PROTECTED SOURCE SCRIPT

Premarket Zones

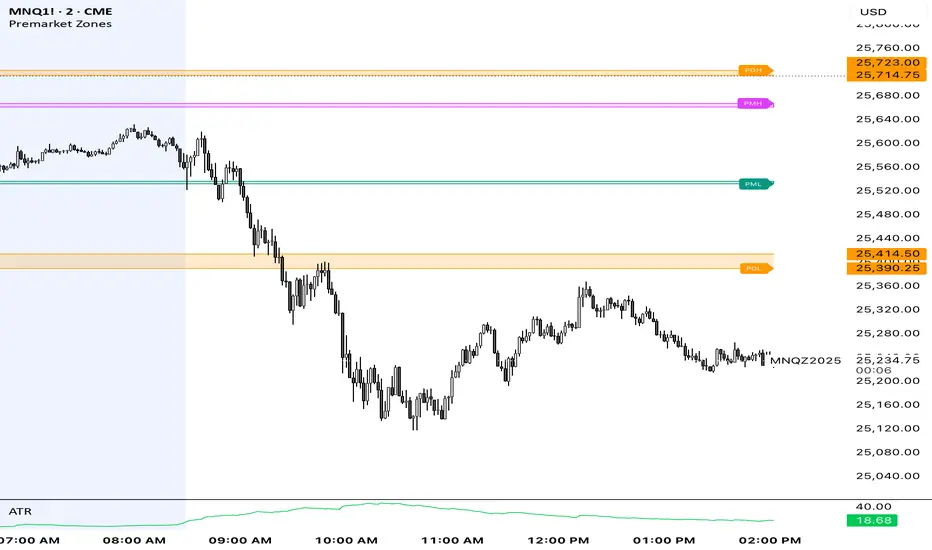

This indicator is built for index futures traders (ES, NQ, RTY, YM) who trade liquidity, session structure, and high-probability reaction levels using true CME futures timing.

It automatically plots:

Premarket High & Low zones (wick + body)

Previous Day Futures RTH High & Low zones (PDH / PDL)

Clean right-edge labels

First-touch alerts (once per day)

All calculations are based on Central Time (CT) and CME futures sessions, not equity cash-market hours.

🕒 Session Definitions (CME / Central Time)

Session Time (CT) Purpose

Premarket 03:00 – 08:30 Overnight liquidity build

Futures RTH (Calc) 08:30 – 15:00 True CME regular trading hours

Plot Window 03:00 – 16:00 Visual extension of zones

This script intentionally uses 08:30 CT as the futures open — not 09:30 equity cash open.

🔷 Premarket Zones (PMH / PML)

The indicator builds two premarket zones using multi-timeframe precision.

How they are calculated:

1-minute candles → capture the true wick extremes

5-minute candles → capture the dominant body area

Zones:

Premarket High Zone (PMH)

Between the highest 5-minute candle body and the highest 1-minute wick

Premarket Low Zone (PML)

Between the lowest 1-minute wick and the lowest 5-minute candle body

Key behavior:

Zones finalize at 08:30 CT

Once finalized, zones are drawn as boxes that extend left to 03:00 CT

Zones extend forward through the trading day for context

PMH / PML labels are plotted on the right edge

These zones represent overnight liquidity pools commonly used for:

Opening drive continuation

Liquidity sweeps

Mean reversion

Acceptance vs rejection at the open

🔶 Previous Day High / Low (PDH / PDL)

This script plots TRUE futures PDH / PDL, not equity-based levels.

How they are calculated:

Uses only the prior day’s futures RTH (08:30–15:00 CT)

1-minute candles → wick extremes

5-minute candles → body value areas

Zones:

PDH Zone: 5m body → 1m wick

PDL Zone: 1m wick → 5m body

These levels represent:

Institutional reference points

Prior session balance extremes

High-probability reaction zones

Clean PDH / PDL labels are plotted on the right edge.

