PROTECTED SOURCE SCRIPT

[Jett.][GoldenRush] Market Direction

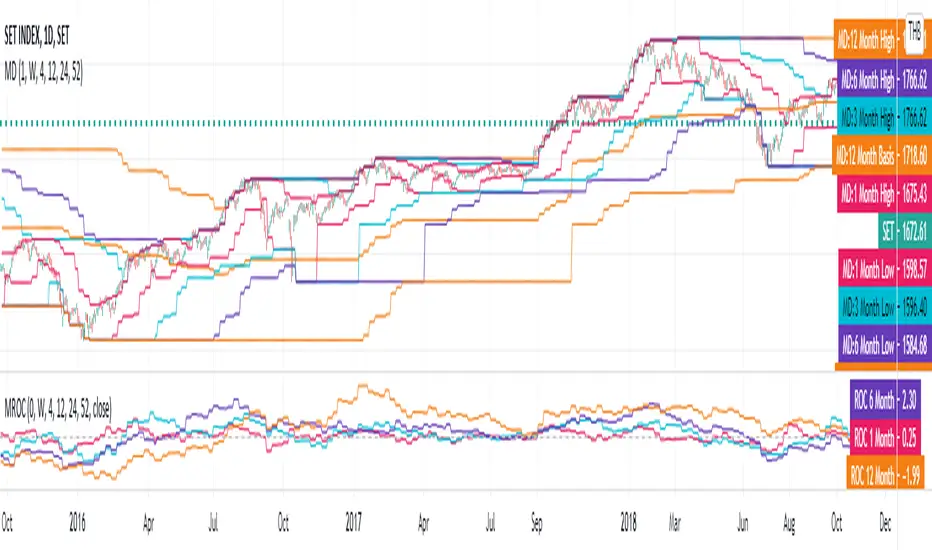

This script was created to analyze levels of market trends.

This is an indicator that is used to analyze the overall 2 levels.

1.Considering the index's key trends (Strategic Level)

2.Trend Analysis (Tactical Level)

To get a big overview of the trend and catch short-term movements. In this indicator, there are 4 levels of momentum measurements.

with the default setting

Major trends (Strategic Level)

1.We have the highest and lowest prices in the 52-week or 1-year scale.

2.We use the average of the highest and lowest prices(basis of 52-week). can be filtering the overview of the trend

3.As for the trend in 24-week or 6-month. Used to find the direction of the price And helps confirm that a trend is starting to take a certain direction.

Sub-level trend (Tactical Level)

1.Price in the level 12-week or 3-month. We use it to calculate the direction of movement in the short term, it is possible that the market will be bullish or bearish in 3-month.

2.And the 12-week or 3-month price is a confirmation of how strongly the short-term price moves in any direction.

3.If there will be a correction of the price base 12 weeks or 3-month price swings always happen first.

4.The 1-month price is the same as the trigger, if the market has a breakout in any way it could mean the start of a short sway.

By this indicator Besides being used to measure direction or trend, it can also be used as a significant filter for both support and resistance for short, medium, long term.

Jet.T.S. Trader

This is an indicator that is used to analyze the overall 2 levels.

1.Considering the index's key trends (Strategic Level)

2.Trend Analysis (Tactical Level)

To get a big overview of the trend and catch short-term movements. In this indicator, there are 4 levels of momentum measurements.

with the default setting

Major trends (Strategic Level)

1.We have the highest and lowest prices in the 52-week or 1-year scale.

2.We use the average of the highest and lowest prices(basis of 52-week). can be filtering the overview of the trend

3.As for the trend in 24-week or 6-month. Used to find the direction of the price And helps confirm that a trend is starting to take a certain direction.

Sub-level trend (Tactical Level)

1.Price in the level 12-week or 3-month. We use it to calculate the direction of movement in the short term, it is possible that the market will be bullish or bearish in 3-month.

2.And the 12-week or 3-month price is a confirmation of how strongly the short-term price moves in any direction.

3.If there will be a correction of the price base 12 weeks or 3-month price swings always happen first.

4.The 1-month price is the same as the trigger, if the market has a breakout in any way it could mean the start of a short sway.

By this indicator Besides being used to measure direction or trend, it can also be used as a significant filter for both support and resistance for short, medium, long term.

Jet.T.S. Trader

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。