INVITE-ONLY SCRIPT

Institutional VWAPs

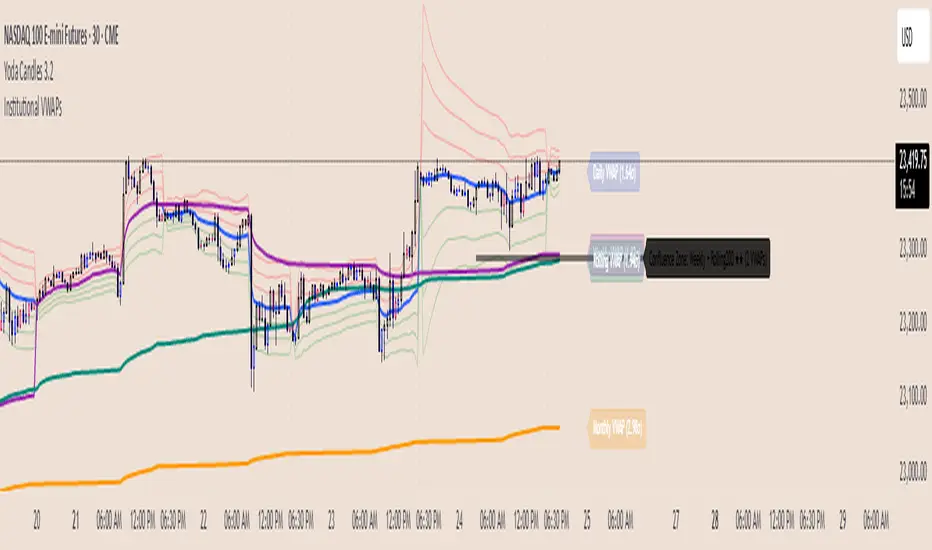

📊 Institutional VWAPs - Multi-Timeframe Confluence Detection

Track the VWAP levels that institutions are watching. This comprehensive indicator identifies high-probability reversal zones by detecting confluences between multiple timeframe VWAPs.

✨ Key Features:

4 Customizable VWAPs - Mix Daily, Weekly, Monthly, Quarterly, Yearly, RTH, or Rolling anchors

Institutional Rolling VWAP - Default 200-period used by algorithms and smart money

Automatic Confluence Detection - Highlights zones where multiple VWAPs converge

Standard Deviation Bands - 1, 2, and 3 sigma levels for mean reversion trades

Real-time Distance Tracking - Shows current price position in standard deviations

Clean Visual Design - Professional appearance with customizable colors and styles

🎯 Perfect For:

Day traders seeking institutional support/resistance levels

Swing traders identifying high-probability reversal zones

Scalpers trading mean reversion from deviation bands

Anyone wanting to see where algorithms are positioned

💡 How It Works:

The indicator monitors up to 4 VWAPs simultaneously and automatically detects when they converge within your specified threshold. These confluence zones act as powerful magnets for price action, often marking significant reversals.

🔧 Smart Defaults:

VWAP 1: Daily (Primary intraday anchor)

VWAP 2: RTH (Regular Trading Hours)

Rolling: 200-period (Institutional standard)

Confluence threshold: 0.2% (Optimal for most instruments)

Stop guessing where institutions are positioned. See exactly where the smart money is watching.

Track the VWAP levels that institutions are watching. This comprehensive indicator identifies high-probability reversal zones by detecting confluences between multiple timeframe VWAPs.

✨ Key Features:

4 Customizable VWAPs - Mix Daily, Weekly, Monthly, Quarterly, Yearly, RTH, or Rolling anchors

Institutional Rolling VWAP - Default 200-period used by algorithms and smart money

Automatic Confluence Detection - Highlights zones where multiple VWAPs converge

Standard Deviation Bands - 1, 2, and 3 sigma levels for mean reversion trades

Real-time Distance Tracking - Shows current price position in standard deviations

Clean Visual Design - Professional appearance with customizable colors and styles

🎯 Perfect For:

Day traders seeking institutional support/resistance levels

Swing traders identifying high-probability reversal zones

Scalpers trading mean reversion from deviation bands

Anyone wanting to see where algorithms are positioned

💡 How It Works:

The indicator monitors up to 4 VWAPs simultaneously and automatically detects when they converge within your specified threshold. These confluence zones act as powerful magnets for price action, often marking significant reversals.

🔧 Smart Defaults:

VWAP 1: Daily (Primary intraday anchor)

VWAP 2: RTH (Regular Trading Hours)

Rolling: 200-period (Institutional standard)

Confluence threshold: 0.2% (Optimal for most instruments)

Stop guessing where institutions are positioned. See exactly where the smart money is watching.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。