OPEN-SOURCE SCRIPT

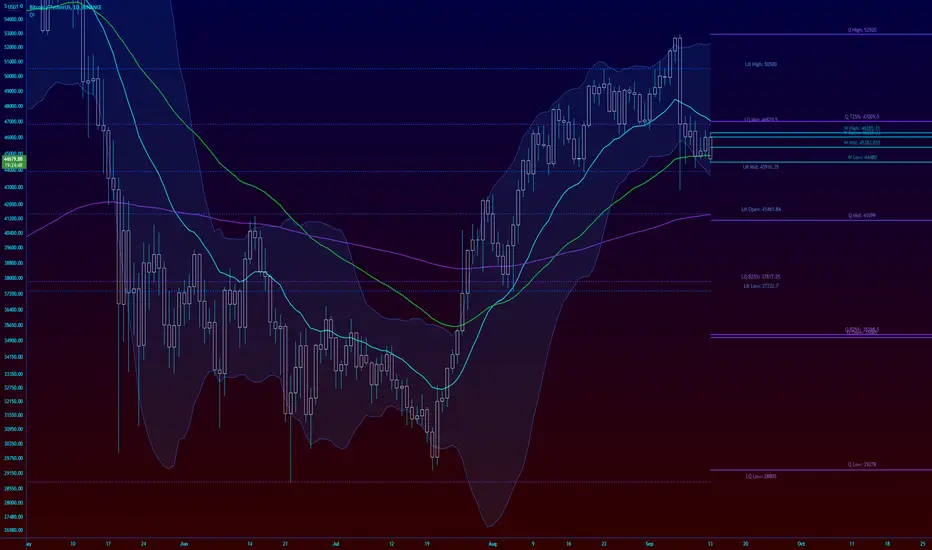

已更新 Overlay Indicators (EMAs, SMAs, Ichimoku & Bollinger Bands)

This is a combination of popular overlay indicators that are used for dynamic support and resistance, trade targets and trend strength.

Included are:

-> 6 Exponential Moving Averages

-> 6 Simple Moving Averages

-> Ichimoku Cloud

-> Bollinger Bands

-> There is also a weekend background marker ideal for cryptocurrency trading

Using all these indicators in conjunction with each other provide great confluence and confidence in trades and price targets.

An explanation of each indicator is listed below.

What Is an Exponential Moving Average (EMA)?

"An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period.

What Does the Exponential Moving Average Tell You?

The 12- and 26-day exponential moving averages (EMAs) are often the most quoted and analyzed short-term averages. The 12- and 26-day are used to create indicators like the moving average convergence divergence (MACD) and the percentage price oscillator (PPO). In general, the 50- and 200-day EMAs are used as indicators for long-term trends. When a stock price crosses its 200-day moving average, it is a technical signal that a reversal has occurred.

Traders who employ technical analysis find moving averages very useful and insightful when applied correctly. However, they also realize that these signals can create havoc when used improperly or misinterpreted. All the moving averages commonly used in technical analysis are, by their very nature, lagging indicators."

Source: investopedia.com/terms/e/ema.asp

Popular EMA lookback periods include fibonacci numbers and round numbers such as the 100 or 200. The default values of the EMAs in this indicator are the most widely used, specifically for cryptocurrency but they also work very well with traditional.

EMAs are normally used in conjunction with Simple Moving Averages.

"What Is Simple Moving Average (SMA)?

A simple moving average (SMA) calculates the average of a selected range of prices, usually closing prices, by the number of periods in that range.

Simple Moving Average vs. Exponential Moving Average

The major difference between an exponential moving average (EMA) and a simple moving average is the sensitivity each one shows to changes in the data used in its calculation. More specifically, the EMA gives a higher weighting to recent prices, while the SMA assigns an equal weighting to all values."

Source: investopedia.com/terms/s/sma.asp

In this indicator, I've included 6 popular moving averages that are commonly used. Most traders will find specific settings for their own personal trading style.

Along with the EMA and SMA, another indicator that is good for finding confluence between these two is the Ichimoku Cloud.

"What is the Ichimoku Cloud?

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on the chart. It also uses these figures to compute a "cloud" which attempts to forecast where the price may find support or resistance in the future.

The Ichimoku cloud was developed by Goichi Hosoda, a Japanese journalist, and published in the late 1960s.1 It provides more data points than the standard candlestick chart. While it seems complicated at first glance, those familiar with how to read the charts often find it easy to understand with well-defined trading signals."

More info can be seen here: investopedia.com/terms/i/ichimoku-cloud.asp

I have changed the default settings on the Ichimoku to suit cryptocurrency trading (as cryptocurrency is usually fast and thus require slightly longer lookbacks) to 20 60 120 30.

Along with the Ichimoku, I like to use Bollinger Bands to not only find confluence for support and resistance but for price discovery targets and trend strength.

