OPEN-SOURCE SCRIPT

Sigma Score

Function and Purpose

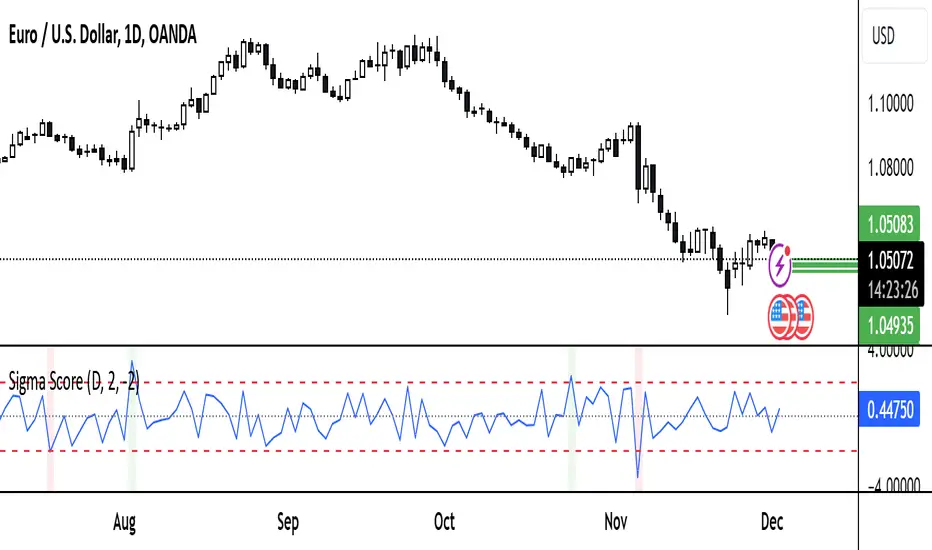

The Sigma Score indicator is a tool for analyzing volatility and identifying unusual price movements of a financial instrument over a specified timeframe. It calculates the "Sigma Score," which measures how far the current price change deviates from its historical average in terms of standard deviations. This helps identify potential extremes and unusual market conditions.

Features

Sigma Score Calculation

Visual Representation

Sigma Score Plot: The Sigma Score is displayed as a line.

Horizontal Threshold Lines:

Background Highlighting:

Custom Settings

Use Cases

Notes and Limitations

Summary

The Sigma Score indicator is a powerful tool for traders and analysts to quickly identify unusual market conditions and make informed decisions. Its flexibility in adjusting timeframes and thresholds makes it a versatile addition to any trading strategy.

The Sigma Score indicator is a tool for analyzing volatility and identifying unusual price movements of a financial instrument over a specified timeframe. It calculates the "Sigma Score," which measures how far the current price change deviates from its historical average in terms of standard deviations. This helps identify potential extremes and unusual market conditions.

Features

- Timeframe Control

- Users can select the desired timeframe for analysis (e.g., minutes, hours, days). This makes the indicator adaptable to various trading styles:

- Supported timeframes: Minutes (M1, M5, M10, M15), Hours (H1, H4, H12), Days (D), Weeks (W), Months (M).

Sigma Score Calculation

- The indicator computes the logarithmic return between consecutive price values.

- It calculates a simple moving average (SMA) and the standard deviation (StDev) of these returns.

- The Sigma Score is derived as the difference between the current return and the average, divided by the standard deviation.

Visual Representation

Sigma Score Plot: The Sigma Score is displayed as a line.

Horizontal Threshold Lines:

- A middle line (0) for reference.

- Upper and lower threshold lines (default: 2.0 and -2.0) for highlighting extremes.

Background Highlighting:

- Green for values above the upper threshold (positive deviations).

- Red for values below the lower threshold (negative deviations).

Custom Settings

- Timeframe

- Select the timeframe for analysis using a dropdown menu (default: D for daily).

- Thresholds

- Upper Threshold: Default = 2.0 (positive extreme area).

- Lower Threshold: Default = -2.0 (negative extreme area).

- Both values can be adjusted to modify the indicator's sensitivity.

Use Cases

- Identifying Extremes: Values above or below the thresholds can signal unusual market conditions, such as overbought or oversold areas.

- Analyzing Market Anomalies: The Sigma Score quantifies how unusual a price movement is based on historical data.

- Visual Aid: Threshold lines and background highlighting simplify the interpretation of boundary conditions.

Notes and Limitations

- Timeframe Dependency: Results may vary depending on the selected timeframe. Shorter timeframes highlight short-term movements, while longer timeframes capture broader trends.

- Volatility Sensitivity: The indicator is sensitive to changes in market volatility. Sudden price swings may produce extreme Sigma values.

Summary

The Sigma Score indicator is a powerful tool for traders and analysts to quickly identify unusual market conditions and make informed decisions. Its flexibility in adjusting timeframes and thresholds makes it a versatile addition to any trading strategy.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。