INVITE-ONLY SCRIPT

已更新 GKD-C Digital Kahler Stochastic [Loxx]

Giga Kaleidoscope GKD-C Digital Kahler Stochastic is a Confirmation module included in Loxx's "Giga Kaleidoscope Modularized Trading System".

█ Giga Kaleidoscope Modularized Trading System

What is Loxx's "Giga Kaleidoscope Modularized Trading System"?

The Giga Kaleidoscope Modularized Trading System is a trading system built on the philosophy of the NNFX (No Nonsense Forex) algorithmic trading.

What is the NNFX algorithmic trading strategy?

The NNFX (No-Nonsense Forex) trading system is a comprehensive approach to Forex trading that is designed to simplify the process and remove the confusion and complexity that often surrounds trading. The system was developed by a Forex trader who goes by the pseudonym "VP" and has gained a significant following in the Forex community.

The NNFX trading system is based on a set of rules and guidelines that help traders make objective and informed decisions. These rules cover all aspects of trading, including market analysis, trade entry, stop loss placement, and trade management.

Here are the main components of the NNFX trading system:

1. Trading Philosophy: The NNFX trading system is based on the idea that successful trading requires a comprehensive understanding of the market, objective analysis, and strict risk management. The system aims to remove subjective elements from trading and focuses on objective rules and guidelines.

2. Technical Analysis: The NNFX trading system relies heavily on technical analysis and uses a range of indicators to identify high-probability trading opportunities. The system uses a combination of trend-following and mean-reverting strategies to identify trades.

3. Market Structure: The NNFX trading system emphasizes the importance of understanding the market structure, including price action, support and resistance levels, and market cycles. The system uses a range of tools to identify the market structure, including trend lines, channels, and moving averages.

4. Trade Entry: The NNFX trading system has strict rules for trade entry. The system uses a combination of technical indicators to identify high-probability trades, and traders must meet specific criteria to enter a trade.

5. Stop Loss Placement: The NNFX trading system places a significant emphasis on risk management and requires traders to place a stop loss order on every trade. The system uses a combination of technical analysis and market structure to determine the appropriate stop loss level.

6. Trade Management: The NNFX trading system has specific rules for managing open trades. The system aims to minimize risk and maximize profit by using a combination of trailing stops, take profit levels, and position sizing.

Overall, the NNFX trading system is designed to be a straightforward and easy-to-follow approach to Forex trading that can be applied by traders of all skill levels.

Core components of an NNFX algorithmic trading strategy

The NNFX algorithm is built on the principles of trend, momentum, and volatility. There are six core components in the NNFX trading algorithm:

1. Volatility - price volatility; e.g., Average True Range, True Range Double, Close-to-Close, etc.

2. Baseline - a moving average to identify price trend

3. Confirmation 1 - a technical indicator used to identify trends

4. Confirmation 2 - a technical indicator used to identify trends

5. Continuation - a technical indicator used to identify trends

6. Volatility/Volume - a technical indicator used to identify volatility/volume breakouts/breakdown

7. Exit - a technical indicator used to determine when a trend is exhausted

What is Volatility in the NNFX trading system?

In the NNFX (No Nonsense Forex) trading system, ATR (Average True Range) is typically used to measure the volatility of an asset. It is used as a part of the system to help determine the appropriate stop loss and take profit levels for a trade. ATR is calculated by taking the average of the true range values over a specified period.

True range is calculated as the maximum of the following values:

-Current high minus the current low

-Absolute value of the current high minus the previous close

-Absolute value of the current low minus the previous close

ATR is a dynamic indicator that changes with changes in volatility. As volatility increases, the value of ATR increases, and as volatility decreases, the value of ATR decreases. By using ATR in NNFX system, traders can adjust their stop loss and take profit levels according to the volatility of the asset being traded. This helps to ensure that the trade is given enough room to move, while also minimizing potential losses.

Other types of volatility include True Range Double (TRD), Close-to-Close, and Garman-Klass

What is a Baseline indicator?

The baseline is essentially a moving average, and is used to determine the overall direction of the market.

The baseline in the NNFX system is used to filter out trades that are not in line with the long-term trend of the market. The baseline is plotted on the chart along with other indicators, such as the Moving Average (MA), the Relative Strength Index (RSI), and the Average True Range (ATR).

