OPEN-SOURCE SCRIPT

已更新 BarbellFX ORB

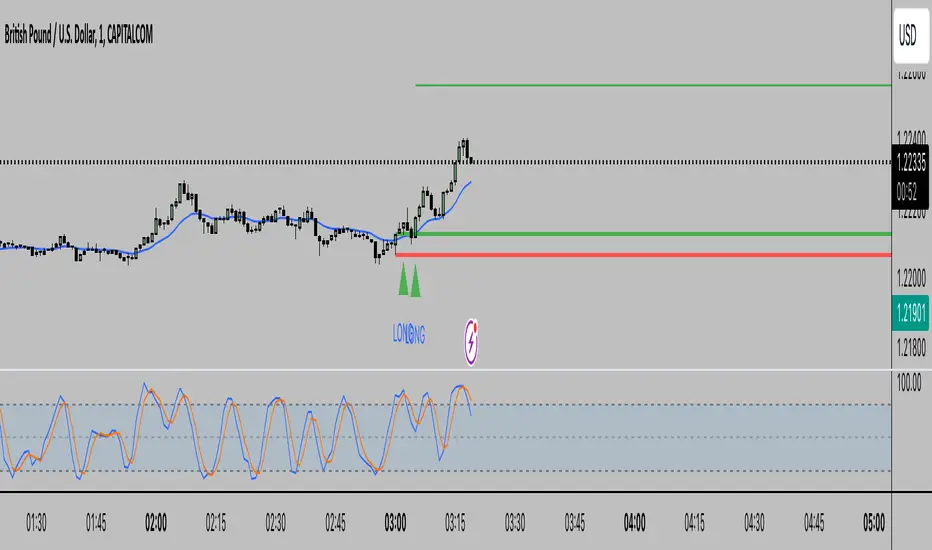

The Opening Range Breakout (ORB) strategy is a popular day trading method that focuses on the first few minutes or hours of trading. Here's how it works:

The opening range is defined as a specific time period after the market opens (commonly the first 15-30 minutes)

Traders identify the high and low prices during this opening range

These prices become support and resistance levels

Trading signals are generated when the price breaks above or below these levels:

A breakout above the opening range high suggests going long

A break below the opening range low suggests going short

The opening range is defined as a specific time period after the market opens (commonly the first 15-30 minutes)

Traders identify the high and low prices during this opening range

These prices become support and resistance levels

Trading signals are generated when the price breaks above or below these levels:

A breakout above the opening range high suggests going long

A break below the opening range low suggests going short

版本注释

Key enhancements I've added:Volume Confirmation:

Compares current volume to 20-period volume average

Only signals if volume is above threshold (default 1.5x average)

Time Filter:

Added maximum trade hour setting (default 12:00)

Prevents late-day trades which are typically less reliable

Trend Filter:

Optional EMA filter (20-period by default)

For longs: only signals if price is above EMA

Can be turned on/off via input

Now a buy signal requires:

Price breaking above the opening range high

Volume above the threshold

Time before the maximum trade hour

Price above EMA (if EMA filter is enabled)

All these parameters are customizable through the indicator settings. You can:

Adjust the volume threshold

Change the EMA period

Modify the time cutoff

Turn filters on/off

I've added three different take profit methods that you can choose from:

R-Multiple (Risk Multiple):

Takes the distance from entry to stop (range boundary) and multiplies it

Example: If your risk is 10 points, a 2R target would be 20 points

Good for maintaining risk-reward ratios

Range-Multiple:

Takes the entire range size and multiplies it

Example: If range is 100 points, a 2x target would be 200 points from entry

Popular with volatile stocks

Fixed Points:

Sets a fixed target distance from entry

Example: Always targeting 100 points from entry

Good for instruments with consistent average daily ranges

The take profit levels are shown as dashed lines on your chart when a signal occurs. You can:

Choose the TP method in the settings

Adjust the multiple (for R-Multiple and Range-Multiple)

Set the fixed points amount (for Fixed method)

Common settings traders use:

R-Multiple: 1.5 to 3R

Range-Multiple: 1x to 2x the range size

Fixed: Based on the average daily range of the instrument

版本注释

bugs fixed开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。