解更多信息。

Make your Money work for you !

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

Don’t worry — you don’t need to be a pro to start. I’ve got a community and tools that make it super easy to learn and actually understand what’s going on in the markets.

Check it out here 👉 whop.com/ztcryptolab/

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。