Trades are only taken when the price is in the same direction as the baseline. For example, if the baseline is sloping upwards, only long trades are taken, and if the baseline is sloping downwards, only short trades are taken. This approach helps to ensure that trades are in line with the overall trend of the market, and reduces the risk of entering trades that are likely to fail.

By using a baseline in the NNFX system, traders can have a clear reference point for determining the overall trend of the market, and can make more informed trading decisions. The baseline helps to filter out noise and false signals, and ensures that trades are taken in the direction of the long-term trend.

What is a Confirmation indicator?

Confirmation indicators are technical indicators that are used to confirm the signals generated by primary indicators. Primary indicators are the core indicators used in the NNFX system, such as the Average True Range (ATR), the Moving Average (MA), and the Relative Strength Index (RSI).

The purpose of the confirmation indicators is to reduce false signals and improve the accuracy of the trading system. They are designed to confirm the signals generated by the primary indicators by providing additional information about the strength and direction of the trend.

Some examples of confirmation indicators that may be used in the NNFX system include the Bollinger Bands, the MACD (Moving Average Convergence Divergence), and the Stochastic Oscillator. These indicators can provide information about the volatility, momentum, and trend strength of the market, and can be used to confirm the signals generated by the primary indicators.

In the NNFX system, confirmation indicators are used in combination with primary indicators and other filters to create a trading system that is robust and reliable. By using multiple indicators to confirm trading signals, the system aims to reduce the risk of false signals and improve the overall profitability of the trades.

What is a Continuation indicator?

In the NNFX (No Nonsense Forex) trading system, a continuation indicator is a technical indicator that is used to confirm a current trend and predict that the trend is likely to continue in the same direction. A continuation indicator is typically used in conjunction with other indicators in the system, such as a baseline indicator, to provide a comprehensive trading strategy.

What is a Volatility/Volume indicator?

Volume indicators, such as the On Balance Volume (OBV), the Chaikin Money Flow (CMF), or the Volume Price Trend (VPT), are used to measure the amount of buying and selling activity in a market. They are based on the trading volume of the market, and can provide information about the strength of the trend. In the NNFX system, volume indicators are used to confirm trading signals generated by the Moving Average and the Relative Strength Index. Volatility indicators include Average Direction Index, Waddah Attar, and Volatility Ratio. In the NNFX trading system, volatility is a proxy for volume and vice versa.

By using volume indicators as confirmation tools, the NNFX trading system aims to reduce the risk of false signals and improve the overall profitability of trades. These indicators can provide additional information about the market that is not captured by the primary indicators, and can help traders to make more informed trading decisions. In addition, volume indicators can be used to identify potential changes in market trends and to confirm the strength of price movements.

What is an Exit indicator?

The exit indicator is used in conjunction with other indicators in the system, such as the Moving Average (MA), the Relative Strength Index (RSI), and the Average True Range (ATR), to provide a comprehensive trading strategy.

The exit indicator in the NNFX system can be any technical indicator that is deemed effective at identifying optimal exit points. Examples of exit indicators that are commonly used include the Parabolic SAR, the Average Directional Index (ADX), and the Chandelier Exit.

The purpose of the exit indicator is to identify when a trend is likely to reverse or when the market conditions have changed, signaling the need to exit a trade. By using an exit indicator, traders can manage their risk and prevent significant losses.

In the NNFX system, the exit indicator is used in conjunction with a stop loss and a take profit order to maximize profits and minimize losses. The stop loss order is used to limit the amount of loss that can be incurred if the trade goes against the trader, while the take profit order is used to lock in profits when the trade is moving in the trader's favor.

Overall, the use of an exit indicator in the NNFX trading system is an important component of a comprehensive trading strategy. It allows traders to manage their risk effectively and improve the profitability of their trades by exiting at the right time.

How does Loxx's GKD (Giga Kaleidoscope Modularized Trading System) implement the NNFX algorithm outlined above?

