OPEN-SOURCE SCRIPT

已更新 Crypto Macro Cockpit

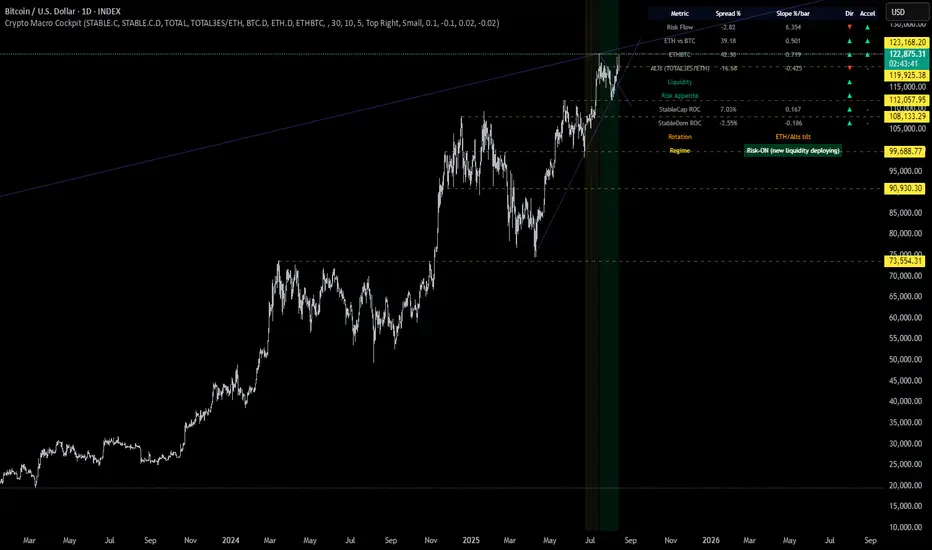

Crypto Macro Cockpit — Institutional Liquidity Regime Detection

🔍 Overview

This script introduces a modern macro framework for crypto market regime detection, leveraging newly added stablecoin market data on TradingView. It’s designed to guide traders through the evolving institutional era of crypto — where liquidity, not just price, is king.

🌐 Why This Matters

Historically, traditional proxies like M2 money supply or bond yields were referenced to infer macro liquidity shifts. But with the regulatory green light and institutional embrace of stablecoins, on-chain fiat liquidity is now directly observable.

Stablecoins = The new M2 for crypto.

This script utilizes real-time data from:

📊 CRYPTOCAP:STABLE.C (Total Stablecoin Market Cap)

📊 CRYPTOCAP:STABLE.C.D (Stablecoin Dominance)

to assess dry powder, risk appetite, and macro regime transitions.

📋 How to Read the Crypto Macro Cockpit

This dashboard updates every few bars and is organized into four actionable segments:

1️⃣ Macro Spreads

Metric --> Interpretation

Risk Flow --> Measures capital flow between stablecoins and total crypto market cap. → Green = risk deploying.

ETH vs BTC --> Shift in dominance between ETH and BTC → rotation gauge.

ETHBTC --> Price ratio movement → confirms leadership tilt.

ALTs (TOTAL3ES) --> Momentum in altcoin market, excluding BTC/ETH/stables → key for alt season timing.

2️⃣ Liquidity & Risk Appetite

Metric --> Interpretation

Liquidity --> Directional change in stablecoin cap → more stables = more dry powder.

Risk Appetite --> Inverse of stablecoin dominance → falling dominance = capital rotating into risk.

3️⃣ Stablecoin Context

Metric --> Interpretation

StableCap ROC --> Growth rate of stablecoin market cap → proxy for fiat inflows.

StableDom ROC --> Change in stablecoin dominance → reflects market caution or aggression.

4️⃣ Composite Labels

Label --> Interpretation

Rotation --> Sector tilt (BTC-led vs ETH/Alts)

Regime --> Synthesized macro environment → "Risk-ON", "Caution", "Waiting", or "Risk-OFF"

Background Color --> Optional tint reflecting regime for quick glance validation

All metrics are evaluated with directional arrows (▲/▼/•) and acceleration overlays, using user-defined thresholds scaled by timeframe for precision.

🔔 Built-in Alerts

Predefined, non-repainting alerts include:

Regime transitions

Sector rotations

Confirmed ETH/ALT rotations

Stablecoin market cap spikes

Risk Flow acceleration

You can use these alerts for discretionary trading or automated system triggers.

