OPEN-SOURCE SCRIPT

Financial-Conditions Brake Index (FCBI) — US10Y brake on USIRYY

Financial-Conditions Brake Index (FCBI) – US10Y Brake on USIRYY

Concept

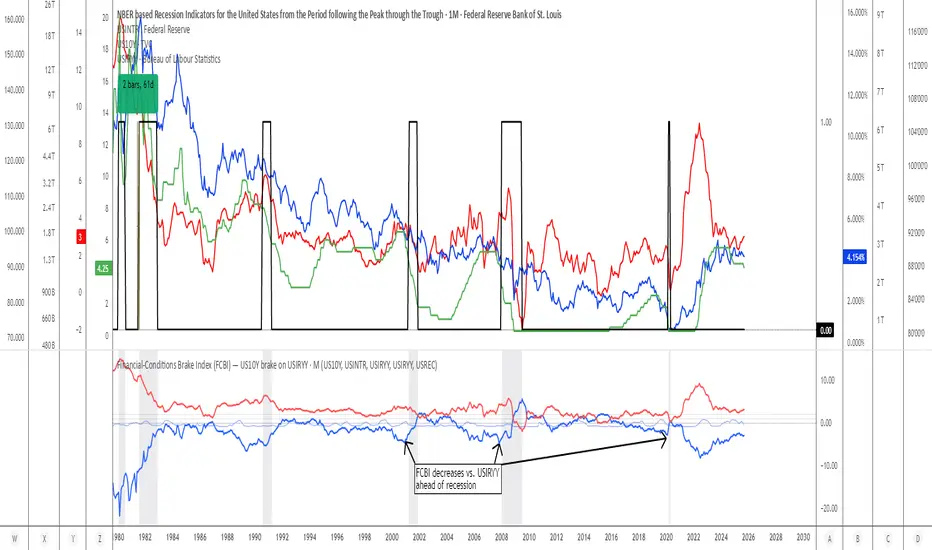

The Financial-Conditions Brake Index (FCBI) measures how U.S. long-term yields (US10Y) interact with the Federal Funds Rate (USINTR) and inflation (CPI YoY) to shape real-rate conditions (USIRYY).

It visualizes whether the bond market is tightening or loosening overall financial conditions relative to the Federal Reserve’s policy stance.

Formula

FCBI = (US10Y) − (USINTR) − (CPI YoY)

How It Works

The FCBI expresses the difference between the long-term yield curve and short-term policy rates, adjusted for inflation. It shows whether the long end of the curve is amplifying or counteracting the Fed’s stance.

FCBI > +2 → Strong brake → Long yields remain elevated despite easing → tight conditions → recession delayed.

FCBI +1 to +2 → Mild brake → Financial transmission slower; lag ≈ 12–18 months.

FCBI 0 to +1 → Neutral → Typical early post-cut environment.

FCBI < 0 → Accelerator → Long yields and inflation expectations falling → liquidity flows freely → recession often follows within 6–14 months.

How to Read the Chart

Blue line (FCBI) shows the strength of the financial brake.

Red line (USIRYY) represents the real yield baseline.

Recession shading (gray) marks NBER recessions for comparison.

FCBI < USIRYY → Brake engaged → financial conditions tighter than real-rate baseline.

FCBI > USIRYY → Brake released → long end easing faster than policy → liquidity surge → late-cycle setup.

Historically, U.S. recessions begin on average about 14 months after the first Fed rate cut, and a decline of the FCBI below zero often precedes that window.

Practical Use

Use the FCBI to identify when policy transmission is blocked (brake engaged) or flowing (brake released).

Cross-check with yield-curve inversions, Fed policy shifts, and inflation expectations to estimate macro timing windows.

Current Example (Oct 2025)

FCBI ≈ −3.1, USIRYY ≈ +3.0 → Brake still engaged.

Once FCBI rises above USIRYY and crosses positive, it signals the “brake released” phase — historically the final liquidity surge before a U.S. recession.

Summary

FCBI shows how tight the brake is.

USIRYY shows how fast the car is moving.

When FCBI rises above USIRYY, the brake is released — liquidity accelerates and the historical recession countdown begins.

Concept

The Financial-Conditions Brake Index (FCBI) measures how U.S. long-term yields (US10Y) interact with the Federal Funds Rate (USINTR) and inflation (CPI YoY) to shape real-rate conditions (USIRYY).

It visualizes whether the bond market is tightening or loosening overall financial conditions relative to the Federal Reserve’s policy stance.

Formula

FCBI = (US10Y) − (USINTR) − (CPI YoY)

How It Works

The FCBI expresses the difference between the long-term yield curve and short-term policy rates, adjusted for inflation. It shows whether the long end of the curve is amplifying or counteracting the Fed’s stance.

FCBI > +2 → Strong brake → Long yields remain elevated despite easing → tight conditions → recession delayed.

FCBI +1 to +2 → Mild brake → Financial transmission slower; lag ≈ 12–18 months.

FCBI 0 to +1 → Neutral → Typical early post-cut environment.

FCBI < 0 → Accelerator → Long yields and inflation expectations falling → liquidity flows freely → recession often follows within 6–14 months.

How to Read the Chart

Blue line (FCBI) shows the strength of the financial brake.

Red line (USIRYY) represents the real yield baseline.

Recession shading (gray) marks NBER recessions for comparison.

FCBI < USIRYY → Brake engaged → financial conditions tighter than real-rate baseline.

FCBI > USIRYY → Brake released → long end easing faster than policy → liquidity surge → late-cycle setup.

Historically, U.S. recessions begin on average about 14 months after the first Fed rate cut, and a decline of the FCBI below zero often precedes that window.

Practical Use

Use the FCBI to identify when policy transmission is blocked (brake engaged) or flowing (brake released).

Cross-check with yield-curve inversions, Fed policy shifts, and inflation expectations to estimate macro timing windows.

Current Example (Oct 2025)

FCBI ≈ −3.1, USIRYY ≈ +3.0 → Brake still engaged.

Once FCBI rises above USIRYY and crosses positive, it signals the “brake released” phase — historically the final liquidity surge before a U.S. recession.

Summary

FCBI shows how tight the brake is.

USIRYY shows how fast the car is moving.

When FCBI rises above USIRYY, the brake is released — liquidity accelerates and the historical recession countdown begins.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。