Loxx's GKD v1.0 system has five types of modules (indicators/strategies). These modules are:

1. GKD-BT - Backtesting module (Volatility, Number 1 in the NNFX algorithm)

2. GKD-B - Baseline module (Baseline and Volatility/Volume, Numbers 1 and 2 in the NNFX algorithm)

3. GKD-C - Confirmation 1/2 and Continuation module (Confirmation 1/2 and Continuation, Numbers 3, 4, and 5 in the NNFX algorithm)

4. GKD-V - Volatility/Volume module (Confirmation 1/2, Number 6 in the NNFX algorithm)

5. GKD-E - Exit module (Exit, Number 7 in the NNFX algorithm)

(additional module types will added in future releases)

Each module interacts with every module by passing data between modules. Data is passed between each module as described below:

GKD-B => GKD-V => GKD-C(1) => GKD-C(2) => GKD-C(Continuation) => GKD-E => GKD-BT

That is, the Baseline indicator passes its data to Volatility/Volume. The Volatility/Volume indicator passes its values to the Confirmation 1 indicator. The Confirmation 1 indicator passes its values to the Confirmation 2 indicator. The Confirmation 2 indicator passes its values to the Continuation indicator. The Continuation indicator passes its values to the Exit indicator, and finally, the Exit indicator passes its values to the Backtest strategy.

This chaining of indicators requires that each module conform to Loxx's GKD protocol, therefore allowing for the testing of every possible combination of technical indicators that make up the six components of the NNFX algorithm.

What does the application of the GKD trading system look like?

Example trading system:

Each GKD indicator is denoted with a module identifier of either: GKD-BT, GKD-B, GKD-C, GKD-V, or GKD-E. This allows traders to understand to which module each indicator belongs and where each indicator fits into the GKD protocol chain.

Giga Kaleidoscope Modularized Trading System Signals (based on the NNFX algorithm)

Standard Entry

1. GKD-C Confirmation 1 Signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

Continuation Entry

1. Standard Entry, Baseline Entry, or Pullback; entry triggered previously

2. GKD-B Baseline hasn't crossed since entry signal trigger

3. GKD-C Confirmation Continuation Indicator signals

4. GKD-C Confirmation 1 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 2 agrees

1-Candle Rule Standard Entry

1. GKD-C Confirmation 1 signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

1-Candle Rule Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

PullBack Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is beyond 1.0x Volatility of Baseline

Next Candle:

1. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

█ GKD-C Digital Kahler Stochastic

What is Digital Kahler?

From Philipp Kahler's article for traders-mag.com, August 2008. "A Classic Indicator in a New Suit: Digital Stochastic"

Digital Indicators

Whenever you study the development of trading systems in particular, you will be struck in an extremely unpleasant way by the seemingly unmotivated indentations and changes in direction of each indicator. An experienced trader can recognise many false signals of the indicator on the basis of his solid background; a stupid trading system usually falls into any trap offered by the unclear indicator course. This is what motivated me to improve even further this and other indicators with the help of a relatively simple procedure. The goal of this development is to be able to use this indicator in a trading system with as few additional conditions as possible. Discretionary traders will likewise be happy about this clear course, which is not nerve-racking and makes concentrating on the essential elements of trading possible.

How Is It Done?

The digital stochastic is a child of the original indicator. We owe a debt of gratitude to George Lane for his idea to design an indicator which describes the position of the current price within the high-low range of the historical price movement. My contribution to this indicator is the changed pattern which improves the quality of the signal without generating too long delays in giving signals. The trick used to generate this “digital” behavior of the indicator. It can be used with most oscillators like RSI or CCI .

First of all, the original is looked at. The indicator always moves between 0 and 100. The precise position of the indicator or its course relative to the trigger line are of no interest to me, I would just like to know whether the indicator is quoted below or above the value 50. This is tantamount to the question of whether the market is just trading above or below the middle of the high-low range of the past few days. If the market trades in the upper half of its high-low range, then the digital stochastic is given the value 1; if the original stochastic is below 50, then the value –1 is given. This leads to a sequence of 1/-1 values – the digital core of the new indicator. These values are subsequently smoothed by means of a short exponential moving average . This way minor false signals are eliminated and the indicator is given its typical form.