⚠️ Disclaimer

This script is for educational and informational purposes only. It does not constitute financial advice. Trading cryptocurrencies involves risk, and past performance does not guarantee future results. Always do your own research and manage risk responsibly.

✅ Ready to Use

No configuration needed — just load the script

Works on all timeframes (optimized for 1D)

Thresholds and smoothing are customizable

Table positioning and sizing is user-controlled

If you find this helpful, feel free to ⭐️ favorite or leave feedback. Questions welcome in the comments.

Let’s trade with macro awareness in this new era.

🔍 Overview

This script introduces a modern macro framework for crypto market regime detection, leveraging newly added stablecoin market data on TradingView. It’s designed to guide traders through the evolving institutional era of crypto — where liquidity, not just price, is king.

🌐 Why This Matters

Historically, traditional proxies like M2 money supply or bond yields were referenced to infer macro liquidity shifts. But with the regulatory green light and institutional embrace of stablecoins, on-chain fiat liquidity is now directly observable.

Stablecoins = The new M2 for crypto.

This script utilizes real-time data from:

📊 CRYPTOCAP:STABLE.C (Total Stablecoin Market Cap)

📊 CRYPTOCAP:STABLE.C.D (Stablecoin Dominance)

to assess dry powder, risk appetite, and macro regime transitions.

📋 How to Read the Crypto Macro Cockpit

This dashboard updates every few bars and is organized into four actionable segments:

1️⃣ Macro Spreads

Metric --> Interpretation

Risk Flow --> Measures capital flow between stablecoins and total crypto market cap. → Green = risk deploying.

ETH vs BTC --> Shift in dominance between ETH and BTC → rotation gauge.

ETHBTC --> Price ratio movement → confirms leadership tilt.

ALTs (TOTAL3ES) --> Momentum in altcoin market, excluding BTC/ETH/stables → key for alt season timing.

2️⃣ Liquidity & Risk Appetite

Metric --> Interpretation

Liquidity --> Directional change in stablecoin cap → more stables = more dry powder.

Risk Appetite --> Inverse of stablecoin dominance → falling dominance = capital rotating into risk.

3️⃣ Stablecoin Context

Metric --> Interpretation

StableCap ROC --> Growth rate of stablecoin market cap → proxy for fiat inflows.

StableDom ROC --> Change in stablecoin dominance → reflects market caution or aggression.

4️⃣ Composite Labels

Label --> Interpretation

Rotation --> Sector tilt (BTC-led vs ETH/Alts)

Regime --> Synthesized macro environment → "Risk-ON", "Caution", "Waiting", or "Risk-OFF"

Background Color --> Optional tint reflecting regime for quick glance validation

All metrics are evaluated with directional arrows (▲/▼/•) and acceleration overlays, using user-defined thresholds scaled by timeframe for precision.

🔔 Built-in Alerts

Predefined, non-repainting alerts include:

Regime transitions

Sector rotations

Confirmed ETH/ALT rotations

Stablecoin market cap spikes

Risk Flow acceleration

You can use these alerts for discretionary trading or automated system triggers.

⚠️ Disclaimer

This script is for educational and informational purposes only. It does not constitute financial advice. Trading cryptocurrencies involves risk, and past performance does not guarantee future results. Always do your own research and manage risk responsibly.

✅ Ready to Use

No configuration needed — just load the script

Works on all timeframes (optimized for 1D)

Thresholds and smoothing are customizable

Table positioning and sizing is user-controlled

If you find this helpful, feel free to ⭐️ favorite or leave feedback. Questions welcome in the comments.

Let’s trade with macro awareness in this new era.

版本注释

🔁 Update: Altcoin Ratio Improved (TOTAL3ES/ETH)This update replaces the previous TOTAL3ES input with a new custom ratio:

TOTAL3ES / ETH Market Cap, which acts as a dynamic altcoin strength gauge relative to Ethereum.

🧠 Why This Matters:

Ethereum is often the "gateway" or "benchmark" for altcoin rotation. By comparing TOTAL3ES (which excludes BTC, ETH, and stables) to ETH itself, this ratio filters out ETH's outsized weight and sharpens focus on pure alt momentum. It helps identify whether capital is flowing deeper into the altcoin space or consolidating around ETH as the dominant alt.

This is especially relevant under the Trojan Cycle thesis, where institutions rotate through regulated channels (e.g. ETH, stables), while retail is drawn into speculative altseasons. The TOTAL3ES/ETH ratio captures that rotation shift more clearly than TOTAL3ES alone.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。