INVITE-ONLY SCRIPT

已更新 Technimentals Oscillator

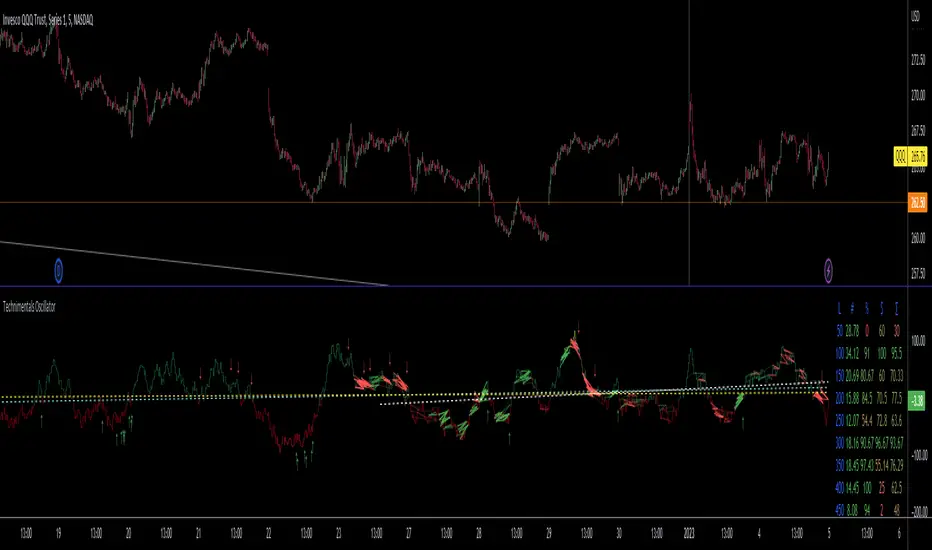

Technimentals Oscillator is a bundle of cutting edge oscillators. At it's core is a powerful and dynamic money flow algorithm suitable for any asset and market. Delve into astronomical potentialities with sharp visuals and best-in-class data.

As of this update, Technimentals Oscillator includes:

Technimentals Oscillator is an all-in-one flow indicator. Between the Money Flow Oscillator and the Sophistication Gauge, users can assess whether the area of trade has an underlying direction of flow and what type of market participant is behind the moves. This data is to be used to add to and, more importantly, remove confidence from trade ideas. The range or length of the indicator settings are of paramount importance. Your trade duration must be congruent with your trade thesis. You would not use a 1-minute chart with relatively short lengths to justify a multi-year investment otherwise based upon fundamentals. Likewise, you would not use this indicator on the daily timeframe to justify an intraday scalp. In fact, the Money Flow oscillator does give surprisingly long term signals. With default settings, the one minute chart may offer signals up to multiple days in advance. Consider the previous point carefully; as with any technical indicator, it is unwise to act upon these signals alone. They are to be used in combination with a clear trade plan in mind.

Sub-Component Descriptions:

Money Flow Oscillator

The Money Flow Oscillator is the core component of Technimentals Oscillator. It features 8 primary signals of various money flow sources which are then processed through a user defined series of iterative modules to output both long and short term trading signals.

The initial signals are typical of money flow analysis; it’s the post-signal processing which really gives this oscillator it’s incredible edge with longer term accumulation and distribution signals. It does this by comparing price and volume over a period of time and measuring the strength of the signal to the strength of the price and volume. It’s comparison works over a user defined period and will naturally form wave patterns. Changes in tone often precede changes in trend. It is the divergences over these periods which can expose longer term changes in tone long before it occurs on the chart through price.

Like any oscillator, there are two primary signal types generated from the Money Flow Oscillator; confirmation (the indicator is moving in the same direction as price) and divergence (the indicator is in a different trend to the price). Ultimately, how you use the indicator is up to you, but Technimentals recommends the Money Flow Oscillator primarily as a contrarian indicator.

Money Flow Table:

L = Length

# = Simple Moving Average value of the money flow output

% = Percent rank of the money flow Simple Moving Average compared with it's own length

$ = Percent rank of price compared with the same length

∑ = ( % + $ ) / 2 - or the sum of the '%' and '$' columns divided by two. The divergence between the money flow output and price.

WARNING!

The money flow side of this oscillator should be studied extensively before putting it to work. With a near infinite amount of settings, you are guaranteed to find one to suit your trade thesis and confirm your bias. Therefore it is recommended decide on a configuration which suits you and your trading style, study it thoroughly and then stick with it.

Sophistication Gauge

The Sophistication Gauge works under the principles of how big money builds and exits positions. They do so very carefully by trying to influence the price as little as possible before their position has been established or exited so that they can get the best average price. There are various ways this can be achieved, most obviously this is done by executing the bulk of orders during technical areas and time periods of high volume. There are services exclusively for whales which specialize on this and this is what the Sophistication Gauge is designed to detect.

Retail traders, even in large groups, do not have the capital or cohesive strategy to trade in this way over any significant period of time, particularly on highly liquid assets. The Sophistication Gauge determines, through the behaviour of the chart, what type of actor is likely to be behind the trade. This can be extremely useful for identifying when sophisticated players are making moves so that you, most importantly, do not try to fight them.

There are many ways to use and interpret this indicator. I have shown usage examples below. This is a leading and generally contrarian indicator.

Do not glance at the pictures below. Take the time to look closely!