Calculation

The calculation is simple

Step1: create the CCI

Step 2: Use CCI as Fast MA and smoothed CCI as Slow MA

Step 3: Multiple the Slow and Fast MAs by their respective input ratios, and then divide by their sum. if the result is greater than 0, then the result is 1, if it's less than 0 then the result is -1, then chart the data

if ((slowr * slow_k + fastr * fast_k) / (fastr + slowr) > 50.0)

temp := 1

if ((slowr * slow_k + fastr * fast_k) / (fastr + slowr) < 50.0)

temp := -1

Step 4: Profit

Requirements

Inputs

Confirmation 1 and Solo Confirmation: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Outputs

Confirmation 2 and Solo Confirmation Complex: GKD-E Exit indicator

Confirmation 1: GKD-C Confirmation indicator

Continuation: GKD-E Exit indicator

Solo Confirmation Simple: GKD-BT Backtest strategy

Additional features will be added in future releases.

█ Giga Kaleidoscope Modularized Trading System

What is Loxx's "Giga Kaleidoscope Modularized Trading System"?

The Giga Kaleidoscope Modularized Trading System is a trading system built on the philosophy of the NNFX (No Nonsense Forex) algorithmic trading.

What is the NNFX algorithmic trading strategy?

The NNFX (No-Nonsense Forex) trading system is a comprehensive approach to Forex trading that is designed to simplify the process and remove the confusion and complexity that often surrounds trading. The system was developed by a Forex trader who goes by the pseudonym "VP" and has gained a significant following in the Forex community.

The NNFX trading system is based on a set of rules and guidelines that help traders make objective and informed decisions. These rules cover all aspects of trading, including market analysis, trade entry, stop loss placement, and trade management.

Here are the main components of the NNFX trading system:

1. Trading Philosophy: The NNFX trading system is based on the idea that successful trading requires a comprehensive understanding of the market, objective analysis, and strict risk management. The system aims to remove subjective elements from trading and focuses on objective rules and guidelines.

2. Technical Analysis: The NNFX trading system relies heavily on technical analysis and uses a range of indicators to identify high-probability trading opportunities. The system uses a combination of trend-following and mean-reverting strategies to identify trades.

3. Market Structure: The NNFX trading system emphasizes the importance of understanding the market structure, including price action, support and resistance levels, and market cycles. The system uses a range of tools to identify the market structure, including trend lines, channels, and moving averages.

4. Trade Entry: The NNFX trading system has strict rules for trade entry. The system uses a combination of technical indicators to identify high-probability trades, and traders must meet specific criteria to enter a trade.

5. Stop Loss Placement: The NNFX trading system places a significant emphasis on risk management and requires traders to place a stop loss order on every trade. The system uses a combination of technical analysis and market structure to determine the appropriate stop loss level.

6. Trade Management: The NNFX trading system has specific rules for managing open trades. The system aims to minimize risk and maximize profit by using a combination of trailing stops, take profit levels, and position sizing.

Overall, the NNFX trading system is designed to be a straightforward and easy-to-follow approach to Forex trading that can be applied by traders of all skill levels.

Core components of an NNFX algorithmic trading strategy

The NNFX algorithm is built on the principles of trend, momentum, and volatility. There are six core components in the NNFX trading algorithm:

1. Volatility - price volatility; e.g., Average True Range, True Range Double, Close-to-Close, etc.

2. Baseline - a moving average to identify price trend

3. Confirmation 1 - a technical indicator used to identify trends

4. Confirmation 2 - a technical indicator used to identify trends

5. Continuation - a technical indicator used to identify trends

6. Volatility/Volume - a technical indicator used to identify volatility/volume breakouts/breakdown

7. Exit - a technical indicator used to determine when a trend is exhausted

What is Volatility in the NNFX trading system?

In the NNFX (No Nonsense Forex) trading system, ATR (Average True Range) is typically used to measure the volatility of an asset. It is used as a part of the system to help determine the appropriate stop loss and take profit levels for a trade. ATR is calculated by taking the average of the true range values over a specified period.

True range is calculated as the maximum of the following values:

-Current high minus the current low

-Absolute value of the current high minus the previous close

-Absolute value of the current low minus the previous close

ATR is a dynamic indicator that changes with changes in volatility. As volatility increases, the value of ATR increases, and as volatility decreases, the value of ATR decreases. By using ATR in NNFX system, traders can adjust their stop loss and take profit levels according to the volatility of the asset being traded. This helps to ensure that the trade is given enough room to move, while also minimizing potential losses.

