INVITE-ONLY SCRIPT

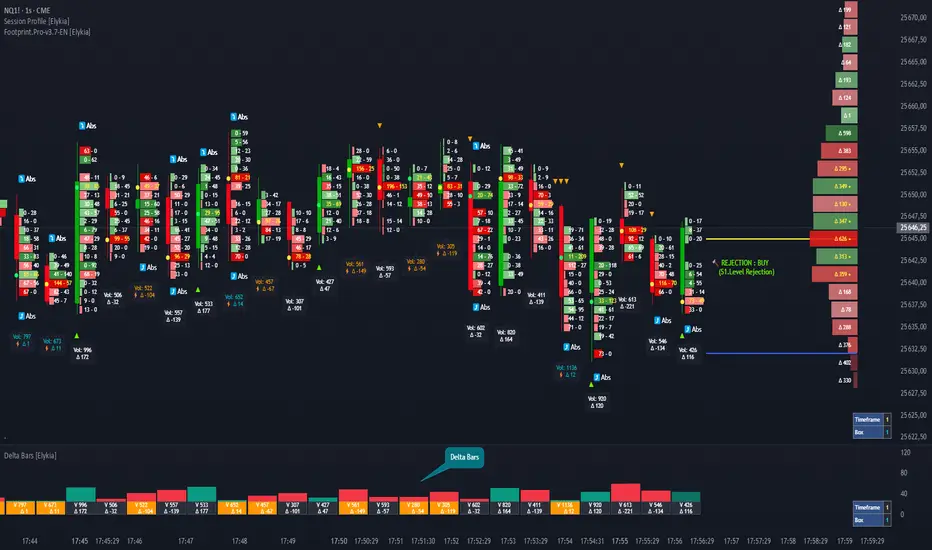

Delta Bars [Elykia]

Delta Bars [Elykia] — Order Flow & Momentum Analysis

Description:

Delta Bars [Elykia] is an "Order Flow Oscillator" designed to instantly visualize buyer and seller aggression within every price move.

Unlike standard volume, it breaks down what is happening "under the hood" (Delta) and offers a clear reading of market reversals thanks to intelligent divergence detection.

🔥 Key Features:

1. Dual Calculation Mode:

2. 🧠 Smart Auto-Detection (Plug & Play):

No need to manually calculate "Box" or "Tick" sizes for each asset. The indicator automatically recognizes the asset you are trading and applies the optimal institutional calibration:

3. "Flip" Detection (Divergences) ⚡:

The indicator automatically identifies anomalies between price and Delta:

4. Technical Dashboard:

A discreet panel displays the current mode and "Box" size (in ticks/points) in real-time, ensuring you always know how the data is being filtered.

How to read the signals?

1. Green/Red Bars: They indicate Net Delta (the difference between buying and selling volume). A tall bar implies strong conviction.

2. The ⚡ Symbol (The Flip): This is the most critical signal. It appears when Delta contradicts the candle direction (e.g., Positive Delta on a Bearish candle). This indicates Absorption (passive orders blocking the move) and often precedes a reversal.

3. Range Bars Mode: Use this mode to "smooth out" the market. If the market is choppy, Range Bars will filter the noise and only draw a new bar if the price actually moves.

⚠️ Important: Replay Mode

Since this indicator performs heavy calculations (simulated tick-by-tick), it includes a safety feature for Replay Mode.

Configuration:

Description:

Delta Bars [Elykia] is an "Order Flow Oscillator" designed to instantly visualize buyer and seller aggression within every price move.

Unlike standard volume, it breaks down what is happening "under the hood" (Delta) and offers a clear reading of market reversals thanks to intelligent divergence detection.

🔥 Key Features:

1. Dual Calculation Mode:

- Timeframe Mode: Displays classic Delta based on time (e.g., 1min, 5min).

- Range Bars Mode: (Exclusive) Builds Delta bars based on price movement (volatility) rather than time. This filters out noise during consolidation periods and reveals true strength during impulses.

2. 🧠 Smart Auto-Detection (Plug & Play):

No need to manually calculate "Box" or "Tick" sizes for each asset. The indicator automatically recognizes the asset you are trading and applies the optimal institutional calibration:

- US Indices (NQ, ES, YM...)

- Forex (EURUSD, JPY...)

- Crypto (BTC, ETH)

- Commodities (Gold, Oil)

- Note: You can still switch to manual mode if needed.

3. "Flip" Detection (Divergences) ⚡:

The indicator automatically identifies anomalies between price and Delta:

- If the candle closes Green but Delta is Negative (Absorption/Failed Selling Effort).

- If the candle closes Red but Delta is Positive.

- These situations are marked with a ⚡ symbol and a specific highlight color (Orange by default), often signaling an imminent reversal.

4. Technical Dashboard:

A discreet panel displays the current mode and "Box" size (in ticks/points) in real-time, ensuring you always know how the data is being filtered.

How to read the signals?

1. Green/Red Bars: They indicate Net Delta (the difference between buying and selling volume). A tall bar implies strong conviction.

2. The ⚡ Symbol (The Flip): This is the most critical signal. It appears when Delta contradicts the candle direction (e.g., Positive Delta on a Bearish candle). This indicates Absorption (passive orders blocking the move) and often precedes a reversal.

3. Range Bars Mode: Use this mode to "smooth out" the market. If the market is choppy, Range Bars will filter the noise and only draw a new bar if the price actually moves.

⚠️ Important: Replay Mode

Since this indicator performs heavy calculations (simulated tick-by-tick), it includes a safety feature for Replay Mode.

- To use Replay: Go to settings and set the "Force Replay Date" to a date close to your starting point. This ensures maximum fluidity and avoids TradingView limit errors.

Configuration:

- Works on all timeframes but excels on seconds charts (1s, 5s) or fast minute charts (1m) for scalping.

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系Elykia34。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Trading (Futures, Crypto, Forex) involves a high level of risk. This indicator is a decision-support and technical analysis tool, not investment advice. The author cannot be held responsible for any losses incurred.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系Elykia34。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Trading (Futures, Crypto, Forex) involves a high level of risk. This indicator is a decision-support and technical analysis tool, not investment advice. The author cannot be held responsible for any losses incurred.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。