Money Flow:

Sophistication Gauge:

You are responsible for your own trading decisions. Trading signals are worthless if you do not have a clear plan, including exit targets and risk management. If you do not have these, you should study them seriously before considering fancy indicators. This indicator is probably unsuitable for beginners.

- Leading proprietary money flow signals

- Inexhaustible optionality to suit any trading style in any market

- Detect tops and bottoms ahead of time with clinical precision

As of this update, Technimentals Oscillator includes:

- Money Flow Oscillator with 8 base signals to plug into 7 further filtering settings for massive customization and multiple built-in quantified metrics including a table featuring the performance and divergence between the oscillator and price

- Sophistication Gauge - detect what type of player is behind market activity and get clues to detect major pivots as they're being constructed. Sophisticated money moves in and out in particular ways; move with the tide.

- ...and much more! Check the change log below for new features.

Technimentals Oscillator is an all-in-one flow indicator. Between the Money Flow Oscillator and the Sophistication Gauge, users can assess whether the area of trade has an underlying direction of flow and what type of market participant is behind the moves. This data is to be used to add to and, more importantly, remove confidence from trade ideas. The range or length of the indicator settings are of paramount importance. Your trade duration must be congruent with your trade thesis. You would not use a 1-minute chart with relatively short lengths to justify a multi-year investment otherwise based upon fundamentals. Likewise, you would not use this indicator on the daily timeframe to justify an intraday scalp. In fact, the Money Flow oscillator does give surprisingly long term signals. With default settings, the one minute chart may offer signals up to multiple days in advance. Consider the previous point carefully; as with any technical indicator, it is unwise to act upon these signals alone. They are to be used in combination with a clear trade plan in mind.

Sub-Component Descriptions:

Money Flow Oscillator

The Money Flow Oscillator is the core component of Technimentals Oscillator. It features 8 primary signals of various money flow sources which are then processed through a user defined series of iterative modules to output both long and short term trading signals.

The initial signals are typical of money flow analysis; it’s the post-signal processing which really gives this oscillator it’s incredible edge with longer term accumulation and distribution signals. It does this by comparing price and volume over a period of time and measuring the strength of the signal to the strength of the price and volume. It’s comparison works over a user defined period and will naturally form wave patterns. Changes in tone often precede changes in trend. It is the divergences over these periods which can expose longer term changes in tone long before it occurs on the chart through price.

Like any oscillator, there are two primary signal types generated from the Money Flow Oscillator; confirmation (the indicator is moving in the same direction as price) and divergence (the indicator is in a different trend to the price). Ultimately, how you use the indicator is up to you, but Technimentals recommends the Money Flow Oscillator primarily as a contrarian indicator.

Money Flow Table:

L = Length

# = Simple Moving Average value of the money flow output

% = Percent rank of the money flow Simple Moving Average compared with it's own length

$ = Percent rank of price compared with the same length

∑ = ( % + $ ) / 2 - or the sum of the '%' and '$' columns divided by two. The divergence between the money flow output and price.

WARNING!

The money flow side of this oscillator should be studied extensively before putting it to work. With a near infinite amount of settings, you are guaranteed to find one to suit your trade thesis and confirm your bias. Therefore it is recommended decide on a configuration which suits you and your trading style, study it thoroughly and then stick with it.

Sophistication Gauge

The Sophistication Gauge works under the principles of how big money builds and exits positions. They do so very carefully by trying to influence the price as little as possible before their position has been established or exited so that they can get the best average price. There are various ways this can be achieved, most obviously this is done by executing the bulk of orders during technical areas and time periods of high volume. There are services exclusively for whales which specialize on this and this is what the Sophistication Gauge is designed to detect.

Retail traders, even in large groups, do not have the capital or cohesive strategy to trade in this way over any significant period of time, particularly on highly liquid assets. The Sophistication Gauge determines, through the behaviour of the chart, what type of actor is likely to be behind the trade. This can be extremely useful for identifying when sophisticated players are making moves so that you, most importantly, do not try to fight them.

There are many ways to use and interpret this indicator. I have shown usage examples below. This is a leading and generally contrarian indicator.

Do not glance at the pictures below. Take the time to look closely!

Money Flow:

Sophistication Gauge:

You are responsible for your own trading decisions. Trading signals are worthless if you do not have a clear plan, including exit targets and risk management. If you do not have these, you should study them seriously before considering fancy indicators. This indicator is probably unsuitable for beginners.

版本注释

v427• Added various post-process signal filters [BETA]

• Added Technimentals Auto Divergence

• Added two more linear regression lines

• Improved performance

仅限邀请脚本

只有经作者批准的用户才能访问此脚本。您需要申请并获得使用权限。该权限通常在付款后授予。如需了解更多详情,请按照以下作者的说明操作,或直接联系barnabygraham。

除非您完全信任其作者并了解脚本的工作原理,否則TradingView不建议您付费或使用脚本。您还可以在我们的社区脚本中找到免费的开源替代方案。

作者的说明

Obtain access at technimentals.net. Please do not ask for access in the comments.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

仅限邀请脚本

只有经作者批准的用户才能访问此脚本。您需要申请并获得使用权限。该权限通常在付款后授予。如需了解更多详情,请按照以下作者的说明操作,或直接联系barnabygraham。

除非您完全信任其作者并了解脚本的工作原理,否則TradingView不建议您付费或使用脚本。您还可以在我们的社区脚本中找到免费的开源替代方案。

作者的说明

Obtain access at technimentals.net. Please do not ask for access in the comments.

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。