Other types of volatility include True Range Double (TRD), Close-to-Close, and Garman-Klass

What is a Baseline indicator?

The baseline is essentially a moving average, and is used to determine the overall direction of the market.

The baseline in the NNFX system is used to filter out trades that are not in line with the long-term trend of the market. The baseline is plotted on the chart along with other indicators, such as the Moving Average (MA), the Relative Strength Index (RSI), and the Average True Range (ATR).

Trades are only taken when the price is in the same direction as the baseline. For example, if the baseline is sloping upwards, only long trades are taken, and if the baseline is sloping downwards, only short trades are taken. This approach helps to ensure that trades are in line with the overall trend of the market, and reduces the risk of entering trades that are likely to fail.

By using a baseline in the NNFX system, traders can have a clear reference point for determining the overall trend of the market, and can make more informed trading decisions. The baseline helps to filter out noise and false signals, and ensures that trades are taken in the direction of the long-term trend.

What is a Confirmation indicator?

Confirmation indicators are technical indicators that are used to confirm the signals generated by primary indicators. Primary indicators are the core indicators used in the NNFX system, such as the Average True Range (ATR), the Moving Average (MA), and the Relative Strength Index (RSI).

The purpose of the confirmation indicators is to reduce false signals and improve the accuracy of the trading system. They are designed to confirm the signals generated by the primary indicators by providing additional information about the strength and direction of the trend.

Some examples of confirmation indicators that may be used in the NNFX system include the Bollinger Bands, the MACD (Moving Average Convergence Divergence), and the Stochastic Oscillator. These indicators can provide information about the volatility, momentum, and trend strength of the market, and can be used to confirm the signals generated by the primary indicators.

In the NNFX system, confirmation indicators are used in combination with primary indicators and other filters to create a trading system that is robust and reliable. By using multiple indicators to confirm trading signals, the system aims to reduce the risk of false signals and improve the overall profitability of the trades.

What is a Continuation indicator?

In the NNFX (No Nonsense Forex) trading system, a continuation indicator is a technical indicator that is used to confirm a current trend and predict that the trend is likely to continue in the same direction. A continuation indicator is typically used in conjunction with other indicators in the system, such as a baseline indicator, to provide a comprehensive trading strategy.

What is a Volatility/Volume indicator?

Volume indicators, such as the On Balance Volume (OBV), the Chaikin Money Flow (CMF), or the Volume Price Trend (VPT), are used to measure the amount of buying and selling activity in a market. They are based on the trading volume of the market, and can provide information about the strength of the trend. In the NNFX system, volume indicators are used to confirm trading signals generated by the Moving Average and the Relative Strength Index. Volatility indicators include Average Direction Index, Waddah Attar, and Volatility Ratio. In the NNFX trading system, volatility is a proxy for volume and vice versa.

By using volume indicators as confirmation tools, the NNFX trading system aims to reduce the risk of false signals and improve the overall profitability of trades. These indicators can provide additional information about the market that is not captured by the primary indicators, and can help traders to make more informed trading decisions. In addition, volume indicators can be used to identify potential changes in market trends and to confirm the strength of price movements.

What is an Exit indicator?

The exit indicator is used in conjunction with other indicators in the system, such as the Moving Average (MA), the Relative Strength Index (RSI), and the Average True Range (ATR), to provide a comprehensive trading strategy.

The exit indicator in the NNFX system can be any technical indicator that is deemed effective at identifying optimal exit points. Examples of exit indicators that are commonly used include the Parabolic SAR, the Average Directional Index (ADX), and the Chandelier Exit.

The purpose of the exit indicator is to identify when a trend is likely to reverse or when the market conditions have changed, signaling the need to exit a trade. By using an exit indicator, traders can manage their risk and prevent significant losses.

In the NNFX system, the exit indicator is used in conjunction with a stop loss and a take profit order to maximize profits and minimize losses. The stop loss order is used to limit the amount of loss that can be incurred if the trade goes against the trader, while the take profit order is used to lock in profits when the trade is moving in the trader's favor.

Overall, the use of an exit indicator in the NNFX trading system is an important component of a comprehensive trading strategy. It allows traders to manage their risk effectively and improve the profitability of their trades by exiting at the right time.

