OPEN-SOURCE SCRIPT

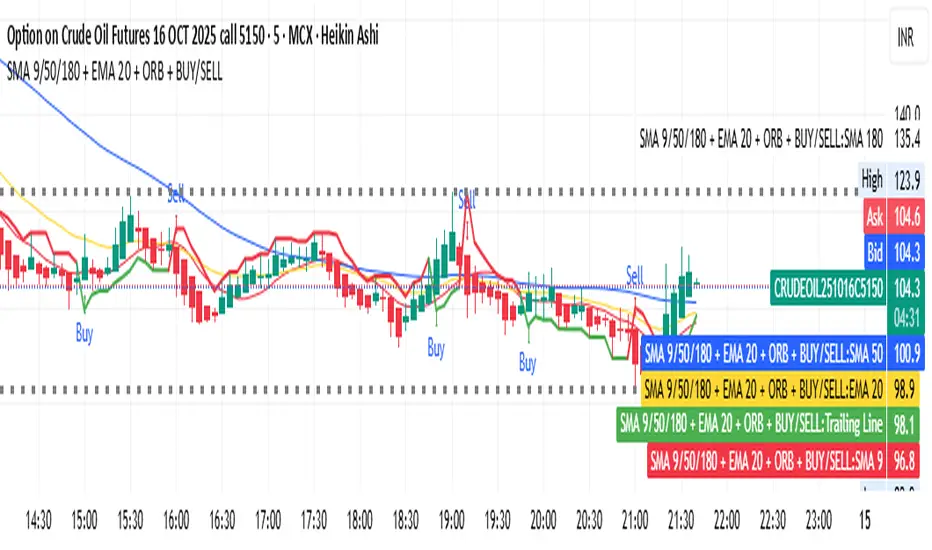

SMA 9/50/180 + EMA 20 + ORB + BUY/SELL

SMA + EMA + ORB + Buy/Sell indicator step by step.

🧠 1️⃣ What the Indicator Does

This TradingView script combines four systems in one:

Component Purpose

SMA 9 / 50 / 180 Shows short-, medium-, and long-term trend direction

EMA 20 Gives quicker trend signals

Buy/Sell Swing Logic Generates arrow signals based on breakout/reversal

ORB (Opening Range Breakout) Marks high and low of the market’s first few minutes (e.g. 9:15–9:20)

Together, it helps identify:

The main market trend

Entry/exit signals

Early breakout zones for intraday trading

📊 2️⃣ Moving Averages (SMA & EMA)

Indicator Meaning

SMA 9 Tracks short-term price (fast signal)

SMA 50 Tracks medium trend

SMA 180 Long-term trend direction

EMA 20 Gives quicker reactions than SMA (useful for early entries)

How to use:

When SMA9 > SMA50 > SMA180, trend = strong uptrend

When SMA9 < SMA50 < SMA180, trend = strong downtrend

So you trade in the same direction as the moving averages.

💡 3️⃣ Buy / Sell Swing Logic

This part finds small swing breakouts:

It checks the highest high and lowest low of the last few candles (default = 3).

If price closes above the previous high → Buy Signal (Green Arrow)

If price closes below the previous low → Sell Signal (Red Arrow)

It also plots a Trailing Line (TSL) that flips color:

🟢 Green line → Uptrend (price above TSL)

🔴 Red line → Downtrend (price below TSL)

Optional:

You can color bars/background to match buy/sell zones.

⏰ 4️⃣ ORB – Opening Range Breakout

Opening Range Breakout (ORB) marks the market’s first few minutes’ high and low (default 9:15–9:20).

These two lines act as important breakout zones.

If price breaks above ORB high → bullish momentum

If price breaks below ORB low → bearish momentum

Helps you trade early intraday moves confidently.

🧩 5️⃣ How to Use Together

🔼 Buy Setup

SMA9 > SMA50 → uptrend

Price near ORB High or above it

Green “Buy” arrow appears

✅ Enter Buy position

🎯 Exit near resistance (previous swing high)

🔽 Sell Setup

SMA9 < SMA50 → downtrend

Price near ORB Low or below it

Red “Sell” arrow appears

✅ Enter Sell position

🎯 Exit near next support

⚙️ 6️⃣ Customization

You can adjust:

SMA & EMA periods

ORB session time (e.g. 9:15–9:30)

Swing candle count

Color options for background/bars

✅ 7️⃣ Why It’s Useful

Benefit Description

Multi-confirmation Combines trend + breakout + swing signals

Intraday friendly ORB + fast MAs = perfect for 5–15 min charts

Visual clarity Arrows, lines, and colors show direction clearly

Alerts ready You get notifications when Buy/Sell triggers

🧠 1️⃣ What the Indicator Does

This TradingView script combines four systems in one:

Component Purpose

SMA 9 / 50 / 180 Shows short-, medium-, and long-term trend direction

EMA 20 Gives quicker trend signals

Buy/Sell Swing Logic Generates arrow signals based on breakout/reversal

ORB (Opening Range Breakout) Marks high and low of the market’s first few minutes (e.g. 9:15–9:20)

Together, it helps identify:

The main market trend

Entry/exit signals

Early breakout zones for intraday trading

📊 2️⃣ Moving Averages (SMA & EMA)

Indicator Meaning

SMA 9 Tracks short-term price (fast signal)

SMA 50 Tracks medium trend

SMA 180 Long-term trend direction

EMA 20 Gives quicker reactions than SMA (useful for early entries)

How to use:

When SMA9 > SMA50 > SMA180, trend = strong uptrend

When SMA9 < SMA50 < SMA180, trend = strong downtrend

So you trade in the same direction as the moving averages.

💡 3️⃣ Buy / Sell Swing Logic

This part finds small swing breakouts:

It checks the highest high and lowest low of the last few candles (default = 3).

If price closes above the previous high → Buy Signal (Green Arrow)

If price closes below the previous low → Sell Signal (Red Arrow)

It also plots a Trailing Line (TSL) that flips color:

🟢 Green line → Uptrend (price above TSL)

🔴 Red line → Downtrend (price below TSL)

Optional:

You can color bars/background to match buy/sell zones.

⏰ 4️⃣ ORB – Opening Range Breakout

Opening Range Breakout (ORB) marks the market’s first few minutes’ high and low (default 9:15–9:20).

These two lines act as important breakout zones.

If price breaks above ORB high → bullish momentum

If price breaks below ORB low → bearish momentum

Helps you trade early intraday moves confidently.

🧩 5️⃣ How to Use Together

🔼 Buy Setup

SMA9 > SMA50 → uptrend

Price near ORB High or above it

Green “Buy” arrow appears

✅ Enter Buy position

🎯 Exit near resistance (previous swing high)

🔽 Sell Setup

SMA9 < SMA50 → downtrend

Price near ORB Low or below it

Red “Sell” arrow appears

✅ Enter Sell position

🎯 Exit near next support

⚙️ 6️⃣ Customization

You can adjust:

SMA & EMA periods

ORB session time (e.g. 9:15–9:30)

Swing candle count

Color options for background/bars

✅ 7️⃣ Why It’s Useful

Benefit Description

Multi-confirmation Combines trend + breakout + swing signals

Intraday friendly ORB + fast MAs = perfect for 5–15 min charts

Visual clarity Arrows, lines, and colors show direction clearly

Alerts ready You get notifications when Buy/Sell triggers

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

开源脚本

本着TradingView的真正精神,此脚本的创建者将其开源,以便交易者可以查看和验证其功能。向作者致敬!虽然您可以免费使用它,但请记住,重新发布代码必须遵守我们的网站规则。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。