"What Is a Bollinger Band®?

A Bollinger Band® is a technical analysis tool defined by a set of trendlines plotted two standard deviations (positively and negatively) away from a simple moving average (SMA) of a security's price, but which can be adjusted to user preferences.

Bollinger Bands® were developed and copyrighted by famous technical trader John Bollinger, designed to discover opportunities that give investors a higher probability of properly identifying when an asset is oversold or overbought."

This article goes into great detail of the complexities of using the Bollinger band and how to use it.

=======

This indicator combines all these powerful indicators into one so that it is easier to input different settings, turn specific tools on or off and can be easily customised.

Included are:

-> 6 Exponential Moving Averages

-> 6 Simple Moving Averages

-> Ichimoku Cloud

-> Bollinger Bands

-> There is also a weekend background marker ideal for cryptocurrency trading

Using all these indicators in conjunction with each other provide great confluence and confidence in trades and price targets.

An explanation of each indicator is listed below.

What Is an Exponential Moving Average (EMA)?

"An exponential moving average (EMA) is a type of moving average (MA) that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average. An exponentially weighted moving average reacts more significantly to recent price changes than a simple moving average (SMA), which applies an equal weight to all observations in the period.

What Does the Exponential Moving Average Tell You?

The 12- and 26-day exponential moving averages (EMAs) are often the most quoted and analyzed short-term averages. The 12- and 26-day are used to create indicators like the moving average convergence divergence (MACD) and the percentage price oscillator (PPO). In general, the 50- and 200-day EMAs are used as indicators for long-term trends. When a stock price crosses its 200-day moving average, it is a technical signal that a reversal has occurred.

Traders who employ technical analysis find moving averages very useful and insightful when applied correctly. However, they also realize that these signals can create havoc when used improperly or misinterpreted. All the moving averages commonly used in technical analysis are, by their very nature, lagging indicators."

Source: investopedia.com/terms/e/ema.asp

Popular EMA lookback periods include fibonacci numbers and round numbers such as the 100 or 200. The default values of the EMAs in this indicator are the most widely used, specifically for cryptocurrency but they also work very well with traditional.

EMAs are normally used in conjunction with Simple Moving Averages.

"What Is Simple Moving Average (SMA)?

A simple moving average (SMA) calculates the average of a selected range of prices, usually closing prices, by the number of periods in that range.

Simple Moving Average vs. Exponential Moving Average

The major difference between an exponential moving average (EMA) and a simple moving average is the sensitivity each one shows to changes in the data used in its calculation. More specifically, the EMA gives a higher weighting to recent prices, while the SMA assigns an equal weighting to all values."

Source: investopedia.com/terms/s/sma.asp

In this indicator, I've included 6 popular moving averages that are commonly used. Most traders will find specific settings for their own personal trading style.

Along with the EMA and SMA, another indicator that is good for finding confluence between these two is the Ichimoku Cloud.

"What is the Ichimoku Cloud?

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on the chart. It also uses these figures to compute a "cloud" which attempts to forecast where the price may find support or resistance in the future.

The Ichimoku cloud was developed by Goichi Hosoda, a Japanese journalist, and published in the late 1960s.1 It provides more data points than the standard candlestick chart. While it seems complicated at first glance, those familiar with how to read the charts often find it easy to understand with well-defined trading signals."

More info can be seen here: investopedia.com/terms/i/ichimoku-cloud.asp

I have changed the default settings on the Ichimoku to suit cryptocurrency trading (as cryptocurrency is usually fast and thus require slightly longer lookbacks) to 20 60 120 30.

Along with the Ichimoku, I like to use Bollinger Bands to not only find confluence for support and resistance but for price discovery targets and trend strength.

"What Is a Bollinger Band®?

A Bollinger Band® is a technical analysis tool defined by a set of trendlines plotted two standard deviations (positively and negatively) away from a simple moving average (SMA) of a security's price, but which can be adjusted to user preferences.

Bollinger Bands® were developed and copyrighted by famous technical trader John Bollinger, designed to discover opportunities that give investors a higher probability of properly identifying when an asset is oversold or overbought."

This article goes into great detail of the complexities of using the Bollinger band and how to use it.

=======

This indicator combines all these powerful indicators into one so that it is easier to input different settings, turn specific tools on or off and can be easily customised.

版本注释

Menu and code optimised. Removed unnecessary text from menu.版本注释

Added High/Low ranges:Daily & previous daily High/Low/Open/Mid

Weekly & previous Weekly High/Low/Open/Mid

Monthly & previous monthly High/Low/Open/Mid

Quarterly & previous quarterly High/Low/Open/Mid

Each level has the price specified and also comes with a vertical divider for that period.

Unfortunately, I had to remove the MTF function as that wasn't compatible with the new code as it would've called upon too many security functions.

Let me know if I should re publish the previous version or if there are any bugs with this update.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。