How does Loxx's GKD (Giga Kaleidoscope Modularized Trading System) implement the NNFX algorithm outlined above?

Loxx's GKD v1.0 system has five types of modules (indicators/strategies). These modules are:

1. GKD-BT - Backtesting module (Volatility, Number 1 in the NNFX algorithm)

2. GKD-B - Baseline module (Baseline and Volatility/Volume, Numbers 1 and 2 in the NNFX algorithm)

3. GKD-C - Confirmation 1/2 and Continuation module (Confirmation 1/2 and Continuation, Numbers 3, 4, and 5 in the NNFX algorithm)

4. GKD-V - Volatility/Volume module (Confirmation 1/2, Number 6 in the NNFX algorithm)

5. GKD-E - Exit module (Exit, Number 7 in the NNFX algorithm)

(additional module types will added in future releases)

Each module interacts with every module by passing data between modules. Data is passed between each module as described below:

GKD-B => GKD-V => GKD-C(1) => GKD-C(2) => GKD-C(Continuation) => GKD-E => GKD-BT

That is, the Baseline indicator passes its data to Volatility/Volume. The Volatility/Volume indicator passes its values to the Confirmation 1 indicator. The Confirmation 1 indicator passes its values to the Confirmation 2 indicator. The Confirmation 2 indicator passes its values to the Continuation indicator. The Continuation indicator passes its values to the Exit indicator, and finally, the Exit indicator passes its values to the Backtest strategy.

This chaining of indicators requires that each module conform to Loxx's GKD protocol, therefore allowing for the testing of every possible combination of technical indicators that make up the six components of the NNFX algorithm.

What does the application of the GKD trading system look like?

Example trading system:

- Backtest: Strategy with 1-3 take profits, trailing stop loss, multiple types of PnL volatility, and 2 backtesting styles

- Baseline: Hull Moving Average

- Volatility/Volume: Hurst Exponent

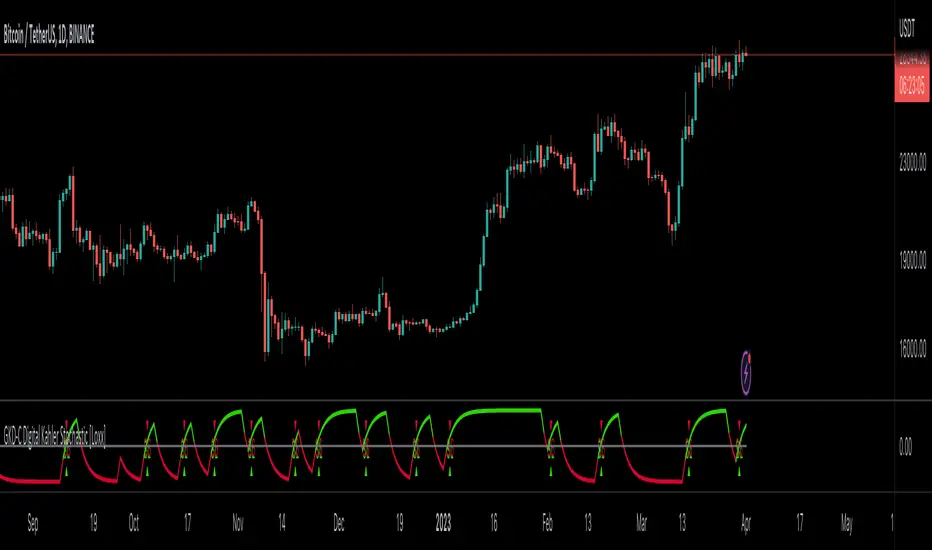

- Confirmation 1: Digital Kahler Stochastic as shown on the chart above

- Confirmation 2: Williams Percent Range

- Continuation: Fisher Transform

- Exit: Rex Oscillator

Each GKD indicator is denoted with a module identifier of either: GKD-BT, GKD-B, GKD-C, GKD-V, or GKD-E. This allows traders to understand to which module each indicator belongs and where each indicator fits into the GKD protocol chain.