🔔 Alerts (Once Per Day)

The indicator includes first-touch alerts for:

PDH

PDL

Premarket High Zone

Premarket Low Zone

Each alert triggers only once per session, making it ideal for:

Trade planning

Discipline-based execution

Prop firm risk control

📈 How Traders Use This Script

This indicator is context-based, not predictive.

Common use cases:

Waiting for liquidity sweeps into PMH / PML

Trading rejection or acceptance at PDH / PDL

Combining with:

VWAP

Opening Range

Market structure

Volume or delta tools

It works especially well on:

Opening range days

Mean-reversion conditions

Trend continuation days after overnight imbalance

🎯 Design Philosophy

Futures-first logic

No clutter

No repainting

No equity-market assumptions

Levels professionals actually use

This script is designed to mirror how professional futures traders map their charts.

⚠️ Notes

Best used on 1m or 5m charts

Designed for CME index futures

Not a standalone trading system

Always manage risk

It automatically plots:

Premarket High & Low zones (wick + body)

Previous Day Futures RTH High & Low zones (PDH / PDL)

Clean right-edge labels

First-touch alerts (once per day)

All calculations are based on Central Time (CT) and CME futures sessions, not equity cash-market hours.

🕒 Session Definitions (CME / Central Time)

Session Time (CT) Purpose

Premarket 03:00 – 08:30 Overnight liquidity build

Futures RTH (Calc) 08:30 – 15:00 True CME regular trading hours

Plot Window 03:00 – 16:00 Visual extension of zones

This script intentionally uses 08:30 CT as the futures open — not 09:30 equity cash open.

🔷 Premarket Zones (PMH / PML)

The indicator builds two premarket zones using multi-timeframe precision.

How they are calculated:

1-minute candles → capture the true wick extremes

5-minute candles → capture the dominant body area

Zones:

Premarket High Zone (PMH)

Between the highest 5-minute candle body and the highest 1-minute wick

Premarket Low Zone (PML)

Between the lowest 1-minute wick and the lowest 5-minute candle body

Key behavior:

Zones finalize at 08:30 CT

Once finalized, zones are drawn as boxes that extend left to 03:00 CT

Zones extend forward through the trading day for context

PMH / PML labels are plotted on the right edge

These zones represent overnight liquidity pools commonly used for:

Opening drive continuation

Liquidity sweeps

Mean reversion

Acceptance vs rejection at the open

🔶 Previous Day High / Low (PDH / PDL)

This script plots TRUE futures PDH / PDL, not equity-based levels.

How they are calculated:

Uses only the prior day’s futures RTH (08:30–15:00 CT)

1-minute candles → wick extremes

5-minute candles → body value areas

Zones:

PDH Zone: 5m body → 1m wick

PDL Zone: 1m wick → 5m body

These levels represent:

Institutional reference points

Prior session balance extremes

High-probability reaction zones

Clean PDH / PDL labels are plotted on the right edge.

🔔 Alerts (Once Per Day)

The indicator includes first-touch alerts for:

PDH

PDL

Premarket High Zone

Premarket Low Zone

Each alert triggers only once per session, making it ideal for:

Trade planning

Discipline-based execution

Prop firm risk control

📈 How Traders Use This Script

This indicator is context-based, not predictive.

Common use cases:

Waiting for liquidity sweeps into PMH / PML

Trading rejection or acceptance at PDH / PDL

Combining with:

VWAP

Opening Range

Market structure

Volume or delta tools

It works especially well on:

Opening range days

Mean-reversion conditions

Trend continuation days after overnight imbalance

🎯 Design Philosophy

Futures-first logic

No clutter

No repainting

No equity-market assumptions

Levels professionals actually use

This script is designed to mirror how professional futures traders map their charts.

⚠️ Notes

Best used on 1m or 5m charts

Designed for CME index futures

Not a standalone trading system

Always manage risk

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。