Giga Kaleidoscope Modularized Trading System Signals (based on the NNFX algorithm)

Standard Entry

1. GKD-C Confirmation 1 Signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

Continuation Entry

1. Standard Entry, Baseline Entry, or Pullback; entry triggered previously

2. GKD-B Baseline hasn't crossed since entry signal trigger

3. GKD-C Confirmation Continuation Indicator signals

4. GKD-C Confirmation 1 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 2 agrees

1-Candle Rule Standard Entry

1. GKD-C Confirmation 1 signal

2. GKD-B Baseline agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume agrees

1-Candle Rule Baseline Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close[1] or Short: close > close[1])

2. GKD-B Baseline agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

PullBack Entry

1. GKD-B Baseline signal

2. GKD-C Confirmation 1 agrees

3. Price is beyond 1.0x Volatility of Baseline

Next Candle:

1. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-V Volatility/Volume Agrees

█ GKD-C Digital Kahler Stochastic

What is Digital Kahler?

From Philipp Kahler's article for traders-mag.com, August 2008. "A Classic Indicator in a New Suit: Digital Stochastic"

Digital Indicators

Whenever you study the development of trading systems in particular, you will be struck in an extremely unpleasant way by the seemingly unmotivated indentations and changes in direction of each indicator. An experienced trader can recognise many false signals of the indicator on the basis of his solid background; a stupid trading system usually falls into any trap offered by the unclear indicator course. This is what motivated me to improve even further this and other indicators with the help of a relatively simple procedure. The goal of this development is to be able to use this indicator in a trading system with as few additional conditions as possible. Discretionary traders will likewise be happy about this clear course, which is not nerve-racking and makes concentrating on the essential elements of trading possible.

How Is It Done?

The digital stochastic is a child of the original indicator. We owe a debt of gratitude to George Lane for his idea to design an indicator which describes the position of the current price within the high-low range of the historical price movement. My contribution to this indicator is the changed pattern which improves the quality of the signal without generating too long delays in giving signals. The trick used to generate this “digital” behavior of the indicator. It can be used with most oscillators like RSI or CCI .

First of all, the original is looked at. The indicator always moves between 0 and 100. The precise position of the indicator or its course relative to the trigger line are of no interest to me, I would just like to know whether the indicator is quoted below or above the value 50. This is tantamount to the question of whether the market is just trading above or below the middle of the high-low range of the past few days. If the market trades in the upper half of its high-low range, then the digital stochastic is given the value 1; if the original stochastic is below 50, then the value –1 is given. This leads to a sequence of 1/-1 values – the digital core of the new indicator. These values are subsequently smoothed by means of a short exponential moving average . This way minor false signals are eliminated and the indicator is given its typical form.

Calculation

The calculation is simple

Step1: create the CCI

Step 2: Use CCI as Fast MA and smoothed CCI as Slow MA

Step 3: Multiple the Slow and Fast MAs by their respective input ratios, and then divide by their sum. if the result is greater than 0, then the result is 1, if it's less than 0 then the result is -1, then chart the data

if ((slowr * slow_k + fastr * fast_k) / (fastr + slowr) > 50.0)

temp := 1

if ((slowr * slow_k + fastr * fast_k) / (fastr + slowr) < 50.0)

temp := -1

Step 4: Profit

Requirements

Inputs

Confirmation 1 and Solo Confirmation: GKD-V Volatility / Volume indicator

Confirmation 2: GKD-C Confirmation indicator

Outputs

Confirmation 2 and Solo Confirmation Complex: GKD-E Exit indicator

Confirmation 1: GKD-C Confirmation indicator

Continuation: GKD-E Exit indicator

Solo Confirmation Simple: GKD-BT Backtest strategy

Additional features will be added in future releases.

版本注释

Updated default settings版本注释

Fixed signal bug版本注释

Upgraded to relax signal rules. This only applies to the Full GKD systems. All settings for signals are controlled by the Confirmation 2 indicator. So this means when you build a Full GKD system, the C2 indicator controls the relaxation of all signals including the Continuation indicator that you are required to add on top of the C2 indicator the full GKD system.Added the following signal types:

Volatility/Volume Entry

1. GKD-V Volatility/Volume signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 2 agrees

5. GKD-B Baseline agrees

6. GKD-C Confirmation 1 signal was less than 7 candles prior

1-Candle Rule Volatility/Volume Entry

1. GKD-V Volatility/Volume signal

2. GKD-C Confirmation 1 agrees

3. Price is within a range of 0.2x Volatility and 1.0x Volatility of the Goldie Locks Mean

4. GKD-C Confirmation 1 signal was less than 7 candles prior

Next Candle:

1. Price retraced (Long: close < close or Short: close > close)

2. GKD-B Volatility/Volume agrees

3. GKD-C Confirmation 1 agrees

4. GKD-C Confirmation 2 agrees

5. GKD-B Baseline agrees

Added the following backtest options

-Super Complex allows for the creation of a GKD system without Confirmation 2 indicator. This backtest type requires the addition of a GKD-C Confirmation indicator

-Stacked allows for the creation of infinitely stackable GKD-C indicators. This is useful for combining two GKD-C indicators to test their synergy together before using these indicators in a full GKD system.

版本注释

Updated to handle GKD-V stacks版本注释

Added volatility signals to continuation signal qualifiers. Added Confirmation 1 + Confirmation 2 backtesting. This allows you to backtest C1 with C2 indicators together without setting up the full GKD system. In the GKD system, the C2 indicator acts as a minor trend filter while the C1 indicator delivers the actual signals and entries. This new backtest allows you to test the entries and signals from the C1 indicator while using the C2 indicator as the macrotrend filter.

版本注释

Updated for new GKD backtests.版本注释

Additions and Subtractions:-All signal logic has been transferred to the new GKD-BT Backtests. You can access these backtests using the links provided below:

GKD-BT Giga Confirmation Stack Backtest:

![GKD-BT Giga Confirmation Stack Backtest [Loxx]](https://s3.tradingview.com/u/UkVUjO7c_mid.png)

GKD-BT Giga Stacks Backtest:

![GKD-BT Giga Stacks Backtest [Loxx]](https://s3.tradingview.com/0/0L1bTVBC_mid.png)

GKD-BT Full Giga Kaleidoscope Backtest:

![GKD-BT Full Giga Kaleidoscope Backtest [Loxx]](https://s3.tradingview.com/n/NP3VQKIX_mid.png)

GKD-BT Solo Confirmation Super Complex Backtest:

![GKD-BT Solo Confirmation Super Complex Backtest [Loxx]](https://s3.tradingview.com/o/o3a9L51S_mid.png)

GKD-BT Solo Confirmation Complex Backtest:

![GKD-BT Solo Confirmation Complex Backtest [Loxx]](https://s3.tradingview.com/n/NUnXZDbn_mid.png)

GKD-BT Solo Confirmation Simple Backtest:

![GKD-BT Solo Confirmation Simple Backtest [Loxx]](https://s3.tradingview.com/p/piMjJcbx_mid.png)

-Removed all Confirmation Type options except for "Confirmation" and "Continuation." The "Continuation" type is only used in GKD-BT Solo Confirmation Super Complex Backtest and GKD-BT Full Giga Kaleidoscope Backtest when selecting a Confirmation indicator.

-Added new signal plots based on the selected Confirmation Type. For the "Confirmation" type, only initial Longs and Shorts will be displayed on the indicator. For the "Continuation" type, both initial and continuation signals will be displayed. In both cases, if multiple signal types are present (e.g., middle cross, signal cross), these signals can be controlled using the "Signal Type" option.

-Implemented code optimizations to enhance the rendering speed of signals.

-Streamlined the export process by generating only a single value for export to other indicators or backtests. This exported value is named "Input into NEW GKD-BT Backtest."

版本注释

Updated for multi-ticker GKD. 版本注释

Readded smoothing types版本注释

Updated smoothing options.版本注释

Updated for GKD optimizer. 仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系loxx。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This indicator is only available to ALGX Trading VIP group members. For instructions on how to access, send me a private message here on TradingView or message me using the contact information listed in my TradingView profile.

Public Telegram Group, t.me/algxtrading_public

VIP Membership Info: patreon.com/algxtrading/membership

VIP Membership Info: patreon.com/algxtrading/membership

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系loxx。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This indicator is only available to ALGX Trading VIP group members. For instructions on how to access, send me a private message here on TradingView or message me using the contact information listed in my TradingView profile.

Public Telegram Group, t.me/algxtrading_public

VIP Membership Info: patreon.com/algxtrading/membership

VIP Membership Info: patreon.com/algxtrading/membership

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。